Third Quarter 2025 Highlighted Holding

- Contract Pricing Lag: fixed-price contracts signed before the 2021 inflation surge

- Fluid Conservation: reduced IV bag usage following a supply disruption

- Stranded Costs: overhead tied to dialysis divestiture

- Novum IQ Pause: temporary halt in shipments of its new large-volume infusion pump

We view these headwinds as transitory. As they abate, earnings should recover, and investor confidence is likely to return to this high-quality medtech franchise.

BAXTER TODAY

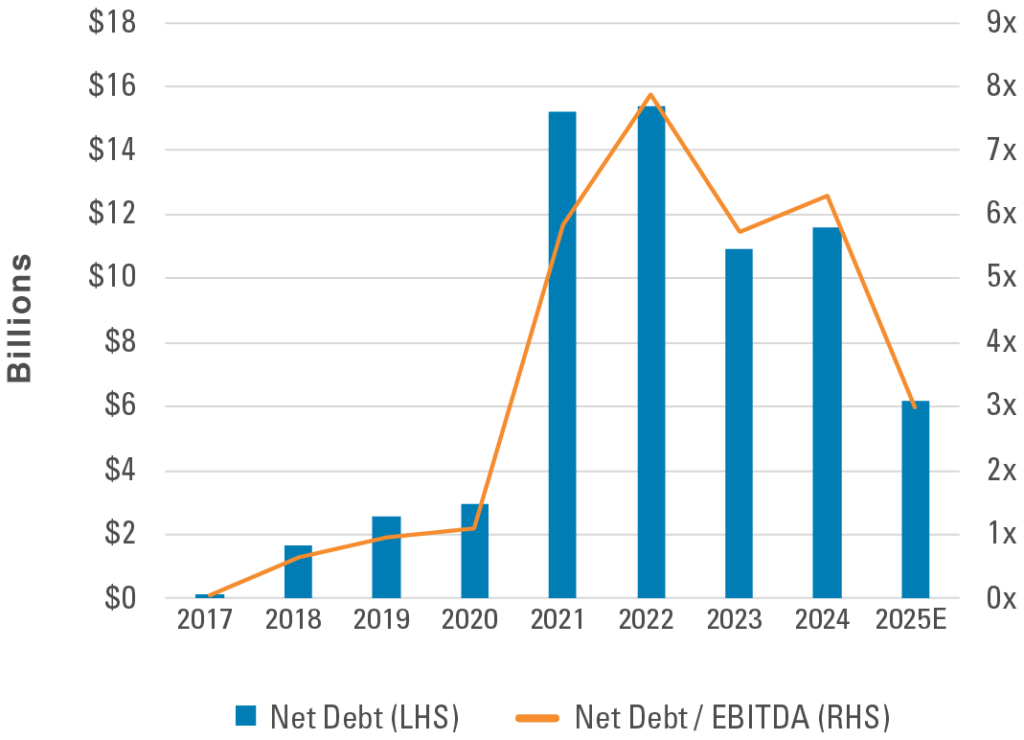

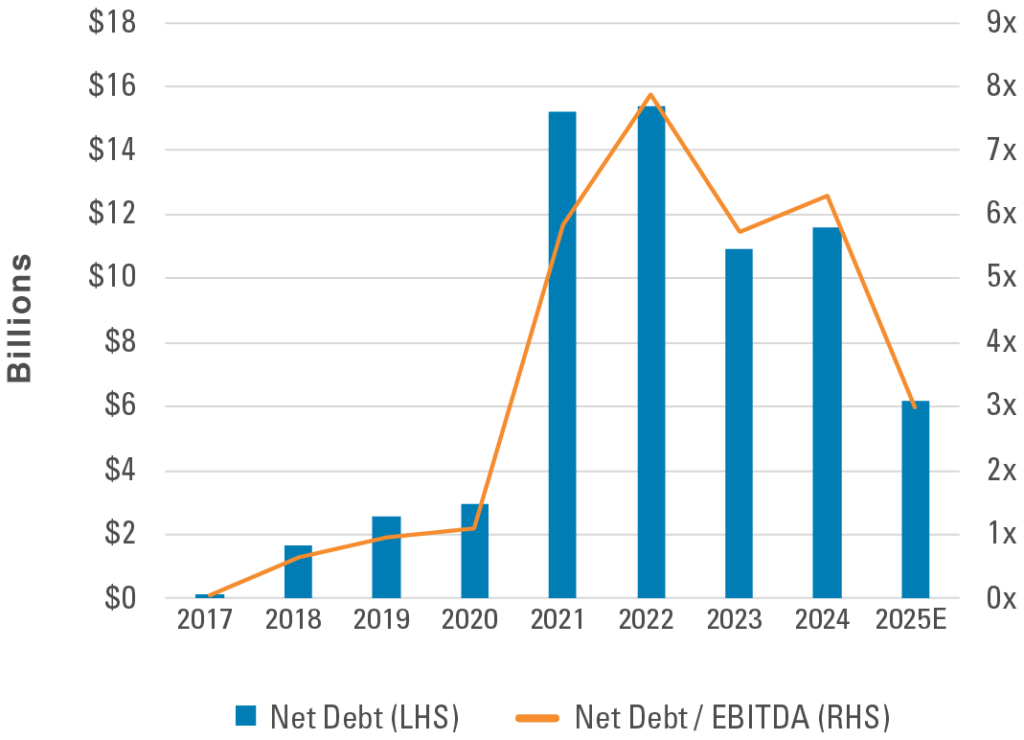

Following major divestitures, Baxter is now a simpler, more focused hospital products company. It sold its pharmaceutical contract manufacturing unit in 2023 and its dialysis business in 2025, which together accounted for roughly one third of its revenue before the separations. The result is a streamlined portfolio organized into three divisions: Medical Products & Therapies (IV solutions, infusion systems, nutrition), Healthcare Systems & Technologies (smart beds, monitoring, and connected-care equipment), and Pharmaceuticals (premix and generic injectables, anesthesia). The company’s debt had swelled following its 2021 acquisition of Hillrom, but proceeds from its recent divestitures have been used to pay down borrowings, reducing net debt from $15 billion in 2023 to $8 billion today, with a target of around 3x net leverage by year end (Exhibit 1). A stronger balance sheet provides flexibility to reinvest for growth while navigating near-term challenges.

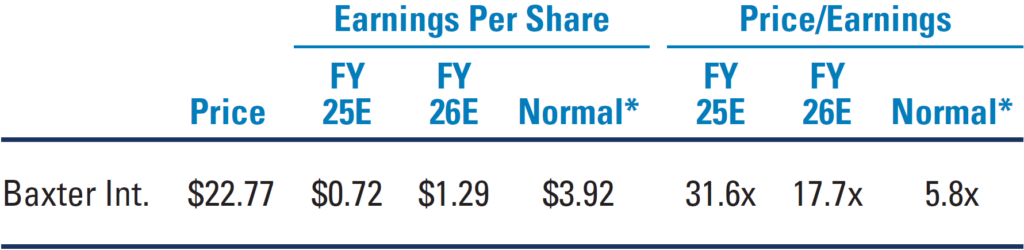

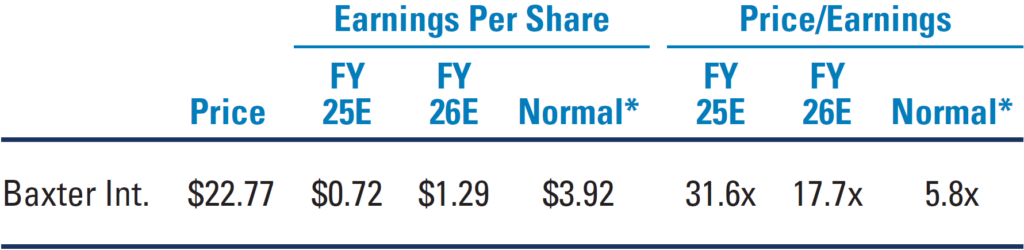

Fiscal year-end December 31.

*Pzena estimate of normal earnings.

Source: S&P Capital IQ, Pzena analysis

Data as of September 30, 2025.

Exhibit 1: Net Debt and Leverage Ratio Improvement

Source: S&P Capital IQ, Company filings

CONTRACT PRICING LAG

Contracting dynamics have been the single largest drag on Baxter’s margins. About 55% of the company’s revenue is generated in the U.S., where most sales are governed by long-term agreements with three major group purchasing organizations (GPOs) that negotiate pricing on behalf of hospitals. Contracts signed before the 2021 inflation surge locked in fixed prices without escalators or force-majeure protections. As supply, freight, and labor costs spiked, Baxter was unable to pass the costs through, absorbing roughly $1 billion of incremental expenses in 2022 that reset its cost base higher and contributed to the company’s decline in adjusted operating margin from 18.0% in 2020 to 13.9% in 2024.

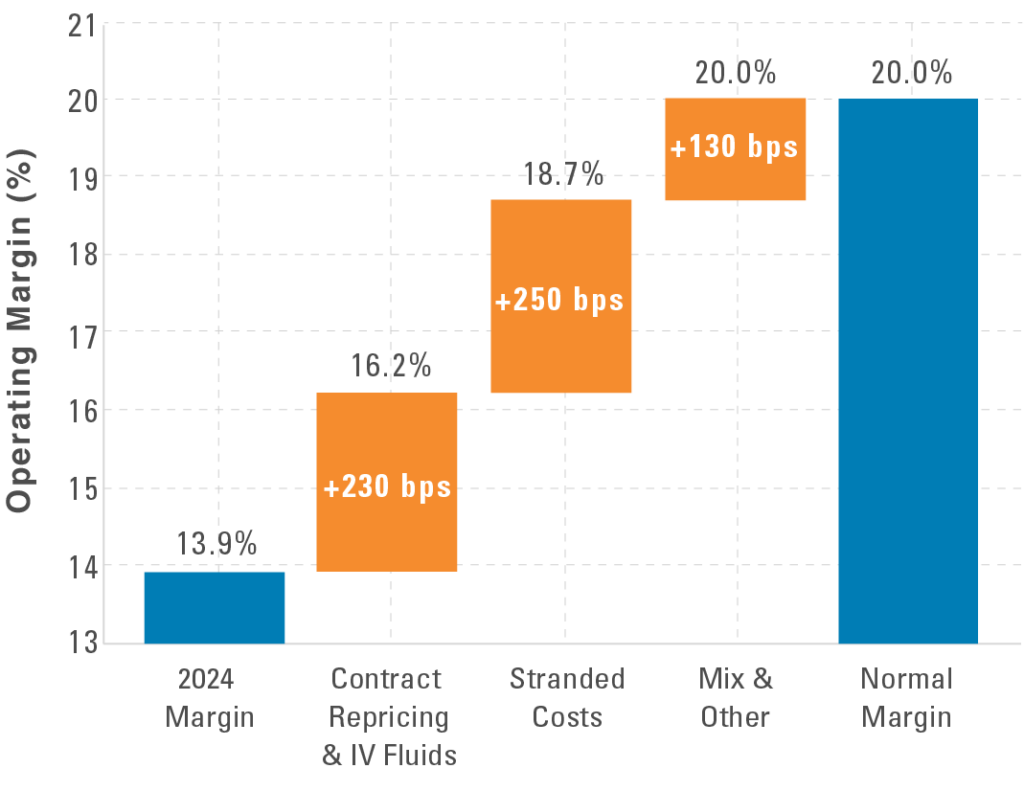

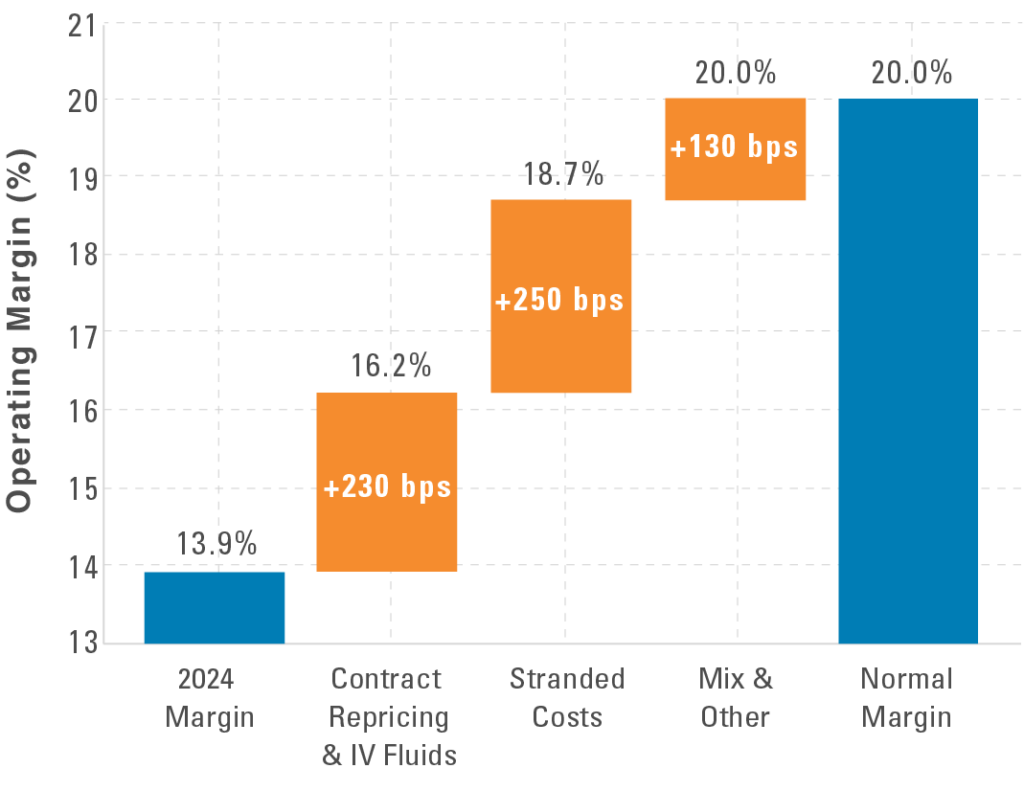

The cycle is now turning in Baxter’s favor. Two of the three major GPO agreements reset in early 2025, with the final renewal scheduled for 2026. The new contracts incorporate greater flexibility to pass through inflationary costs, protecting margins from future cost volatility. As these agreements reset to reflect today’s cost base, margins should begin to recover, representing a major step toward normal operating margins of roughly 20% over time (Exhibit 2).

Exhibit 2: Path to Normal Margin

Source: Company filings, Pzena projections

Source: Company filings, Pzena projections

FLUID CONSERVATION

In late 2024, Hurricane Helene flooded Baxter’s North Cove facility in North Carolina—its largest IV solutions manufacturing plant and the source of approximately 60% of the U.S. IV fluid supply—forcing a temporary shutdown and prompting hospitals to conserve fluids. Hospitals used fewer IV bags per patient, delayed some non-urgent procedures, and switched to direct drug injections instead of IV infusions. Even after supply returned, cautious practices have lingered, leaving IV-solution volumes approximately 20% below historical levels. Because IV fluids are low-value, high-volume products, where scale is critical to profitability, this underutilization has weighed on margins and contributed to recent share weakness.

The situation closely resembles the aftermath of Hurricane Maria in 2017, which severely disrupted Baxter’s Puerto Rico IV fluid facilities and caused a nationwide shortage of IV bags. Hospitals similarly cut back on fluid usage, and management overestimated how quickly demand would return. In that case, volumes eventually recovered as supply stability was re-established, and the same gradual normalization appears to be underway today. The impact of IV fluid normalization is difficult to quantify separately from that of contract repricing, but together they are expected to contribute roughly 230 basis points of margin uplift (Exhibit 2).

STRANDED COSTS

As part of the dialysis divestiture (now Vantive), Baxter agreed to continue providing certain back-office services and to manufacture select products on Vantive’s behalf for a limited period, as is customary in such separations. In 2025, these transition service and manufacturing agreements represent roughly $500 million of combined activity and are dilutive to operating margins.

As these agreements expire and production winds down through 2027, Baxter will eliminate stranded overhead and exit low-return activity, contributing roughly 250 basis points of margin uplift, which is the biggest source of recovery ahead. Additionally, the dialysis business itself was structurally dilutive, earning roughly half the returns on invested capital of Baxter’s continuing operations; therefore, its separation raises the company’s underlying margin profile. This mix improvement helps explain why our normalized margin forecast of roughly 20% sits above Baxter’s historical range, reflecting a structurally higher-margin portfolio.

NOVUM IQ PAUSE

The Novum IQ Large Volume Pump is Baxter’s next-generation infusion platform, designed to deliver IV fluids in a controlled, automated manner. In mid-2025, Baxter voluntarily paused new shipments and installations after identifying workflow issues in certain intensive-care settings and implemented corrective actions. Installed units remain in service, but the pause has raised concern for a product intended to anchor Baxter’s next phase of growth. The pause occurred after the second quarter and therefore has not yet been reflected in reported results, although investors have already priced in the rollout’s disruption. Financially, exposure is limited: Novum IQ represents roughly 2% of revenue, and high-margin consumables used across both Novum IQ and the legacy Spectrum pump continue to ship.

Investor concern reflects both the near-term earnings impact and questions around credibility. The platform was meant to demonstrate Baxter’s ability to modernize its infusion systems and reassert leadership in a concentrated market where reliability and hospital trust are paramount. The pause interrupts that momentum and introduces uncertainty around the timing of a broader launch. Because the issues identified to date are primarily related to software and workflow, rather than structural hardware defects, corrective actions should allow shipments to resume once validations are complete, allowing the platform to regain traction as a growth driver for Baxter.

CONCLUSION

All four of Baxter’s headwinds are company-specific and temporary, with resolutions underway. Risks remain as these areas normalize: pricing resets could lag, volume recovery could take longer, stranded costs could run higher, or the Novum IQ relaunch could face further delay. However, these issues are executional and largely within management’s control. Broader pressures, including tariff uncertainty and weak sentiment across healthcare, have also weighed on the stock, despite limited impact on fundamentals. At today’s valuation, the market is treating these temporary issues as permanent, pricing Baxter at only 5.8x normalized earnings of $3.92 per share.

For long-term investors, this pessimism, in our opinion, creates opportunity. Baxter’s franchise centers on essential, nondiscretionary hospital products, where demand is steady, scale advantages persist, and recurring consumables reinforce long-term customer relationships. Hospitals rarely switch suppliers, while aging populations and chronic disease sustain growth. This durability provides a strong foundation for margins to expand and for earnings to normalize, setting up a powerful recovery as temporary pressures fade.

Source: Company filings, Pzena projections

Source: Company filings, Pzena projections