A MESSAGE FROM OUR CEO

We at Pzena Investment Management are proud to release our fourth annual Stewardship Report. This year’s report holds particular significance as it coincides with the firm’s 30th anniversary – a milestone that underscores the durability of our value investment philosophy and our commitment to active ownership of the companies in which we invest.

As value investors, we view improvement in business fundamentals as a key potential source of excess returns. Our stewardship efforts therefore focus on identifying and advancing opportunities for such improvement, whether they arise from environmental, social, or governance (ESG) issues or other fundamental drivers of value. As fiduciaries, we remain committed to our stewardship responsibilities through direct engagement and proxy voting. We continue to believe that active ownership, rather than divestment, is one of the most effective ways to influence positive change and deliver beneficial long-term outcomes for our clients.

Three years have passed since the creation of our Opportunity List1, and this proprietary framework continues to serve as a valuable tool for tracking and assessing engagement progress and outcomes. Examples can be found starting on page 4 of this report. This year, we further refined our framework for assessing the independence of audit committee members, focusing on the likely alignment of interests between audit committee members and long-term shareholders.

We also continue to explore thematic topics through our engagements to complement our bottom-up company research. These themes reflect the evolving nature of the risks and opportunities facing the companies in which we invest and help ensure that our stewardship activities remain focused and relevant over time. We have highlighted several of the themes identified in 2025 starting on page 14 of this report.

The expanded role of our ESG team in the proxy voting process represents a notable enhancement to our stewardship and engagement process this year. The team now provides a synthesized view of key issues and vote recommendations, helping to streamline decision-making. Voting remains with the respective investment analyst, reflecting our conviction that those with the deepest understanding of a business are best equipped to exercise that responsibility.

We hope this report continues to offer insight into how our stewardship activities evolve over time, while remaining firmly grounded in the principles that have guided us for 30 years.

CAROLINE CAI

Chief Executive Officer and Portfolio Manager

01. STEWARDSHIP PHILOSOPHY

At Pzena, we have always considered our role as responsible stewards of capital to be an integral part of our fiduciary responsibility to act in our clients’ best interests, maximizing long-term shareholder value.

As value investors, taking advantage of the gap between a current valuation reflecting near-term challenges and the value of the long-term earnings power of the company is at the heart of our investment philosophy. Often this means something has gone wrong for the companies we are evaluating, and we rely on fundamental research to assess the likelihood of improvement on these issues. In some cases, the issues or opportunities facing a company fall under the ESG umbrella. Deep research and extensive engagement can help value investors capitalize on controversy and access this potential source of alpha, making engagement a cornerstone of our investment philosophy and a critical component of our process as long-term active investors.

As with all key investment issues, we analyze significant ESG considerations internally, discuss them with company management and industry experts, and monitor changes over time. Each step of this process contributes to the team’s determination of whether to invest and, if we do, at what position size. Once an investment has been made, we continue to engage management on an ongoing basis. Through these conversations, along with our proxy voting and other escalation options, we seek to advocate in a constructive way, oriented toward the long-term success of the company.

02. ENGAGEMENT APPROACH

We engage with company management throughout our due diligence process, and extensively after an investment is made, on all material or potentially material investment issues. As shareholders, we believe we can help guide companies toward long-term value creation, and we therefore favor engagement over divestment.

If we determine an ESG consideration to be material to our investment thesis, we raise it with the management team. As each company and management team is unique, our approach to management conversations is organic in each case; however, we always seek an open, cooperative dialogue. We maintain an ongoing dialogue with company management through regular meetings, in-person site visits, and calls. When we engage with companies, our conversations are generally held with some combination of senior management, board members, ESG or sustainability leads, and investor relations.

Roles & Responsibilities

For ESG to be effectively integrated into the research process, the investment analyst covering the stock must also lead the associated investment due diligence, of which engagement is a key part. The investment analysts are best positioned to evaluate the investment implications of ESG issues, and therefore they bear primary responsibility for discussing these matters with company management. Our ESG team supports the investment analysts in such conversations as needed, but we intentionally do not delegate these responsibilities to a separate stewardship team.

Engagement Purpose

Broadly speaking, our discussions with company management serve the following purposes:

- Testing assumptions — Engagement is intended to deepen our understanding of issues that we have identified as material or potentially material to the investment. Sometimes we identify these issues at the point of investment and other times they arise during ownership. In both cases, we discuss the issues with management, solicit their input, assess their response, and evaluate the impact on our investment thesis. To the extent that the issues are ongoing, we continue to follow up until the issue is resolved or no longer relevant.

- Maintaining an informed dialogue — Engagement keeps us apprised of decisions relating to strategic and operational considerations. We routinely meet with management following earnings, strategic business updates, and management transitions.

- Advocacy — Engagement provides an explicit opportunity for us, as shareholders, to advocate for different decisions that we believe will enhance long-term shareholder value. With increasing regularity, companies also proactively seek our input on a range of issues.

The success of each engagement is measured on a case-by-case basis, considering the company-specific context and engagement objectives. We kept one or more of the above purposes in mind, as we engaged with the companies detailed below.

Examples of Engagement

Dollar General: U.S. Discount Retailer

We have engaged Dollar General’s management and board extensively on labor practices and governance. The company has historically faced criticism over store-level working conditions and broader concerns that discount retailers exploit low-income communities. Our assessment has been more nuanced: we believe the company has made meaningful progress in addressing operational challenges, while continuing to serve an important role in providing affordable essentials to underserved communities. Prior to the CEO transition in late 2023, Dollar General introduced efforts to strengthen store operations. These initiatives included approximately $150 million in additional labor hours, wage increases of approximately 30% from 2020 to 2023 versus pre-pandemic levels, and the addition of roughly 140 new district manager roles meant to reduce span of control and ultimately improve oversight and training. Recent discussions with the new management team highlighted continued progress to sustain and augment these initiatives; examples of further enhancements include reductions in excess inventory, improved stock levels for high-velocity consumables, higher on-time delivery rates, and the removal of self-checkout to address shrink. Management also reported rising employee satisfaction scores and declining turnover, supported by a board that remains closely involved in monitoring labor and operational priorities. We have also maintained a dialogue with management and the board on governance and capital allocation, and we see Dollar General as having made several key improvements. Dollar General has refreshed its board with directors who bring deeper operational and technological expertise and has instituted regular third-party board assessments. Management has pulled back on the cadence of new store openings, while allocating more incremental capital toward remodels, which we believe is a prudent trade-off. We will continue to monitor developments in labor relations, operational execution, and governance oversight as the company works to strengthen store-level performance and stakeholder outcomes.

CVS Health Corporation: U.S. Pharmacy Retailer

Our recent engagements with CVS Health have focused on the company’s management of insurance claims denials, a socially sensitive issue that has drawn increased public and regulatory scrutiny. In discussions with CVS Health’s CEO and CFO, we explored how the company, through its Aetna subsidiary, manages trade-offs between access, cost, and quality of care. Management noted that roughly 80% of medical denials stem from provider submission errors or other administrative inefficiencies, many of which are later reversed without delay and disruption. CVS is reviewing its systems to identify “low-hanging fruit” where improvements could reduce unnecessary denials that add friction without financial benefit. The company is also investing in technology to further automate and improve medical claims processing, as progress lags behind that achieved in prescription drug adjudication. We view these efforts as low-cost opportunities to reduce reputational and operational risk while improving member experience and health outcomes. We will continue to monitor CVS’s progress in aligning its managed care practices with long-term value creation. Separate to these discussions, we also engaged the lead independent director at CVS Health on governance and board leadership, ahead of the 2025 Annual General Meeting. Based on the constructive dialogue, along with evidence of improved capital allocation discipline, we decided to support the say on pay proposal. We will continue to monitor board leadership developments and capital deployment decisions as the company executes its strategic priorities.

Teleperformance: Global Outsourced Customer Experience Provider

Teleperformance has been the subject of allegations related to workers’ freedom of association across several markets. In our engagements, we appreciate that Teleperformance has acknowledged disagreements with certain local labor unions; however, these issues have been limited in scope and have not resulted in findings of wrongdoing. Further, the company has worked constructively with relevant stakeholders and taken proactive measures to address concerns. In Colombia, Teleperformance engaged directly with the local affiliate union and signed a commitment with global union federation UNI Global to strengthen worker rights. Investigations related to this matter have been formally closed, and Teleperformance’s engagement with the union remains ongoing. In Greece, recent strikes were organized at the sector level rather than by Teleperformance employees, and participation among the company’s workforce was below 3 percent. The company continues to engage with the sectoral union SETEP and remains open to discussing operationally feasible proposals. It is our view that Teleperformance has adopted a proactive and increasingly robust approach to managing labor-related risks. The company has been a signatory to the United Nations Global Compact since 2011 and participates in the Human Rights and Labor Working Group. Two years ago, it voluntarily appointed a senior social auditor with more than 20 years of industry experience to monitor employee well-being and provide direct reporting to the Board of Administration. Teleperformance also conducts annual employee engagement surveys, with the most recent results showing 78% workforce satisfaction. We will continue to monitor the company’s engagement with labor stakeholders and the implementation of its global commitments.

03. OPPORTUNITY LIST

The belief in our ability to push for better outcomes by engaging with the companies we own has been a driving force behind the development and application of the Pzena Opportunity List. The Opportunity List seeks to systematically identify opportunities in our portfolio where material ESG issues exist and engagement could have a positive impact. If we choose to add a company to the Opportunity List, we believe the company has significant room for improvement on material ESG considerations.

After placing a company on the Opportunity List, we create an engagement plan with specific objectives to track progress. In practice, progress against the engagement plan does not typically manifest all at once; it appears in incremental steps over the investment time horizon. If we see a company is trending off-track, we have several options to escalate engagement. Persistent failure to address our concerns could lead to our reevaluation of the investment thesis and potential divestment.

Removal from the Opportunity List may come with the gradual resolution of the ESG issue(s) over time and/or may only require discreet changes, such as the resolution of pending litigation. However, in many cases, removal is more nuanced and requires continuous research, engagement, and monitoring. All investments require us to be in dialogue with management and to respond to changes that may impact the range of investment outcomes.

Proprietary ESG Ratings

When companies are given an engagement plan, they are also rated from 1 to 3 in accordance with our objectives. A score of ‘1’ is for those companies that have made little to no progress on the objectives we have outlined and/or have not yet acknowledged the issues. A ‘3’ rating is for companies that are making substantial progress in addressing our objectives and/or are highly engaged in addressing the issues. This rating is determined when the engagement plan is created and is reviewed, at a minimum, every six months during our bi-annual Opportunity List review.

Companies that have been classified as a ‘3’ for six months or longer may be good candidates for potential removal from the Opportunity List, although this is not always the case. A company may be rated a ‘3,’ but the issues the company is addressing may take years to resolve, such as capitalizing on opportunities in the energy transition. Conversely, a company may be rated a ‘3’ because the company is addressing a discreet issue, such as lack of a fully independent audit committee.

These ratings allow us to precisely track the progress of companies on the Opportunity List over time. Along with monitoring how long a company has remained at its rating, we can measure whether the company is making progress toward our objectives and over what time horizon. This also allows us to evaluate in a timely manner whether we need to escalate our engagement.

We have also introduced explicit documentation and tracking of engagement outcomes for companies on the Opportunity List. At every six-month Opportunity List check-in, the research team explicitly discusses whether there have been any notable outcomes related to engagements in the prior six months. We do not always expect outcomes, given that some issues take longer to resolve. Tracking outcomes, where they exist, allows us to progressively judge the success of our engagements.

Over time, we have adjusted the ratings of companies across various investment strategies to reflect observed progress.

Opportunity List Example

Glencore: Global Metals & Mining Company

Prior to investing in Glencore, we engaged directly with the CEO, senior management, and the sustainability team to evaluate the company’s key ESG risks, including transition exposure, human rights concerns, and historical corruption. These discussions led us to invest and add Glencore to our opportunity list with a rating of ‘2’. Our engagement objectives are focused on the areas of potential ESG risk where we still see room for improvement, specifically, transition planning and management of operations in high-risk regions.

A primary concern in our investment diligence was the degree to which historic bribery and corruption allegations were behind them. It was partly through engagement on this topic that we were able to gain conviction in the investment thesis. Glencore has undertaken a substantial and necessary overhaul of its compliance framework. The biggest structural change is that Glencore has centralized its compliance function, allowing for more consistent oversight and governance across diverse global operations. This appropriately acknowledges the complexity of operating in regions with varying levels of regulatory maturity and political risk. Glencore has also implemented a robust anti-bribery and anti-corruption policy that directly addresses high-risk activities, including interactions with public officials, the rejection of facilitation payments/gifts, and prohibition of political contributions. Any pending litigation and investigations have been resolved.

We designated this as an engagement priority as it became clear that Glencore still has opportunities to strengthen its operational risk management. For example, Glencore has historically had a worse fatality record than its peers, though strengthened controls and training have begun to reduce incidents. Also, while Glencore has exited mines in certain geographies where it is too difficult to operate safely, safety incidents persist. Similarly, while Glencore maintains a zero-tolerance policy, child labor allegations continue to surface, and certain assets, such as the Cerrejón mine in Colombia, have faced long-standing community opposition.

Our second engagement objective for Glencore is focused on transition risk, given the inherent challenge of decarbonizing its operations. Glencore is exploring renewable energy as an alternative to sourcing power from carbon-intense power grids, where feasible, but acknowledges that decarbonizing smelting emissions will require long-term technological solutions that are not currently cost competitive. With respect to thermal coal, Glencore has committed to not expanding its footprint; however, it has not set a fixed schedule for asset phase-out, given strong thermal coal demand from Southeast Asia. Potential liabilities from mine closures and rehabilitation are therefore key issues we will continue to monitor.

Vale: Global Metals & Mining Company

As noted in our 2024 Stewardship Report, part of our initial investment due diligence for Vale focused on a thorough assessment of management’s approach to safety, following the high-profile Mariana and Brumadinho dam failures. We were encouraged by cultural and governance improvements, as well as the definitive settlement between the Brazilian government and Vale addressing all remaining Mariana dam disaster claims. However, we considered it prudent to add Vale to our opportunity list to closely track its dam de-characterization progress.

Through our continued engagement in 2025, de-characterization efforts have remained on track. Eighteen of thirty structures have now been completed, with the full program targeted for completion by 2035. Vale has also ceased operations of all dams categorized by the local mining authorities as the highest emergency risk (Level 3).

A major component of Vale’s long-term safety roadmap is its transition away from traditional wet tailings management to dry stacking, and this also remains on track. Dry stacking removes water from tailings waste, and the remaining material is compacted and stored in a more stable facility, significantly reducing the likelihood of catastrophic failure. While dry-stacked facilities carry their own risks, these are typically less severe and more akin to those associated with waste-rock piles, such as drainage issues, erosion, or seismic sensitivity. Management emphasized that this operational change is driven by long-term safety considerations, rather than short-term cost savings. Over time, closure costs for dry tailings should also be significantly lower than for wet tailings facilities.

During our most recent site visit, Vale’s management spoke candidly about the company’s cultural transformation. Management acknowledged past failures and highlighted a renewed commitment to transparency, humility, and community engagement. We have also observed progress in operational safety metrics, with recordable injuries declining from 15 to 9 when comparing the first nine months of 2024 and 2025. This is an area where we will continue to engage, but we do see the company taking meaningful steps to rebuild trust and embed safety more deeply into its culture. At this time, we are confident in rating Vale at a ‘2’ to reflect the engagement progress and interim outcomes.

Hankook Tire & Technology: Global Tire Manufacturer

The purpose of the Opportunity List is not only to track positive progression against our engagement objectives, but also to identify companies that are failing to move in the direction we expect. In these cases, we may need to escalate our engagement and perhaps downgrade the company on our proprietary rating scale.

Hankook is an example of such a case. We initially added the company to the Opportunity List with the objective of advocating for transparent capital allocation that protects minority shareholder interests. This was especially important given the history of corruption allegations against the company, as highlighted in our 2024 Stewardship Report.

Our recent engagement focused on Hankook’s acquisition strategy and the implications for minority shareholders. We downgraded Hankook to a rating of ‘1’ following its acquisition of Hanon Systems, which we view as a problematic and potentially conflicted transaction. We do not believe it is in the interests of long-term shareholders for Hankook to have paid such a high price for a company that is not strategically aligned with the rest of the business. The rating downgrade reflects these concerns, and we plan to advocate for a higher dividend payout to compensate shareholders for the disadvantageous deal terms. We may also escalate our engagement activities ahead of next year’s annual meeting.

Opportunity List Removals

When a company fully achieves the engagement objectives we outlined, we can remove it from the Opportunity List.

Wells Fargo: U.S. Bank

Wells Fargo was added to the Opportunity List due to significant historical governance failures that culminated in a punitive asset cap imposed by the regulator in 2018. These issues included a high-profile misconduct scandal, involving the opening of millions of unauthorized customer accounts. Our engagement objectives focused on regulatory remediation efforts and alignment of senior management incentives with the goal of having the asset cap lifted.

Throughout our engagement, we discussed the ongoing third-party review and progress toward resolving the consent orders, including the asset cap. The Federal Reserve ultimately lifted the asset cap in June 2025, at which point we felt comfortable removing Wells Fargo from the Opportunity List. This step was a clear signal that past governance concerns had been substantively resolved. While progress for companies on the Opportunity List can take different forms, our decision to remove Wells Fargo depended on this clear, external milestone.

We continue to monitor Wells Fargo’s governance, as we do for every company we are invested in. In our most recent engagement after its removal from the Opportunity List, we discussed the recent refreshment of the governance committee and their outlook as Wells moves into this next phase of business without the asset cap.

Opportunity List

Our Opportunity List provides us with a structure to utilize fundamental research for assessing the likelihood of issue improvements.

04. THEMATIC ENGAGEMENTS

Nature/Physical Climate Risk

Nature is increasingly recognized as a critical component of corporate resilience, particularly in light of escalating physical climate risks. Both acute hazards (such as hurricanes, floods and wildfires) and chronic climate shifts (such as rising temperatures and sea levels) are already disrupting company operations by impairing or destroying assets, with potentially significant financial impact. When protected and restored, nature can serve as the first line of defense against physical climate risk, reducing corporate vulnerability and enhancing resilience. Evaluating how businesses manage their exposure to these risks and invest in resilience has become increasingly essential. Understanding and financializing these risks and opportunities is important for long-term value creation, particularly in sectors most acutely exposed to a changing climate.

Barry Callebaut: Global Chocolate Processor

We recently invested in Barry Callebaut, a global chocolate processor. The company operates in regions such as West Africa, where physical climate risk manifests as changing weather patterns and increasingly unpredictable cocoa harvests.

As part of our due diligence, prior to making the investment, we learned that Barry Callebaut is already adapting to physical climate risk successfully, primarily through supporting systems of agroforestry in their supply chain. The goal of agroforestry is to maintain land health biodiversity. For example, a farmer may opt to plant multiple trees that provide shade alongside the cocoa plant. This provides a built-in shield for the cocoa plant, protecting it from excessive heat, while also enriching the soil with nutrients, strengthening productivity and resilience. Additionally, agroforestry can provide multiple revenue streams for farmers who may operate under impoverished conditions.

Financing climate adaptation remains one of the greatest challenges, particularly in agriculturean industry dominated by independent smallholders across diverse regions. Many smallholders lack access to the resources needed to adopt climate-resilient farming measures. This provides an opportunity for larger companies, like Barry Callebaut, to help bridge this financing gap in their supply chain.

Exposure to physical climate risk therefore did not prevent us from investing in Barry Callebaut because we were comfortable with the company’s approach to mitigation and adaptation. We will continue to engage on this topic to ensure we remain confident in Barry Callebaut’s ability to manage its risk exposure.

Decarbonizing the Real Economy

The role asset managers play in the energy transition has matured in recent years. Emphasis on portfolio decarbonization has given way to a focus on helping companies achieve real economy emissions reductions through active ownership. We have long believed that for the global energy transition to succeed, capital must continue to flow to high-emitting, economically critical sectors, to support decarbonization pathways.

Decarbonization is rarely linear for these sectors. Not all companies can, or should, decarbonize at the same pace or use the same technologies to do so. In some cases, revising headline climate targets or pausing capital investment plans reflects a more disciplined and realistic approach to reducing emissions over time, rather than a step back from ambition. We view this transparency and recalibration as a sign of maturity in company transition strategies.

We are encouraged that this pragmatic approach has gained broader support. One positive outcome is that companies are increasingly willing to be transparent about the challenges, in addition to the opportunities, of the transition. The following example highlights a case where we have deepened our understanding of the trade-offs companies are managing as they pursue efficient – and arguably more durable – pathways to reduce real economy emissions over time.

Arcelormittal: Global Steel & Mining Company

At the end of 2024, ArcelorMittal formally announced a delay in committing material decarbonization capital expenditures (capex) in Europe, citing policy and market uncertainties. As of the end of 2025, ArcelorMittal had no plans to spend additional decarbonization capex in Europe, unless the policy environment materially changes. Based on our engagements with ArcelorMittal throughout 2025, we believe this is ultimately the best decision for the business and for real world decarbonization outcomes.

Decarbonizing ArcelorMittal’s operations in Europe would be very expensive, and existing policy incentives do not go far enough to ensure a decent return on the investment required. Significant capex and operating expenses would be required. Electricity, particularly from renewable sources, is expensive in the European markets where ArcelorMittal operates (e.g., Spain, France, and Germany) because the power markets are constrained with higher regulatory charges. Conversely, peer SSAB has access to cheaper green electricity by virtue of operating in the Nordics, where abundant hydro, nuclear, and wind energy significantly reduce the marginal cost of electricity generation.

Our view is that players like SSAB with advantaged access to cheap clean power in Europe should expand production while decarbonizing production processes. We correspondingly believe ArcelorMittal should cede market share in Europe to more advantaged players by not reinvesting in the European business over time. In our opinion, ArcelorMittal should allocate capital to regions where they can earn a higher return based on their competitive advantage, such as the US and Brazil, where they have access to cheap and abundant natural gas and hydroelectric power, respectively. In aggregate, we believe this would make society wealthier and therefore better able to allocate capital to the transition over the long term.

ArcelorMittal continues to explore sustainable production processes that could become viable for its European operations in the future. For example, ArcelorMittal is exploring carbon capture technology, as well as electrolysis as an alternative to green hydrogen. In our view, ArcelorMittal is strategically adopting a wait-and-see, technology-agnostic approach; should market conditions change, they will be well-placed to take advantage of the most economically competitive decarbonization technologies for the industry.

Product Responsibility

Product safety and responsibility are foundational to many of the businesses in which we invest, whether B2B or B2C. The potential financial and reputational impacts of a negative event could be severe, including litigation costs, regulatory fines, and loss of customer trust and associated market share.

In our 2024 Stewardship Report, we highlighted our ongoing engagement with Reckitt Benckiser, following lawsuits alleging their baby formula increases the risk of Necrotizing Enterocolitis (NEC). In our view, the preponderance of evidence remains on the side of the company; however, this case highlights how damaging litigation can be, even if allegations are unproven. We continue to engage actively with Reckitt on this issue and monitor developments as part of our Opportunity List.

Another area of growing relevance for investors has been the management of chemical safety and the responsible phase-out of substances of concern. We detail our engagement with Arkema to illustrate how product responsibility is evolving beyond traditional consumer safety to encompass broader societal and environmental expectations.

Arkema: Global Specialty Chemical Producer

Per- and Polyfluoroalkyl substances (PFAS) or “forever chemicals” have become a focal point for regulators, litigators, and communities due to their persistence in the environment and potential human health impacts. As scrutiny intensifies across jurisdictions, companies involved in the production or use of PFAS face rising operational, legal, and reputational risks.

Arkema faces active litigation across two dimensions: personal injury and environmental contamination. We have maintained an active dialogue with Arkema on both, and it remains our view that overall business exposure is modest. Arkema no longer manufactures any of the high concern PFAS polymers and therefore has much more limited overall litigation exposure than some of its peers.

Arkema is named in the multi-district litigation (MDL) case in the U.S. related to the use of PFAS in firefighter foam, but Arkema has not sold products used in the production of such foam. Recently, Arkema was dismissed as a defendant in bellwether cases related to kidney cancer. Still other MDL cases remain pending, and Arkema continues to defend their stance. While the outcomes are pending, and Arkema cannot discuss the specifics of ongoing litigation, we believe the risk of material fines is low, and Arkema has not taken any associated provisions.

In Europe, Arkema continues to participate in the European Commission’s broad regulatory review of PFAS. While there are some countries in Europe moving toward a PFAS ban on certain product applications, Arkema does not have exposure to these. Arkema continues to engage the Commission on its production of polyvinylidene fluoride (PVDF), a PFAS polymer that is not used directly by consumers and is of low concern per the Organisation for Economic Co-operation and Development (OECD) guidelines. Arkema’s case to the regulator is that this product presents low direct risk to consumers, and there is currently no viable replacement for certain essential industrial applications, such as the production of EV batteries. Arkema remains optimistic that any bans of PFAS in Europe will allow for nuance; barring such consideration, the company believes at the very least there will be a long enough phase-out timeframe to minimize business impact.

News reports continue to connect Arkema’s Pierre-Bénite manufacturing site in France to the production of PFAS, which carries the potential for reputational risk. After engaging with Arkema on these reports, we learned that in 2024 they ceased use of the PFAS surfactant in the production of PVDF at this site. Prior to ceasing production, Arkema had remained in compliance with the local regulatory thresholds for PFAS levels and ongoing monitoring requirements. We therefore expect the media noise around this site to die down in time, and we do not include significant financial penalties in our estimates of future earnings. This is an issue we continue to monitor and discuss with Arkema as the situation evolves.

05. ADDITIONAL ENGAGEMENT TACTICS

Engagement Escalation

In instances where issues have not been adequately addressed during our routine engagement with management teams, we may consider the following actions to escalate our concerns:

- A private meeting with the chairman or other board members

- A written letter to members of the senior management team and/or board members

- Voting against members of the board or resolutions at annual general meetings

- Divestment, if the lack of progress changes our view of the investment’s embedded risk-reward

For example, in February of 2025, we wrote a letter to TriMas’s Chairman regarding concerns over the company’s capital allocation decisions, particularly the ongoing divestitures of key business units at discounted valuations. We felt these actions, along with rising corporate overhead expenses and high-priced acquisitions, were damaging shareholder value. After discussions with management, we decided to formalize our concerns in writing and requested a conversation with the Chairman to better understand the board’s priorities. The company subsequently divested a business at a favorable valuation but with the intention of using the proceeds for incremental acquisitions; again, we engaged with the board to express our views about capital allocation.

Collaborative Engagement

While we typically prefer to engage directly with the companies we own, occasionally we recognize the potential benefits of collaborative engagement with other investors. In such cases, we may seek to work with other investors, but we will only do so when we believe it is in our clients’ best interests and permissible under applicable laws and regulations.

Situations where we have found collaborative engagement helpful include, but are not limited to, advancing a shared agenda with clients for a particular portfolio company and/or working with other investors to share insights on a particular issue.

There are also aspects of collaborative engagement efforts that are less well-aligned with our approach and investment philosophy. First, we do not seek to become activists or insiders, nor do we encourage proxy battles. Instead, we prefer to maintain a constructive dialogue with management teams and work collaboratively to achieve the desired outcome. Second, company-specific, bottom-up, ESG-integrated investment analysis is core to our investment philosophy and approach to stewardship. This naturally lends itself to a more company-specific approach to engagement. The perspective we want to bring to management teams is often more nuanced than some collaborative organizations allow. As such, we have not necessarily found collaborative engagement initiatives particularly helpful to advance our agenda with company management. If we were applying ESG themes top-down, it might make more sense to team up with other investors focusing on the same ESG theme. We also find we maintain good access to management teams through our concentrated portfolios, so we have not needed to leverage these collaborative groups for the purpose of seeking an audience with management teams.

That said, we do periodically consider membership in some of these collaborative organizations and remain open to evolving our approach. Our ESG team has recently joined CII, and we continue to evaluate potential membership of other initiatives as relevant. Our ESG team also spends significant time engaging with the ESG community through panels and other means. As members of the Principles for Responsible Investment (PRI) and the International Financial Reporting Standards (IFRS), we frequently attend convenings with other members.

Policy-Related Engagements

ESG issues often become financially material for companies and industries because of regulation. As such, it is important to maintain a dialogue with policymakers as part of our research and stewardship activities. Over the past year, we have engaged on several regulatory developments, including recent changes to the Inflation Reduction Act, evolving EU climate policy, Japan’s governance and energy transition reforms under the GX Plan, and ongoing corporate governance reforms in Korea. We also continued to evaluate global carbon pricing initiatives and the mechanics of market-specific regulatory frameworks that influence long-term decarbonization pathways and capital allocation decisions.

06. PROXY VOTING

Proxy voting is a critical component of our engagement efforts and ability to drive change. As such, we take our responsibility as stewards of our clients’ capital seriously, actively voting the shares of companies in which we invest on their behalf as an integrated part of our investment process. Each proxy is voted in what we believe to be the best interests of our clients. We exercise proxy voting to highlight our views on management decisions, including ESG-related items, regardless of whether we agree with management’s recommendation. We evaluate each proxy item for any investment on its own merit and therefore vote on a case-by-case basis, informed by our Proxy Voting Policy.

Institutional Shareholder Services (ISS) provides us with a proxy analysis including supporting research and a vote recommendation for each shareholder meeting. Nevertheless, we retain ultimate responsibility for instructing ISS how to vote proxies on behalf of each individual proxy item for each company.

We disclose our proxy voting records publicly, and they can be found AT THIS LINK.

Roles & Responsibilities

Each proxy is reviewed and voted by the investment analyst covering the stock. We intentionally do not outsource this responsibility to a separate stewardship team, as we consider it a fundamental part of our investment due diligence and engagement. Our Director of Research is responsible for monitoring analysts’ compliance with voting procedures.

We have also found value in our ESG team taking on a more formalized role in the proxy voting process, providing a synthesized view of key issues and vote recommendations to the relevant investment analyst. This enhances consistency year-to-year and strengthens the documentation of our vote rationales. The ESG team adds an additional layer of expertise and insight to support the analyst team throughout the process.

Significant Proxy Examples

Pfizer Inc.: Global Developer and Manufacturer of Pharmaceuticals

Pfizer decided to extend the vesting cycle in its long-term incentive plan (LTI), allowing executives two additional years to meet the required performance criteria. Pfizer deemed this modification necessary given changes in the external environment outside of executive control, namely the rapid drop in demand for the COVID-19 vaccine a few years into the pandemic. We considered this context and acknowledged that the adjusted vesting schedule was still performance-conditioned. However, we ultimately decided to vote against both the compensation proposal and members of the compensation committee up for election. We viewed Pfizer’s move as effectively repricing the LTI, creating a misalignment with shareholder interests. Performance goals are set within a specific time frame for a reason, and allowing them to be reset mid-cycle undermines the integrity of setting these goals in the first place.

The Swatch Group AG: Swiss Luxury Watch Manufacturer

For the second consecutive year, we voted against all members of the Swatch Board of Directors to signal our strong preference for board refreshment. The board consisted of seven members, and those same seven members comprised each of the key board committees, including the audit committee. Boards typically recruit specific individuals to serve on key committees, based on skills and experience. Ideally, those committees would be majority or, in the case of the audit committee, fully independent. In our view, having the same seven members sitting on each of the key committees creates an environment for entrenched thinking; many of these individuals are not independent and/or have had very long tenures on the board. We shared this point of view with company management and suggested a potential board member whom we think would be effective. We hope to see positive governance changes.

LKQ Corporation: Alternative Aftermarket Auto Parts Distributor

We generally support actions to improve shareholder rights, such as providing the right for shareholders to call a special meeting. However, we voted against such a shareholder proposal at LKQ, because we disagreed with the specifics of the proposal. Given the presence of activists among LKQ’s investors, we are wary of allowing the right to call a special meeting with only a 10% ownership threshold and no minimum holding period. This relatively low bar to call a special meeting could allow the activists to exercise outsized influence and encourage short-term thinking, counter to our interests as long-term shareholders. While we voted against the specifics of this proposal, we engaged with LKQ to share our preference for the right to call a special meeting with a higher ownership threshold (15–20%) and a minimum one-year holding period.

Coca-Cola Bottlers Japan Inc.: Bottler and Distributor of Coca-Cola Products in Japan

This proxy season, we raised our expectations of board independence in the Japanese market to majority independence, in line with how we think about independence in other regions where we invest. The independent outside director ratio for Tokyo Stock Exchange (TSE) Prime-listed companies is now 44%2, which, in our view, is sufficient to advocate for majority independence. Typically, we vote against all non-independent board members in cases where the board is not majority independent. We make our own determination of independence and do not rely on a third party’s definition. At Coca-Cola Bottlers Japan, significant governance improvements had been made, specifically returning cash to shareholders and improving return on equity (ROE). Consequently, we made an exception to our standard approach and voted for the reelection of the CEO and CFO, while voting against all other non-independent directors. Our intention was to signal our support for management’s recent governance improvements, while also indicating our preference for strong independent oversight of management moving forward.

Shell plc: Global Oil & Gas Major

We voted against a shareholder proposal asking Shell to disclose how its liquefied natural gas (LNG) strategy is consistent with a pathway to net zero. Shell has made extensive disclosures about its LNG strategy and regularly publishes metrics to help shareholders assess progress. Given the uncertainties and dependencies in the various decarbonization pathways, we believe it would be counter to long-term shareholder interests for Shell to assume the global economy is on a deterministic path to net zero by 2050. We engage with Shell regularly on decarbonization and believe that management is sensibly deploying capex into areas of competitive advantage (e.g., carbon capture and storage, biofuels) at a pace consistent with the demand they see for these products. LNG remains a key bridging fuel in the transition, and we are supportive of Shell’s plans to continue to grow this business.

ENGAGEMENT BREAKDOWN

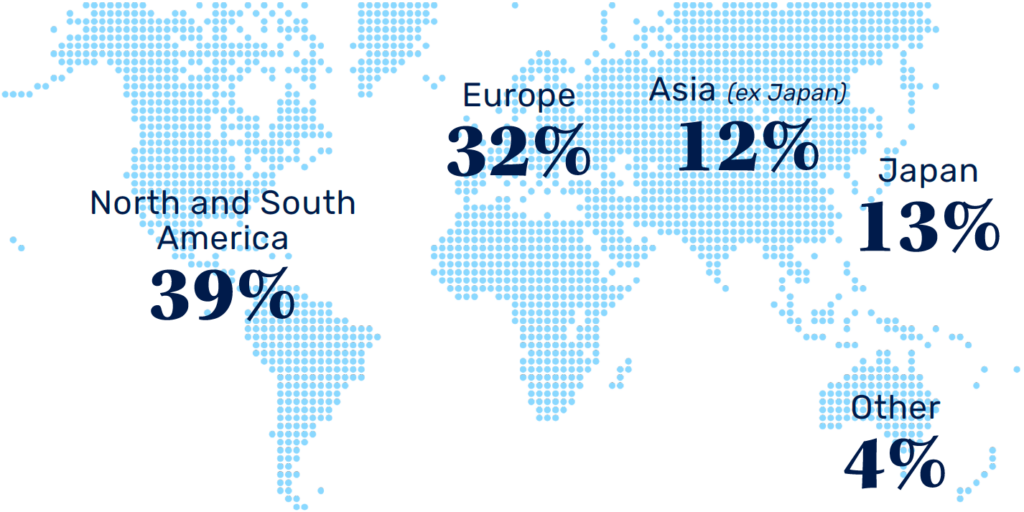

Geographic location breakdown for all engagements in 2025

location is based on the where the headquarters of the company are

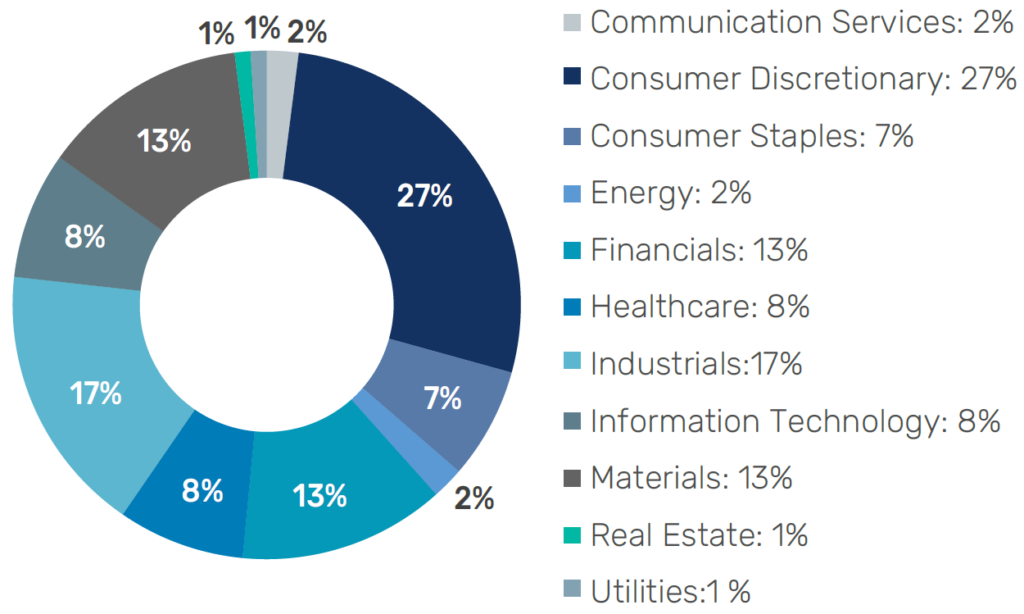

Sector breakdown for all engagements in 2025

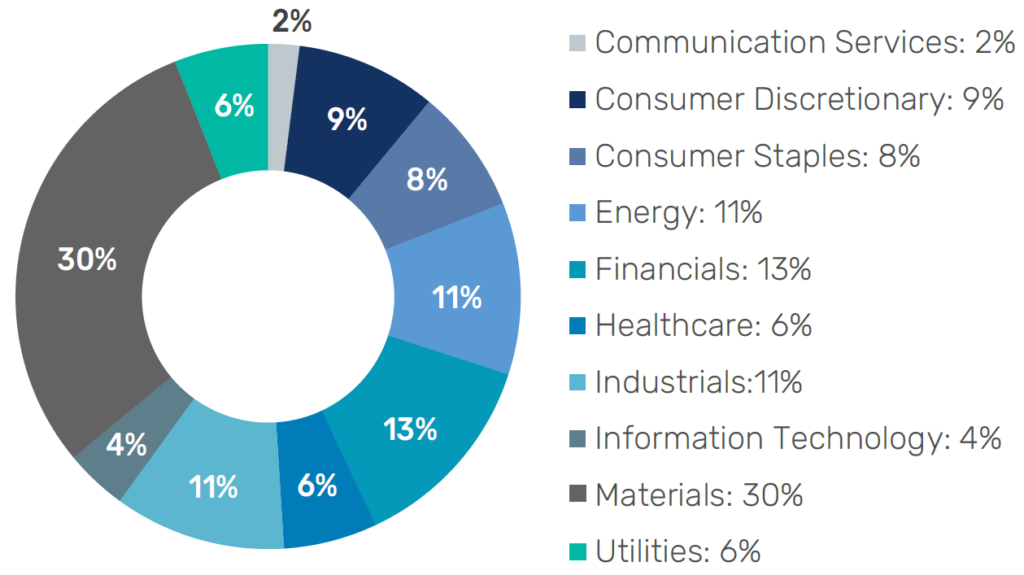

Sector breakdown for all Opportunity List engagements in 2025

E, S & G breakdown of Opportunity List engagements

overlap due to multiple topic meetings

-

The Opportunity List is a portfolio specific set of names that seeks to systematically identify opportunities where material ESG issues exist and engagement could have a positive impact and improve financial outcomes for investors. Details of the Opportunity List can be found HERE

-

Source: Tokyo Stock Exchange, Pzena Analysis

Further information

These materials are intended solely for informational purposes. The views expressed reflect the current views of Pzena Investment Management, LLC (“PIM”) as of the date hereof and are subject to change. PIM is a registered investment adviser registered with the United States Securities and Exchange Commission. PIM does not undertake to advise you of any changes in the views expressed herein. There is no guarantee that any projection, forecast, or opinion in this material will be realized. Past performance does not predict future returns.

All investments involve risk, including loss of principal. The price of equity securities may rise or fall because of economic or political changes or changes in a company’s financial condition, sometimes rapidly or unpredictably. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in Emerging Markets. Investments in small-cap or mid-cap companies involve additional risks such as limited liquidity and greater volatility than larger companies. PIM’s strategies emphasize a “value” style of investing, which targets undervalued companies with characteristics for improved valuations. This style of investing is subject to the risk that the valuations never improve or that returns on “value” securities may not move in tandem with the returns on other styles of investing or the stock market in general.

This document does not constitute a current or past recommendation, an offer, or solicitation of an offer to purchase any securities or provide investment advisory services and should not be construed as such. The information contained herein is general in nature and does not constitute legal, tax, or investment advice. PIM does not make any warranty, express or implied, as to the information’s accuracy or completeness. Prospective investors are encouraged to consult their own professional advisers as to the implications of making an investment in any securities or investment advisory services.

The specific portfolio securities discussed in this presentation are included for illustrative purposes only and were selected based on their ability to help you better understand our investment process. They were selected from securities in one or more of our strategies and were not selected based on performance. They do not represent all of the securities purchased or sold for our client accounts during any particular period, and it should not be assumed that investments in such securities were or will be profitable. PIM is a discretionary investment manager and does not make “recommendations” to buy or sell any securities. There is no assurance that any securities discussed herein remain in our portfolios at the time you receive this presentation or that securities sold have not been repurchased.

For EU Investors Only:

This marketing communication is issued by Pzena Investment Management Europe Limited (“PIM Europe”). PIM Europe (No. C457984) is authorised and regulated by the Central Bank of Ireland as a UCITS management company (pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended). PIM Europe is registered in Ireland with the Companies Registration Office (No. 699811), with its registered office at Riverside One, Sir John Rogerson’s Quay, Dublin, 2, Ireland. Past performance does not predict future returns. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research.

For Australia and New Zealand Investors Only:

This document has been prepared and issued by Pzena Investment Management, LLC (ARBN 108 743 415), a limited liability company (“Pzena”). Pzena is regulated by the Securities and Exchange Commission (SEC) under U.S. laws, which differ from Australian laws. Pzena is exempt from the requirement to hold an Australian financial services license in Australia in accordance with ASIC Class Order CO 03/1110 and the transactional relief under ASIC Corporations (Repeal and Transitional) Instrument 2016/396, extended through 31 March 2027 by ASIC Corporations (Foreign Financial Services Providers) Instrument 2025/798. Pzena offers financial services in Australia to ‘wholesale clients’ only pursuant to that exemption. This document is not intended to be distributed or passed on, directly or indirectly, to any other class of persons in Australia.

In New Zealand, any offer is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013 (‘FMCA’). This document is not to be treated as an offer, and is not capable of acceptance by, any person in New Zealand who is not a Wholesale Investor.

For South African Investors Only:

Collective Investment Schemes in Securities (CIS) should be considered as medium to long-term investments. The value may go up as well as down and past performance is not necessarily a guide to future performance. CISs are traded at the ruling price and can engage in scrip lending and borrowing. A schedule of fees, charges and maximum commissions is available on request from the manager. A CIS may be closed to new investors in order for it to be managed more efficiently in accordance with its mandate. There is no guarantee in respect of capital or returns in a portfolio. Performance has been calculated using net NAV to NAV numbers with income reinvested. The performance for each period shown reflects the return for investors who have been fully invested for that period. Individual investor performance may differ as a result of initial fees, the actual investment date, the date of reinvestments and dividend withholding tax. full performance calculations are available from the manager on request. Annualised performance shows longer term performance rescaled to a 1-year period. Annualised performance is the average return per year over the period. Actual annual figures are available to the investor on request. Highest and lowest returns for any 1 year over the period since inception have been shown. NAV is the net asset value represents the assets of a Fund less its liabilities. Representative Office: Prescient Management Company (RF) (Pty) Ltd is registered and approved under the Collective Investment Schemes Control Act (No. 45 of 2002).

© Pzena Investment Management, LLC, 2026. All rights reserved.