Opportunity in Times of Trouble – The Case for European Equities

Third Quarter 2022 Commentary

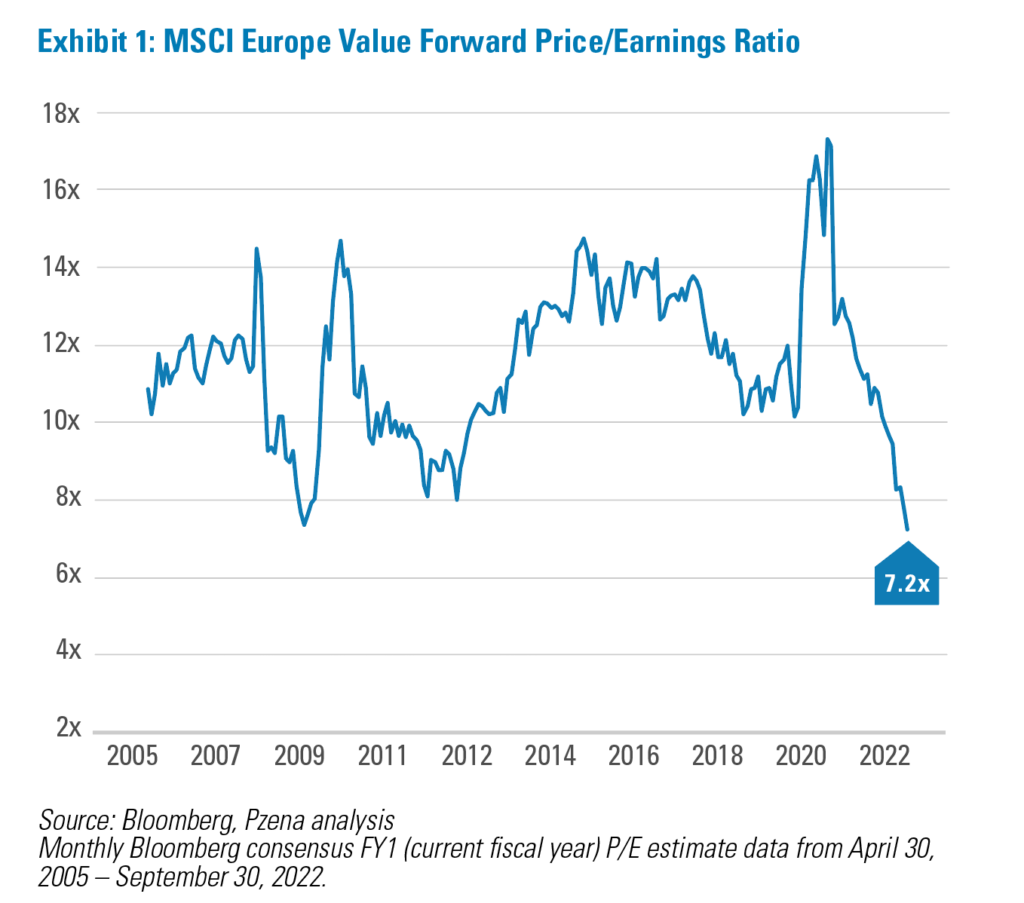

European equities are trading near a 20-year low, driven by macro and geopolitical concerns. We are finding significant opportunity in well positioned, financially sound businesses, that should have the wherewithal to navigate a possible recession.

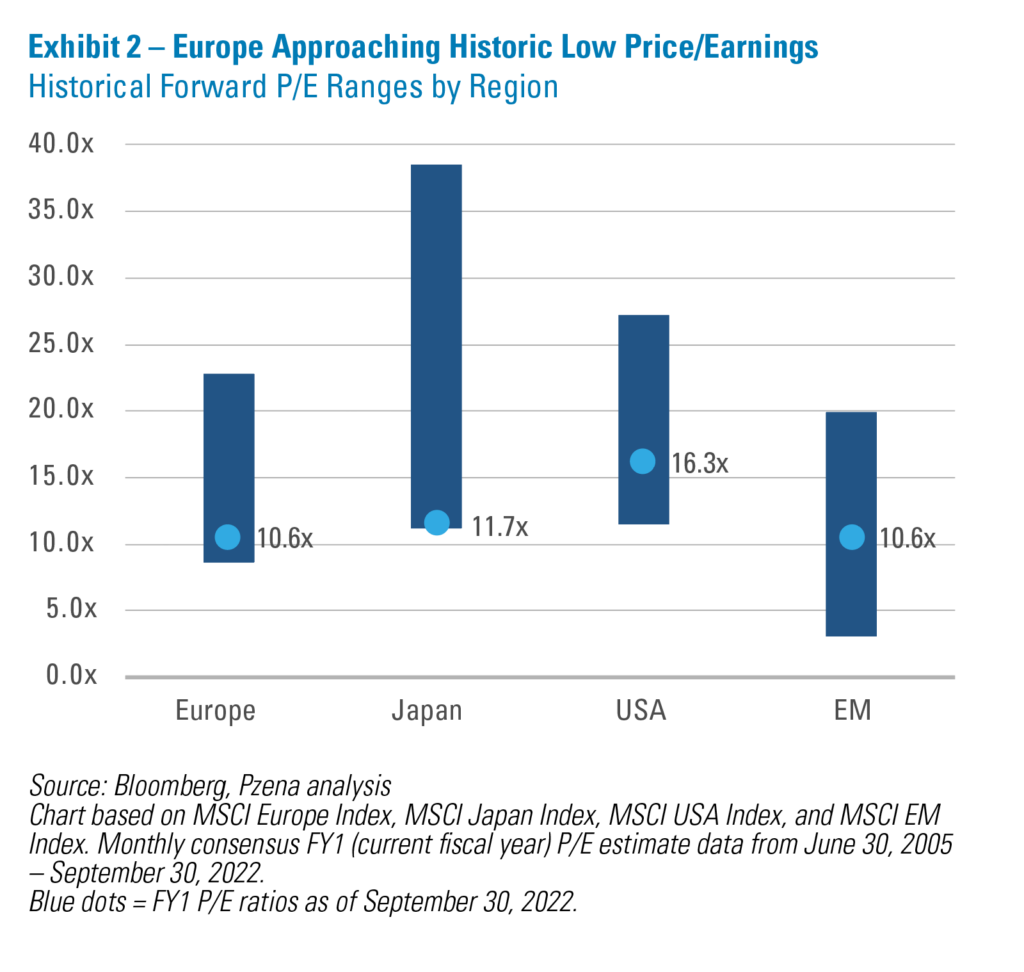

The sharp year-to-date drawdown in global markets has created an opportunity that value investors patiently wait for: the chance to buy great businesses selling at prices well below their intrinsic values. While we see a broad array of opportunities across various geographies, Europe stands out as particularly attractive, trading at near 20-year lows.

A multitude of concerns ranging from high inflation, rising interest rates, and fears of a consequential recession have moved global stock markets into bear territory. Europe has been the hardest hit region, as it is highly exposed to soaring energy costs precipitated by Russia’s invasion of Ukraine. While these concerns are valid, as disciplined value investors, we see the sell-off as an opportunity to find attractive investment opportunities in great companies that have been indiscriminately sold off along with the rest of the market. Generally, they are global businesses with strong balance sheets and franchises that should help them weather the storm and potentially emerge stronger from any potential downturn. Given this backdrop, it is not surprising that we have been adding to our European exposure across our portfolios, at the cheapest levels we have seen since the Global Financial Crisis

(Exhibit 1).

EUROPE ALREADY DISCOUNTING A RECESSION

While Europe has led the sell-off in global equities, European corporate operating performance has held up with margins expanding by 45 basis points since the first quarter of this year[1]. Therefore, the sell-off has been almost entirely based on sentiment, as Europe’s PE multiple has contracted by 33% since the start of the year[2], implying that a damaging recession is a foregone conclusion.

If Europe manages to avoid a long and severe economic downturn, value stocks appear generationally cheap, at their lowest level since the Global Financial Crisis (GFC). We find this rather remarkable considering the macroeconomic backdrop does not appear to be remotely as severe as the GFC and company balance sheets are in far better shape. While the EU may very well enter a recession (or already be in one), we believe much of the pain is likely priced in. Therefore, we believe this valuation reflects an overly pessimistic and fearful sentiment surrounding European stocks, creating the ideal environment to selectively buy shares of excellent companies trading at highly discounted valuations.

SELECTIVITY TO DEAL WITH MACROECONOMIC RISKS

Invariably, stock selection is crucial in the face of economic uncertainty. Investing in market leaders that have the capability and wherewithal to adjust their operations and pass through higher input costs is especially important in high inflation periods. Equally important is a balance sheet strong enough to withstand a potential downturn in the business.

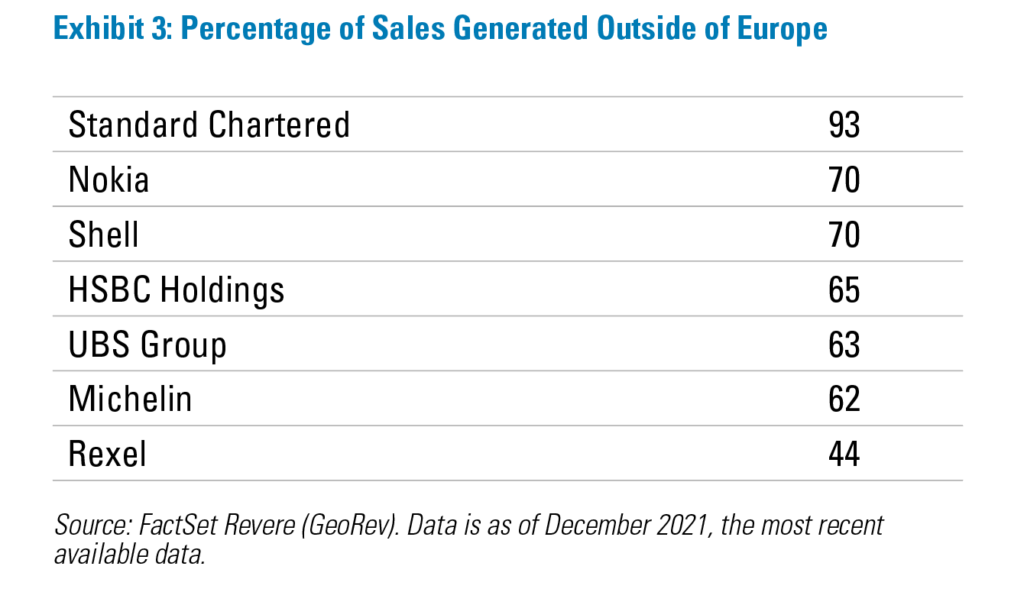

In addition, many of the European companies we own in our portfolios are global businesses generating sales around the world, and their European domiciles are what is largely hurting their valuations. Their geographically diversified revenue streams leave them less exposed to Europe-specific headwinds (Exhibit 3). Additionally, with globally diverse sales they should see a benefit from a weak Euro relative to US competitors.

Below are some European-domiciled companies we own broadly in our European, International, and Global portfolios, which we believe fit these profiles.

COMPANY-SPECIFIC COMMENTS[3]

Michelin is a leading global manufacturer of tires for the premium car and off-highway segments. Michelin, similar to virtually all European manufacturers, has been incurring elevated raw materials and manufacturing/logistics costs in recent quarters; however, the company has been able to pass through price increases to mitigate the impact on the bottom line. In the first half of 2022, revenue grew 19% but volumes were down 2%, mostly driven by the company’s ability to raise prices. Ultimately, we expect costs to normalize, while sales rebound with volumes, leading to positive operating leverage. In the longer term, Michelin is poised to benefit from the shift to electric vehicles, which require premium tires and advanced technical capabilities due to extra performance demands. We believe the stock is one of the portfolio’s most attractive investments, trading at just 6.3x our normal earnings estimate. See our 1Q21 Highlighted Holding (https://www.pzena.com/wp-content/uploads/2022/10/PzenaNewsletter-Highlighted-Holding-1Q21.pdf) for a more detailed discussion.

Shell is an integrated energy giant with both upstream and downstream operations. After years of targeted investments, the company is a leading global player in the liquified natural gas (LNG) value chain. Given the prevailing environment, Shell and its peers have been generating record profits; however, its shares have been stuck in a range due to the same macro concerns impacting most companies with sizable European exposure. We believe the market underestimates Shell’s ability to earn adequate returns through the impending energy transition. The company’s multi-year investments in LNG, coupled with its longer-term ambition to be net-zero by 2050, map out a path for the transition that is reasonable and economically sound. Traditional hydrocarbon fuels are undoubtedly going to remain a vital energy source for years to come as the world ultimately transitions to greener fuels, and Shell’s legacy upstream business has been generating record cash flow (forward FCF yield north of 20%[4]), which management has been using to reduce debt and buy back shares. At ~8x our normal earnings estimate and a forward price-to-earnings ratio under 4.5x — the lowest on record — Shell trades at a significant discount relative to US peers Exxon and Chevron, and we believe the company is well-positioned to capitalize on the clean energy revolution.

Nokia is the third largest global manufacturer of wireless telecom networking equipment. The company has been successfully executing on its turnaround strategy, closing the 5G competition gap, as it seeks to take market share from Huawei and Ericsson. Explicit bans or fears of using Chinese 5G equipment (Huawei and ZTE) have given Nokia an opportunity to catch up and should present it with some natural market share gains — particularly in Europe, where Nokia believes Huawei will shed its dominant market share. Nokia’s balance sheet remains in excellent shape with a net cash position equal to ~15% of its market cap[5], and trades at 7.6x our normal earnings estimate.

Rexel is a France-based global distributor of electrical equipment and supplies to contractors, and a provider of services for automation and energy management. As a distributor, Rexel’s cash flow profile is countercyclical, which benefited the company during the COVID-19-induced sales decline. The current inflationary environment has also been a net positive for Rexel, benefiting from the price increases that their suppliers have been instituting. The company recently posted record earnings, beating consensus estimates by 20% on the bottom line — a testament to its pricing power and strong competitive positioning. With Rexel’s operations performing excellently, we believe investors are overly fixated on a particularly dire macro forecast instead of on the company’s value-proposition, resulting in a valuation of just 6.2x our estimate of normal earnings, and a record low forward EV/EBITDA of 5.2x.

We find European banks particularly compelling, trading at just 6x forward earnings — the lowest level since the GFC and a 42% discount to the broad index[6]. This is despite lenders enjoying positive net interest income momentum on the back of ECB rate hikes. The material valuation discount stems from fears of a rise in defaults should Europe enter a severe recession. Our bank holdings are very well capitalized currently (average of 14.4% CET-1 ratios — well in excess of their regulatory minimums and managements’ targets)[7], while credit has actually improved, as observed by a decline in non-performing loans since the start of the year[8]. These stocks are trading at roughly 85% of their tangible book values[9], reflecting the extreme macro pessimism.

One specific example is ING Groep, the diversified pan-European bank with leading franchises in Belgium and the Netherlands. Similar to peers, ING has been outperforming expectations on higher net interest income and lower credit costs—a function of rising interest rates and growth in performing loans. The stock, nonetheless, traded down due to its Russian business, European revenue concentration, as well as broader macro fears. We view ING’s Russia-related exposure, which the Group reduced by nearly 35% to EUR 4.5bn (< 1% of the loan book) since the start of the war, as manageable and believe ING’s large excess capital position (20–25% of market cap) should afford it the flexibility to navigate a European downturn and continue to return capital to shareholders.[10] Trading at just 5.2x our normal earnings estimate and ~66% of tangible book value, we believe a significant amount of pain is already priced in.

See our Highlighted Holding, Randstad.

CONCLUSION

Trading at near 20-year lows, Europe is one of the most attractively valued regions in our Global Universe. Like any cheap assets, European stocks do not lack for controversy. However, we believe the stocks are trading at valuations that more than discount the uncertain macroeconomic backdrop, and risk mitigation could come by way of careful stock selection.

[1]. Bloomberg; Pzena analysis of MSCI Europe TTM op. margins

[2]. Bloomberg; MSCI Europe, forward price-to-earnings ratios normalized as of 12/31/2021 (Bloomberg Consensus P/E)

[3]. All forward estimates from Bloomberg, FactSet, Pzena as of 9/30/2022

[4]. FactSet; FCF Yield – FY1

[5]. Company filings

[6]. MSCI Europe Banks Index vs. MSCI Europe Index NTM P/E as of 9/30/2022

[7]. Bloomberg; Pzena analysis of CET1 ratios (Tier 1 common equity) as of 6/30/2022

[8]. Bloomberg; Pzena analysis of NPL ratios (Non-performing loans / total assets) between 6/30/2022 and 12/31/2021

[9]. FactSet, Pzena Analysis (simple averages)

[10]. Company filings

FURTHER INFORMATION

These materials are intended solely for informational purposes. The views expressed reflect the current views of Pzena Investment Management (“PIM”) as of the date hereof and are subject to change. PIM is a registered investment adviser registered with the United States Securities and Exchange Commission. PIM does not undertake to advise you of any changes in the views expressed herein. There is no guarantee that any projection, forecast, or opinion in this material will be realized. Past performance is not indicative of future results.

All investments involve risk, including loss of principal. Investments may be in a variety of currencies and therefore changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The price of equity securities may rise or fall because of economic or political changes or changes in a company’s financial condition, sometimes rapidly or unpredictably. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in Emerging Markets. Investments in small-cap or mid-cap companies involve additional risks such as limited liquidity and greater volatility than larger companies. PIM’s strategies emphasize a “value” style of investing, which targets undervalued companies with characteristics for improved valuations. This style of investing is subject to the risk that the valuations never improve or that returns on “value” securities may not move in tandem with the returns on other styles of investing or the stock market in general.

This document does not constitute a current or past recommendation, an offer, or solicitation of an offer to purchase any securities or provide investment advisory services and should not be construed as such. The information contained herein is general in nature and does not constitute legal, tax, or investment advice. PIM does not make any warranty, express or implied, as to the information’s accuracy or completeness. Prospective investors are encouraged to consult their own professional advisers as to the implications of making an investment in any securities or investment advisory services.

The specific portfolio securities discussed in this presentation are included for illustrative purposes only and were selected based on their ability to help you better understand our investment process. They were selected from securities in one or more of our strategies and were not selected based on performance. They do not represent all of the securities purchased or sold for our client accounts during any particular period, and it should not be assumed that investments in such securities were or will be profitable. PIM is a discretionary investment manager and does not make “recommendations” to buy or sell any securities. There is no assurance that any securities discussed herein remain in our portfolios at the time you receive this presentation or that securities sold have not been repurchased.

The MSCI information may only be used for internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the MSCI Parties) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.

For U.K. Investors Only:

This marketing communication is issued by Pzena Investment Management, Ltd. (“PIM UK”). PIM UK is a limited company registered in England and Wales with registered number 09380422, and its registered office is at 34-37 Liverpool Street, London EC2M 7PP, United Kingdom. PIM UK is an appointed representative of Mirabella Advisers LLP, which is authorised and regulated by the Financial Conduct Authority. The Pzena documents are only made available to professional clients and eligible counterparties as defined by the FCA. Past performance is not indicative of future results. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research.

For EU Investors Only:

This marketing communication is issued by Pzena Investment Management Europe Limited (“PIM Europe”). PIM Europe (No. C457984) is authorised and regulated by the Central Bank of Ireland as a UCITS management company (pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended). PIM Europe is registered in Ireland with the Companies Registration Office (No. 699811), with its registered office at Riverside One, Sir John Rogerson’s Quay, Dublin, 2, Ireland. Past performance is not indicative of future results. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research.

For Australia and New Zealand Investors Only:

This document has been prepared and issued by Pzena Investment Management, LLC (ARBN 108 743 415), a limited liability company (“Pzena”). Pzena is regulated by the Securities and Exchange Commission (SEC) under U.S. laws, which differ from Australian laws. Pzena is exempt from the requirement to hold an Australian financial services license in Australia in accordance with ASIC Corporations (Repeal and Transitional) Instrument 2016/396. Pzena offers financial services in Australia to ‘wholesale clients’ only pursuant to that exemption. This document is not intended to be distributed or passed on, directly or indirectly, to any other class of persons in Australia.

In New Zealand, any offer is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013 (‘FMCA’). This document is not to be treated as an offer, and is not capable of acceptance by, any person in New Zealand who is not a Wholesale Investor.

For Jersey Investors Only:

Consent under the Control of Borrowing (Jersey) Order 1958 (the “COBO” Order) has not been obtained for the circulation of this document. Accordingly, the offer that is the subject of this document may only be made in Jersey where the offer is valid in the United Kingdom or Guernsey and is circulated in Jersey only to persons similar to those to whom, and in a manner similar to that in which, it is for the time being circulated in the United Kingdom, or Guernsey, as the case may be. The directors may, but are not obliged to, apply for such consent in the future. The services and/or products discussed herein are only suitable for sophisticated investors who understand the risks involved. Neither Pzena Investment Management, Ltd. nor Pzena Investment Management, LLC nor the activities of any functionary with regard to either Pzena Investment Management, Ltd. or Pzena Investment Management, LLC are subject to the provisions of the Financial Services (Jersey) Law 1998.

For South African Investors Only:

Pzena Investment Management, LLC is an authorised financial services provider licensed by the South African Financial Sector Conduct Authority (licence nr: 49029).

© Pzena Investment Management, LLC, 2023. All rights reserved.