Equity Investing in an Uncertain Macro Backdrop

Fourth Quarter 2022 Commentary

Despite recession, inflation, and geopolitical fears, we believe the value opportunity is compelling, even after its best relative performance in more than two decades.

Macroeconomic and geopolitical fears seemed to be the primary drivers of global equity markets throughout 2022. Inflation worries and the continuing concerns surrounding Russia’s invasion of Ukraine are at the top of investors’ minds, as disruption in the energy market significantly increases the probability of a global recession in 2023.

Acknowledging that we are not geopolitical experts, we believe there are valuable lessons to be learned from economic history to help navigate today’s uncertain markets, including the following:

- Typical recessions are not as severe as the two most recent recessions (COVID-19 and the Global Financial Crisis)

- The peak-to-trough share price decline in 2022 was in the range of typical recessions

- The five-year period following the start of a recession has proven to be a good entry point for stocks in general, and value stocks specifically

- Value equities is one of the few asset classes offering a positive real earnings yieldPast performance is no guarantee of future returns

RECENCY BIAS AND RECESSIONS

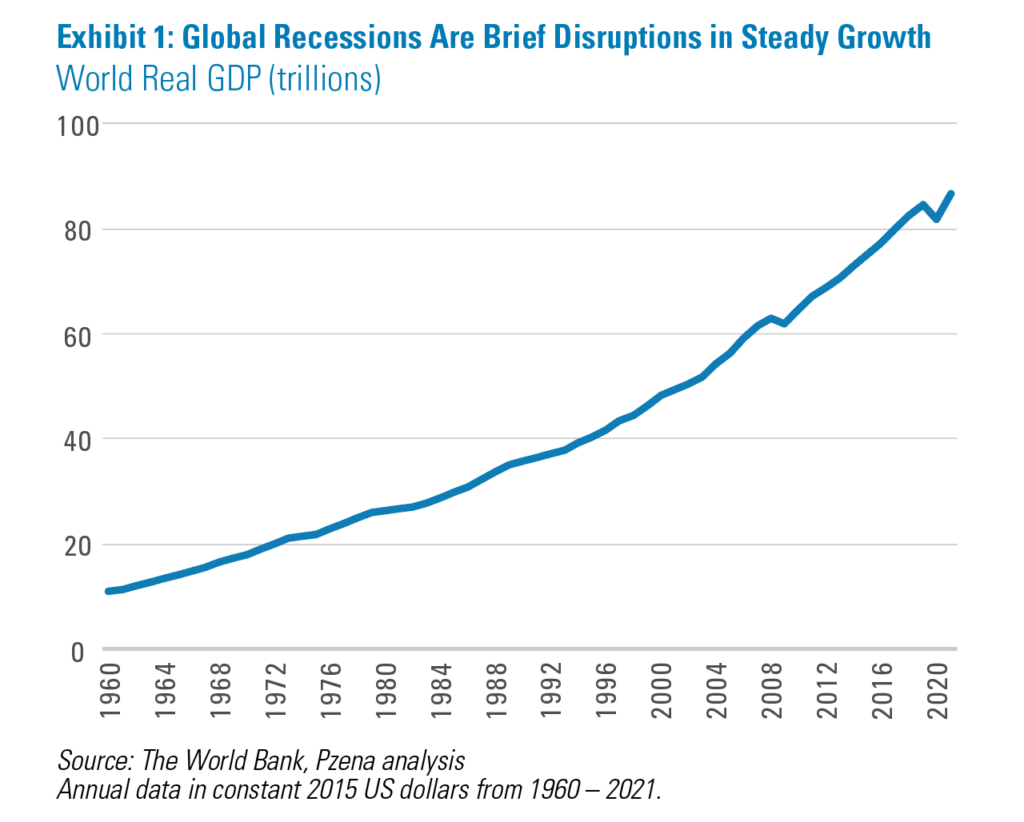

While recessions are bad for economies, the economic disruption from a recession is typically a discrete, brief period until worldwide economic growth continues its long and steady upward trajectory (Exhibit 1). Therefore, long-term investors should be largely unphased by recessions.

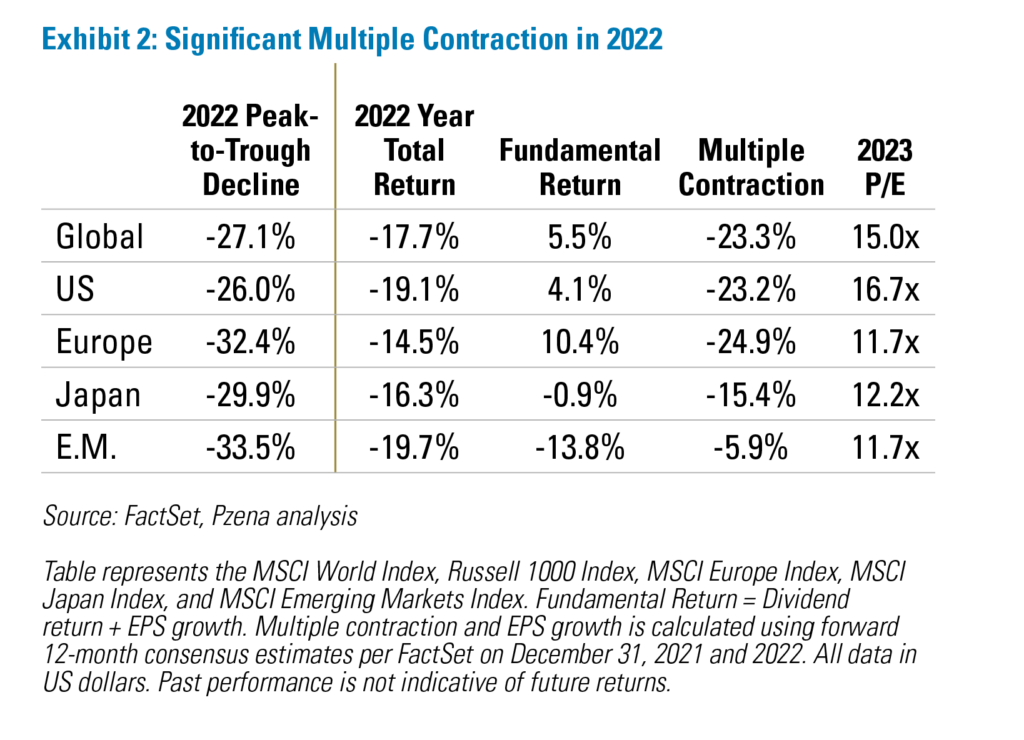

Not surprisingly, recessions have a detrimental impact on equities, with global markets down on average 32% peak-to-trough around recessions. Global equity markets were down 26–34% peak-to-trough in 2022, while earnings grew in most regions other than emerging markets. This means multiple contractions represented all the declines in those indices and then some. While 2023 could see earnings decline, PE multiples have already discounted some recession fears (Exhibit 2).

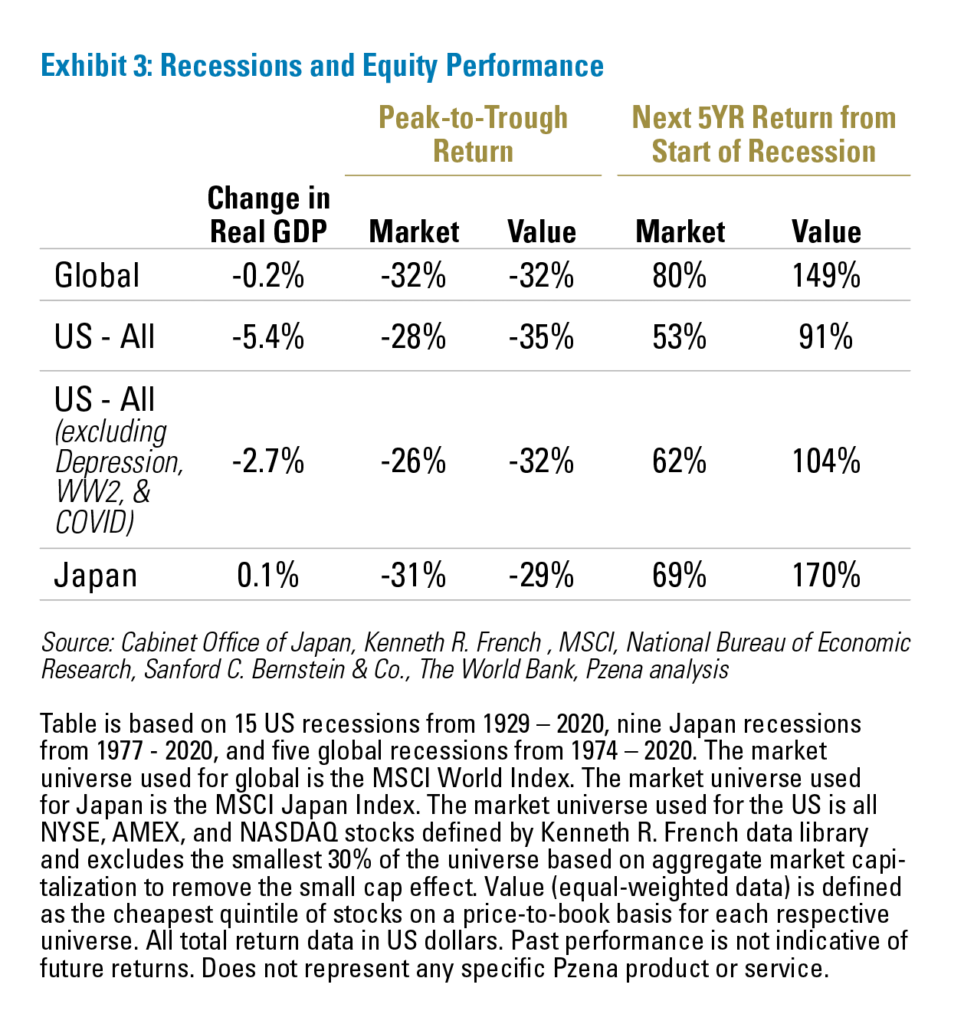

For the US market, which has a longer and more precise history, in the 15 recessions over the past 100 years, GDP has fallen on average by 5.4% through recessions. The recency bias of COVID-19, which saw US GDP fall by 8.5%, may have created the impression that recessions are far more damaging than they typically are. However, the COVID-19 recession was somewhat of an outlier. Removing the extreme recessions, which include the Great Depression, World War 2, and COVID-19, US GDP fell just 2.7% in more “typical” recessions (Exhibit 3). While value has historically trailed the market in recessionary periods, the Russell 1000 Value Index has seen a 20% decline from peak-to-trough this year. This is not unprecedented, as value has lost less than the market in three of the previous seven US recessions.

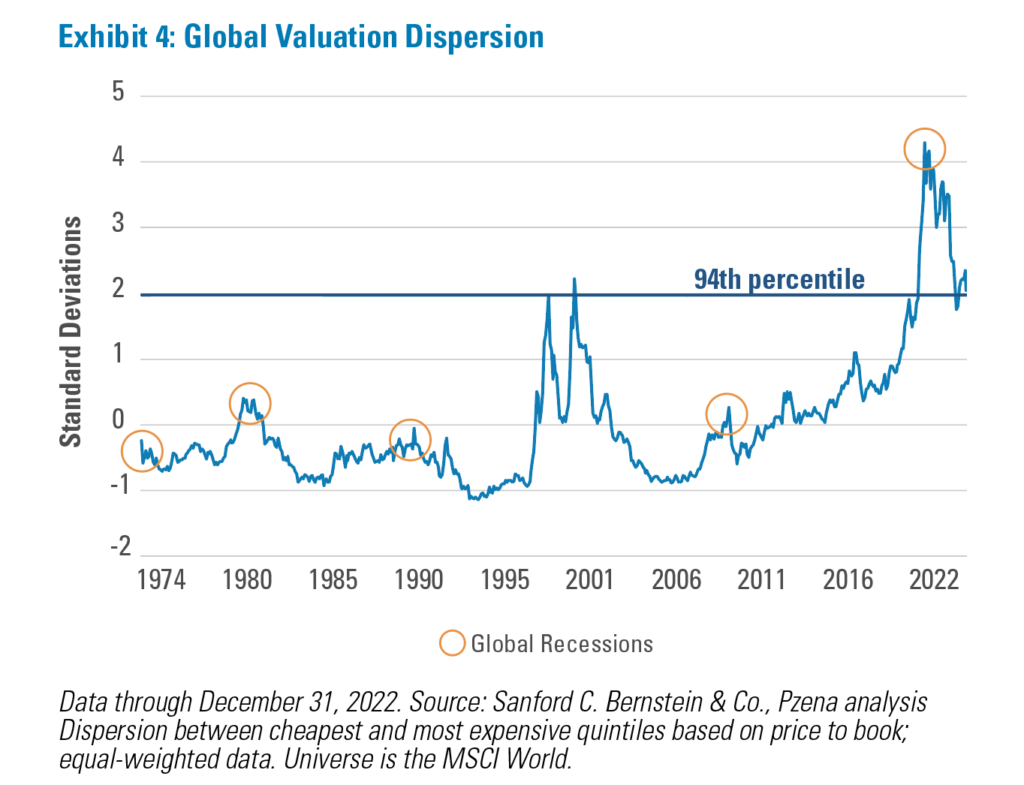

Based on history, once a recession sets in, equities perform quite well over the subsequent five-year period, generating significant outperformance for both US and Global markets. Interestingly, for the three recessions where value outperformed in the cycle’s down-leg, it also generated significant alpha in the subsequent five-year period. Not coincidentally, those three periods started at multiyear peaks in valuation spreads, which subsequently narrowed for several years during long and sustained value rallies (Exhibit 4).

STAGFLATION: CHEAP STOCKS OFFER SUPERIOR REAL RETURNS

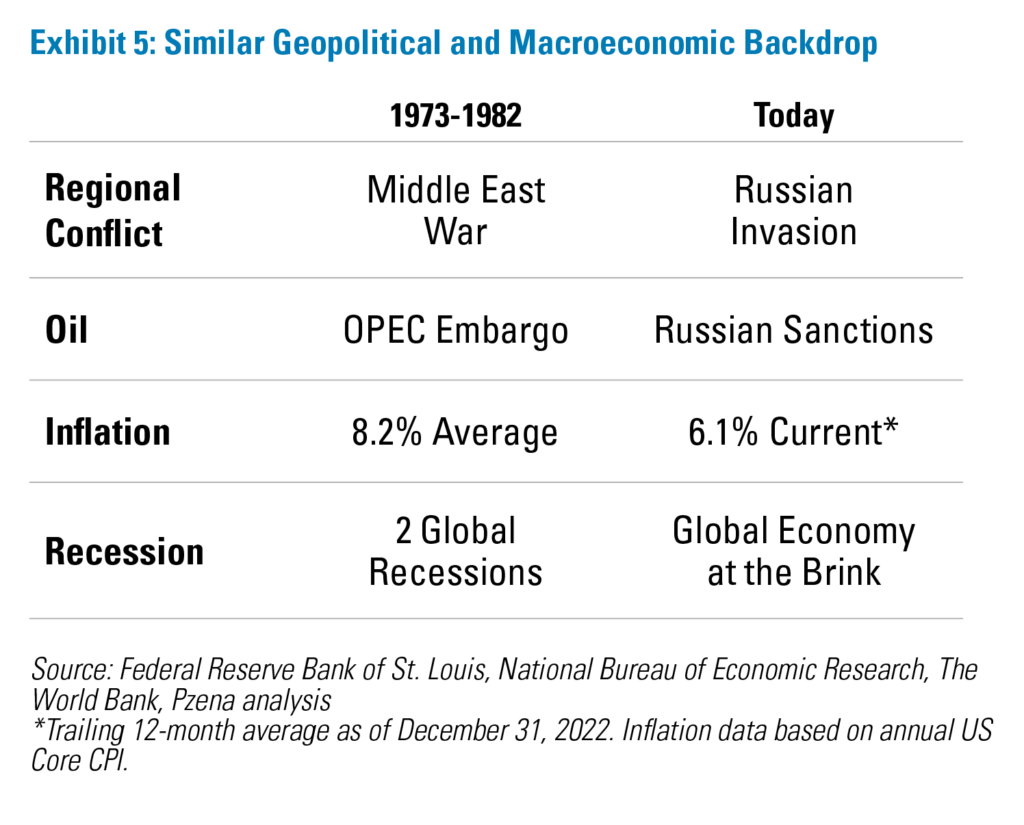

Equity market performance in periods of high inflation and slow or negative GDP growth has been top of mind for many of our clients. While no two periods are exactly alike, history once again provides an interesting comparison, as the period starting in late 1973 and lasting through late 1982 saw a similar geopolitical and macroeconomic backdrop to what we are seeing today (Exhibit 5).

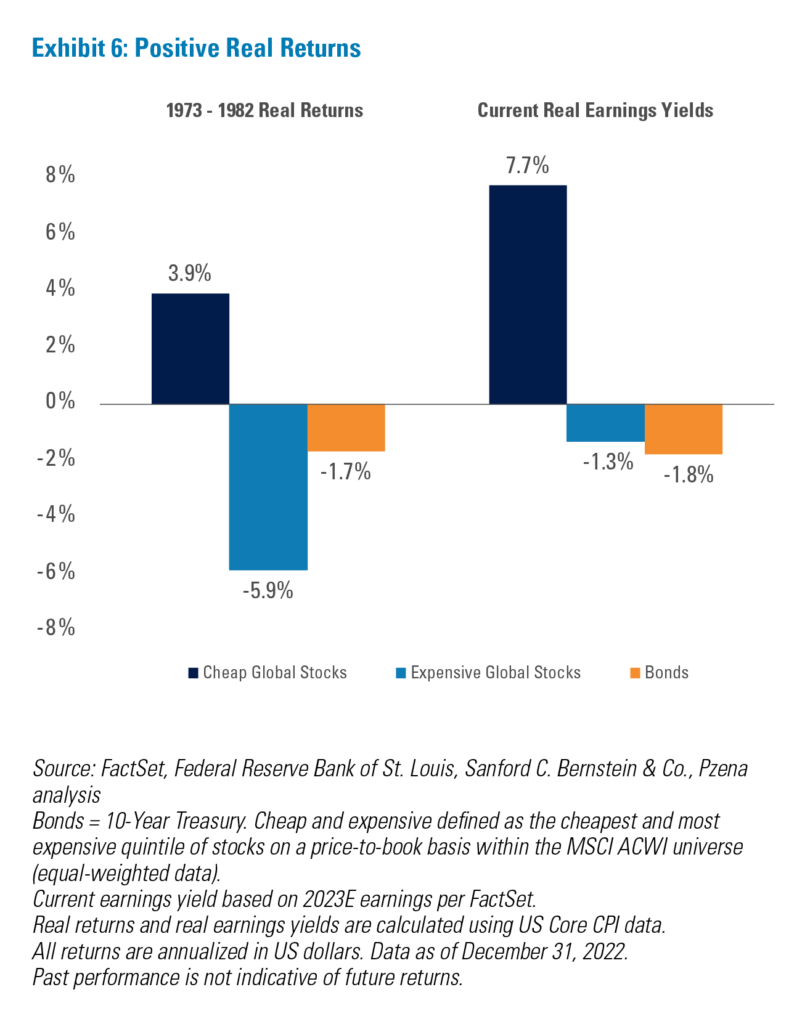

The near decade-long stagflation period saw two global recessions and 8.2% average annual inflation[2], hardly a backdrop conducive to investing in equities. However, real GDP still grew at 3.1% per year[3], global equities returned 5.5% per year[4], and value returned 12.5%[5]. This robust performance made cheap stocks one of the few asset classes that generated positive real returns during this turbulent period (Exhibit 6). We believe that one of the primary drivers of value’s robust performance during this period was its starting point. Record-wide valuation spreads (at the time) following the Nifty Fifty era set the stage for a long and powerful value cycle.

Similarly, the regional conflict in Ukraine has brought higher energy prices, which increased already high inflation and raised the prospect of recessions, particularly in Europe. Despite valuation dispersions narrowing significantly over the past 18 months, largely reflecting the correction in expensive growth stocks, the backdrop remains quite positive for cheap stocks, which are once again one of the few options asset allocators have that offer a positive real earnings yield.

CONCLUSION

Geopolitical and macroeconomic concerns led to global equity market declines this year that were, on average, in line with past recessions. While the macroeconomic environment has not become any clearer this year, it bears remembering that recessions are typically short and manageable and the seeds of market rallies are planted during recession-driven market selloffs, as the market performs particularly well in the five-year period following the start of a recession, and value tends to outperform. Similar to the prior period of stagflation, we believe cheap stocks globally appear to stand out in offering solid positive real earnings yields.

[1]. Past performance is no guarantee of future returns

[2]. Source: Federal Reserve Bank of St. Louis

[3]. Soucre: The World Bank

[4]. MSCI ACWI Universe, Sanford C. Bernstein & Co., Pzena analysis

[5]. Based on price/book of the cheapest quintile, MSCI ACWI Universe

FURTHER INFORMATION

These materials are intended solely for informational purposes. The views expressed reflect the current views of Pzena Investment Management (“PIM”) as of the date hereof and are subject to change. PIM is a registered investment adviser registered with the United States Securities and Exchange Commission. PIM does not undertake to advise you of any changes in the views expressed herein. There is no guarantee that any projection, forecast, or opinion in this material will be realized. Past performance is not indicative of future results.

All investments involve risk, including loss of principal. Investments may be in a variety of currencies and therefore changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The price of equity securities may rise or fall because of economic or political changes or changes in a company’s financial condition, sometimes rapidly or unpredictably. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in Emerging Markets. Investments in small-cap or mid-cap companies involve additional risks such as limited liquidity and greater volatility than larger companies. PIM’s strategies emphasize a “value” style of investing, which targets undervalued companies with characteristics for improved valuations. This style of investing is subject to the risk that the valuations never improve or that returns on “value” securities may not move in tandem with the returns on other styles of investing or the stock market in general.

This document does not constitute a current or past recommendation, an offer, or solicitation of an offer to purchase any securities or provide investment advisory services and should not be construed as such. The information contained herein is general in nature and does not constitute legal, tax, or investment advice. PIM does not make any warranty, express or implied, as to the information’s accuracy or completeness. Prospective investors are encouraged to consult their own professional advisers as to the implications of making an investment in any securities or investment advisory services.

The specific portfolio securities discussed in this presentation are included for illustrative purposes only and were selected based on their ability to help you better understand our investment process. They were selected from securities in one or more of our strategies and were not selected based on performance. They do not represent all of the securities purchased or sold for our client accounts during any particular period, and it should not be assumed that investments in such securities were or will be profitable. PIM is a discretionary investment manager and does not make “recommendations” to buy or sell any securities. There is no assurance that any securities discussed herein remain in our portfolios at the time you receive this presentation or that securities sold have not been repurchased.

The MSCI information may only be used for internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the MSCI Parties) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.

For U.K. Investors Only:

This marketing communication is issued by Pzena Investment Management, Ltd. (“PIM UK”). PIM UK is a limited company registered in England and Wales with registered number 09380422, and its registered office is at 34-37 Liverpool Street, London EC2M 7PP, United Kingdom. PIM UK is an appointed representative of Mirabella Advisers LLP, which is authorised and regulated by the Financial Conduct Authority. The Pzena documents are only made available to professional clients and eligible counterparties as defined by the FCA. Past performance is not indicative of future results. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research.

For EU Investors Only:

This marketing communication is issued by Pzena Investment Management Europe Limited (“PIM Europe”). PIM Europe (No. C457984) is authorised and regulated by the Central Bank of Ireland as a UCITS management company (pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended). PIM Europe is registered in Ireland with the Companies Registration Office (No. 699811), with its registered office at Riverside One, Sir John Rogerson’s Quay, Dublin, 2, Ireland. Past performance is not indicative of future results. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research.

For Australia and New Zealand Investors Only:

This document has been prepared and issued by Pzena Investment Management, LLC (ARBN 108 743 415), a limited liability company (“Pzena”). Pzena is regulated by the Securities and Exchange Commission (SEC) under U.S. laws, which differ from Australian laws. Pzena is exempt from the requirement to hold an Australian financial services license in Australia in accordance with ASIC Corporations (Repeal and Transitional) Instrument 2016/396. Pzena offers financial services in Australia to ‘wholesale clients’ only pursuant to that exemption. This document is not intended to be distributed or passed on, directly or indirectly, to any other class of persons in Australia.

In New Zealand, any offer is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013 (‘FMCA’). This document is not to be treated as an offer, and is not capable of acceptance by, any person in New Zealand who is not a Wholesale Investor.

For Jersey Investors Only:

Consent under the Control of Borrowing (Jersey) Order 1958 (the “COBO” Order) has not been obtained for the circulation of this document. Accordingly, the offer that is the subject of this document may only be made in Jersey where the offer is valid in the United Kingdom or Guernsey and is circulated in Jersey only to persons similar to those to whom, and in a manner similar to that in which, it is for the time being circulated in the United Kingdom, or Guernsey, as the case may be. The directors may, but are not obliged to, apply for such consent in the future. The services and/or products discussed herein are only suitable for sophisticated investors who understand the risks involved. Neither Pzena Investment Management, Ltd. nor Pzena Investment Management, LLC nor the activities of any functionary with regard to either Pzena Investment Management, Ltd. or Pzena Investment Management, LLC are subject to the provisions of the Financial Services (Jersey) Law 1998.

For South African Investors Only:

Pzena Investment Management, LLC is an authorised financial services provider licensed by the South African Financial Sector Conduct Authority (licence nr: 49029).

© Pzena Investment Management, LLC, 2023. All rights reserved.