The Time is Now: International Small Cap Value

International small capitalization stocks – representing a relatively underappreciated and underexploited corner of the global equity market – warrant further attention from investors seeking a diversifying and distinctive asset class with superior return potential. (March 2022)

International, Small Cap, and Value – The Perfect Union

Successful active value investing is predicated on a manager’s ability to identify and capitalize on significant price dislocations – namely, when stocks deviate substantially from their intrinsic values. In the international small capitalization (ISC) space, which is almost entirely composed of developed markets outside of the US, these mispricings can be more prevalent, as markets are inherently less transparent and consequently less efficient. For the active value manager, these price distortions, and the range of unique risks that ISC markets present, are exciting. ISC stocks provide access to a wide array of currencies, economies, regulatory regimes, languages, and market cycles. Understanding these nuances across geographies can present lucrative opportunities but requires specific skill and judgment.

International Small Cap: Where Value Packs a Punch

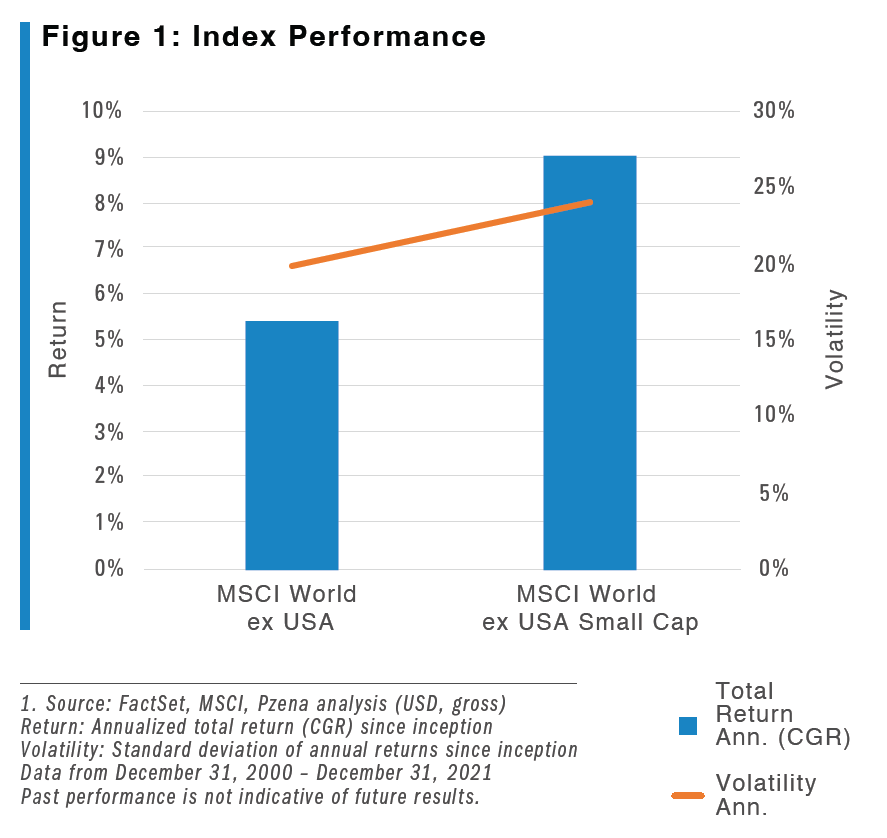

Small-cap stock returns have handily beaten those of large caps in international markets over the last 21 years. This shouldn’t be too surprising to investors; it has been well-documented in academic literature (Fama & French ’93), and a similar dynamic played out in the US over multiple decades. In general, and regardless of domicile, small-cap stocks offer higher rewards for those willing to exercise patience and look past short-term bouts of volatility, as shown in Figure 1¹. The data suggests a form of home-country bias exists, since US-based investors tend to focus on the domestic small-cap universe despite a broad and diverse set of companies existing overseas that effectively doubles the small-cap opportunity set. According to recent data from Morningstar, international small caps represent a minuscule 2% of US equity mutual fund assets (compared to nearly 6% for US small caps), with the value style accounting for a fractional 24 basis points².

Investors not exposed to ISC are forgoing access to approximately $3.2 trillion in market value and 2,500 additional small-cap companies³ – a little more than half the global smallcap stock investment universe (including the US). Further, the returns of those stocks are weakly correlated with global developed large-cap and US small-cap securities. The average rolling five-year correlations of monthly returns between the MSCI World ex USA Small Cap Index to the MSCI World and Russell 2000® indices are 0.79 and 0.74 respectively. The diversification benefit to a global equity portfolio is considerably better than the Russell 2000®’s 0.93 correlation to the MSCI World Index.

Part of the explanation for ISC’s discernible outperformance can be chalked up to a lack of transparency. Valuation distortions can be more pronounced for smaller companies, which attract less attention from brokerage/equity research firms than large companies. In fact, the median number of analyst recommendations for a stock in the broad MSCI World ex USA Index is 17, versus just 6 for the small cap series4. Thin analyst coverage usually manifests in more frequent and measurable short-term pricing deviations, as traders naturally have less reliable, and less readily available information on which to base investment decisions.

2. Source: Morningstar, Pzena analysis of all US-domiciled open-end equity funds (USD)

3. Source: MSCI World ex USA Small Cap Index factsheet

4. Source: Bloomberg, Pzena analysis

In The End, Valuation Matters

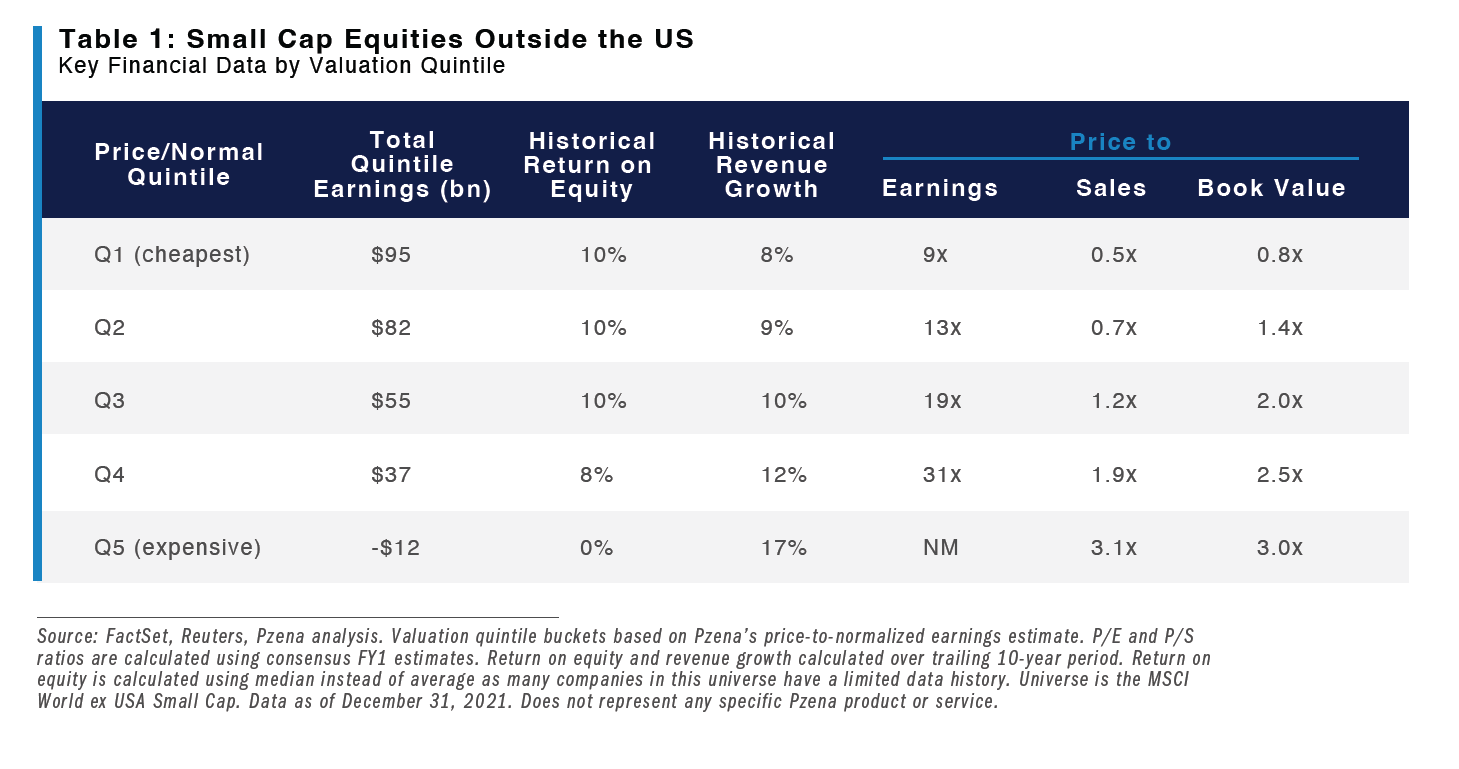

Behavioral biases can cause stocks to be mispriced, creating compelling opportunities for investors who have the experience and discipline to follow an investment process that separates fact from sentiment. More specifically, we believe that overreactions to near-term events often cause investors to undervalue good companies that are experiencing some form of temporary distress. These are value stocks in the traditional sense of the word, evidenced by the data shown below.

As displayed in Table 1, within the 5 quintiles of valuation on a price-to-normal earnings basis, the fundamental earnings power – either measured in returns or revenue growth – doesn’t deviate all that much between groups.

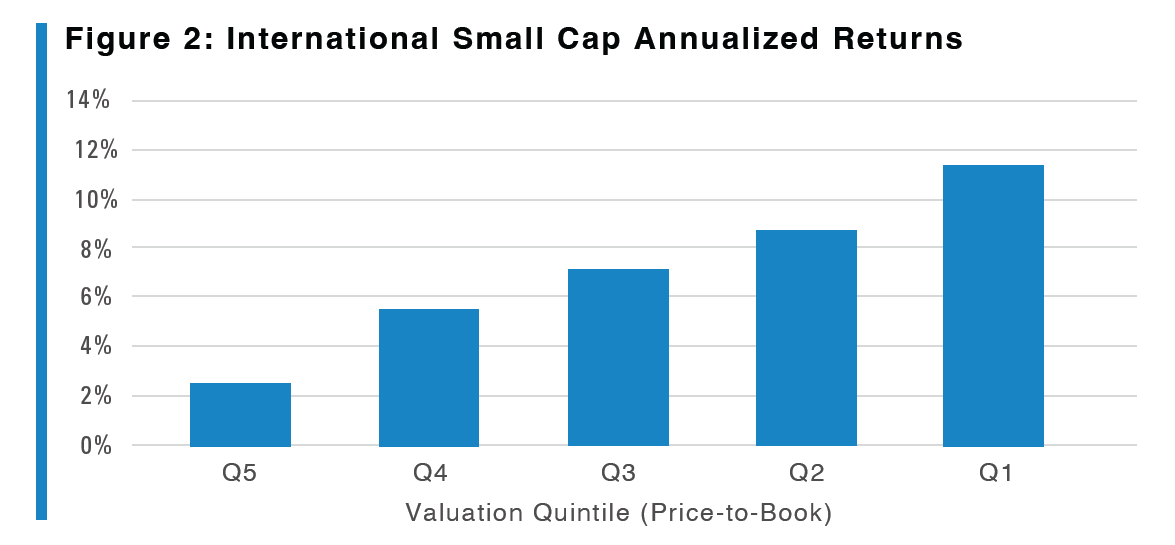

Despite trading at steep discounts regardless of the valuation metric, the companies in the first quintile have similar or better fundamentals as a group than the more expensive securities. As always, we believe that price matters, and, as Figure 25 clearly shows, an investment strategy targeting this cheapest quintile has outperformed the market over time.

5. Source: Kenneth R. French data library, Pzena analysis; The full dataset was created using the 11/2021 Bloomberg database. It contains value-weighted returns for the intersections of 5 market equity portfolios and 5 book equity/market equity portfolios in Developed ex-US. Firms with negative book equity are not included in any portfolio. The universe consists of the smallest 20% of companies (market equity), segregated into valuation quintiles on a price-to-book basis. Performance encompasses the period from July 1990 – November 2021. Past performance is not indicative of future returns. Returns could be reduced, or losses incurred, due to currency fluctuations. Does not represent any specific Pzena product or service.

Uncovering Gems

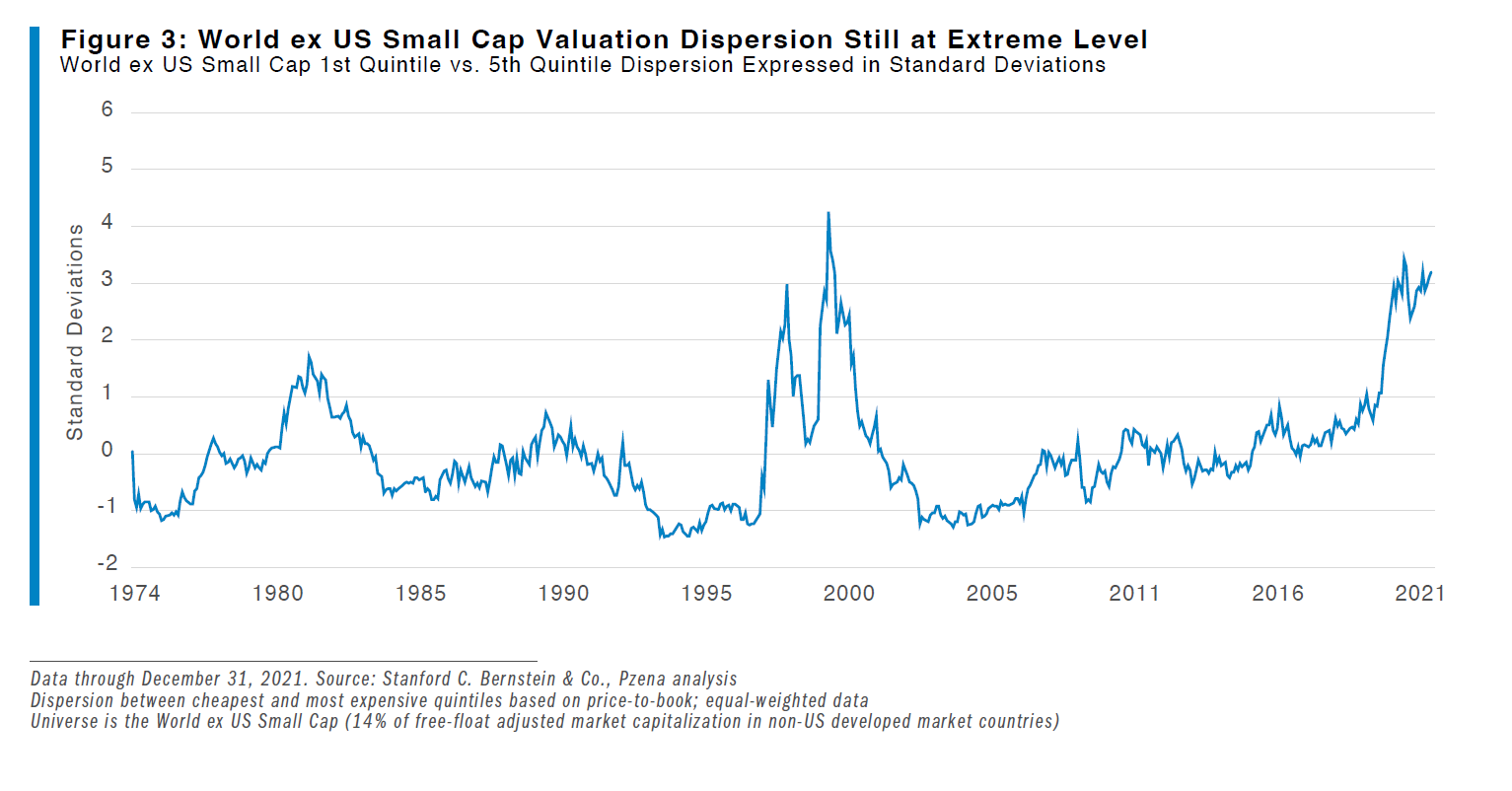

ISC value has proven to be a historically profitable strategy, with the long-term performance of small caps improving markedly as valuations become more attractive. The caveat, of course, is the difficulty of uncovering fundamentally cheap stocks with strong balance sheets and solid business models poised for long-term share price appreciation. An active strategy is therefore critical, especially in the current investing environment where the valuation dispersion among stocks is at record levels.

The better part of the last decade has seen significant outperformance of US stocks over international, large cap over small, and growth over value, implying that each of these segments is worth watching. Within the ISC universe, the valuation dispersion has reached an extreme, at over three standard deviations above the mean. Figure 3 shows the relative difference in price-to-book values between the cheapest and the most expensive stocks since the inception of the data. This differential has only surpassed today’s level during one sustained period in the last ~50 years, creating uniquely compelling conditions to seek active exposure in this space.

Pzena’s Advantage for the Road Ahead

As with all strategies at Pzena, our International Small Cap Focused Value (ISCFV) product adheres to a deep value investing approach and leverages our entire global research team for investment insights. Our analysts cover companies according to global industry, not by product or market cap range; therefore, when we research an ISC company, our industry analysts already have a deep knowledge of the competitive landscape, as well as the customer and supplier bases across the globe. Through rigorous, fundamental research, we possess the tools necessary to create concentrated portfolios of our most attractive ideas, with the aim of achieving meaningful outperformance over the long run.

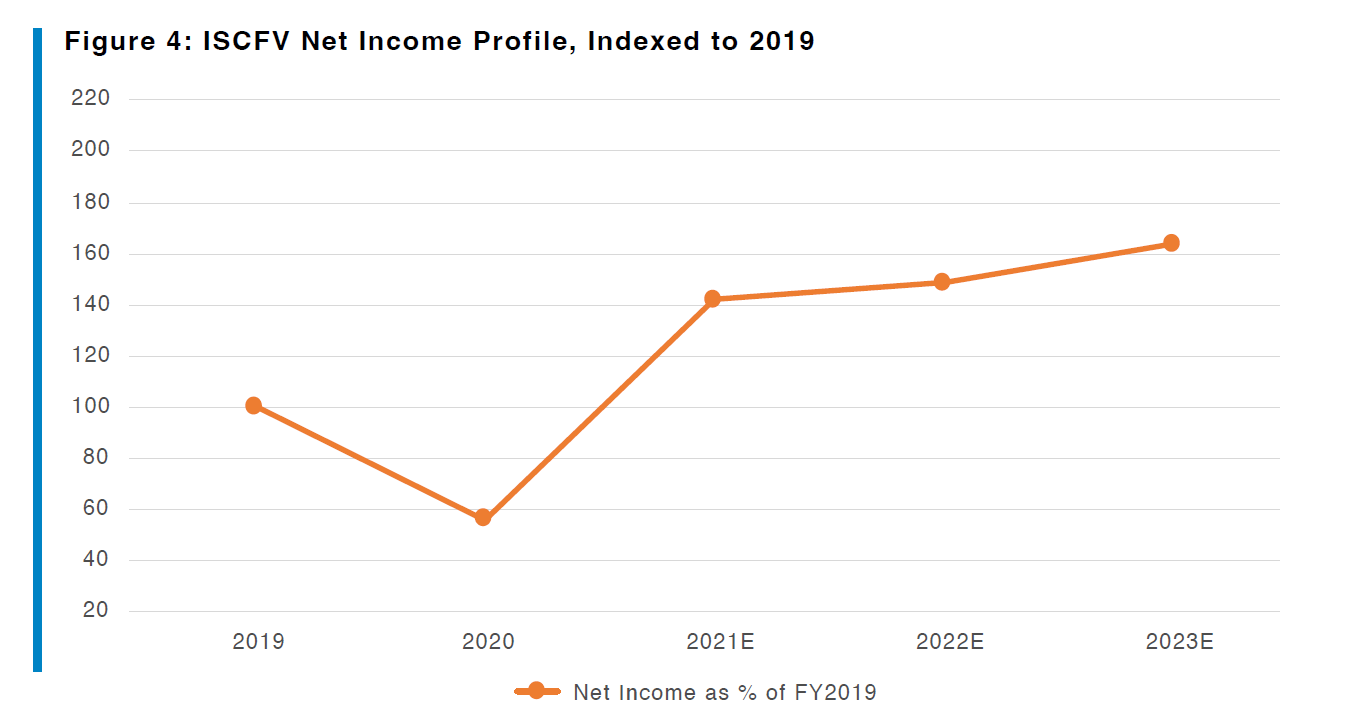

We seek stocks that, in our opinion, sell at substantial discounts to their intrinsic values for reasons we deem to be temporary. Companies included in the ISCFV portfolio are exclusively from the cheapest valuation quintile. The current picture for ISCFV is particularly compelling. During the pandemic downturn, the management teams of our portfolio companies did not sit still. Rather, many of them cut costs and restructured operations to an extent that may not have been possible absent such an acute crisis. These companies – many of which were significantly impacted by global lockdowns – should continue to realize strong earnings growth as revenues recover, operating margins expand, and expenses are held in check, potentially boosting profits above pre-pandemic levels (Figure 4)6. We believe the share prices of these companies are poised for a re-rating as conditions normalize.

6. Source: S&P Capital IQ; Pzena analysis; portfolio holdings as of February 2022

Conclusion

We are currently in the midst of a pro-value cycle that’s fully global in reach, providing investors ample opportunity to diversify their portfolios with attractively valued companies across geographies. Emotional investors tend to overreact to near-term events and misjudge the probabilities of what might happen in the future. As highly disciplined value investors, we are committed to intensive research to find good businesses going through periods of temporary distress. Pro-value periods, like the one we are currently experiencing, have historically begun with uncertainty and cynicism. While value stocks around the world have taken over leadership from their (still expensive) growth counterparts, the cycle has only just begun, and we see perhaps no better market segment to exploit the outperformance opportunity than international small cap.

DISCLOSURES

This document is intended solely for informational purposes. The views expressed reflect the current views of Pzena Investment Management (“PIM”) as of the date hereof and are subject to change. PIM is a registered investment adviser registered with the United States Securities and Exchange Commission. PIM does not undertake to advise you of any changes in the views expressed herein. There is no guarantee that any projection, forecast, or opinion in this material will be realized. Past performance is not indicative of future results. All investments involve risk, including risk of total loss.

This document does not constitute a current or past recommendation, an offer, or solicitation of an offer to purchase any securities or provide investment advisory services and should not be construed as such. The information contained herein is general in nature and does not constitute legal, tax, or investment advice. PIM does not make any warranty, express or implied, as to the information’s accuracy or completeness. Prospective investors are encouraged to consult their own professional advisers as to the implications of making an investment in any securities or investment advisory services.

The MSCI World ex-USA Small-Cap Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of small cap developed markets excluding the US.

Russell 2000 Index

The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. Additional information is available at www.russell.com.

MSCI World Index

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Additional information is available at www.msci.com.

MSCI World ex USA Index

MSCI World ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Additional information is available at www.msci.com.

These indices cannot be invested in directly.

For UK Investors Only: This marketing communication is issued by Pzena Investment Management, Limited (“PIM UK”). PIM UK is a limited company registered in England and Wales with registered number 09380422, and its registered office is at 34-37 Liverpool Street, London EC2M 7PP, United Kingdom. PIM UK is an appointed representative of Mirabella Advisers LLP, which is authorised and regulated by the Financial Conduct Authority. The Pzena documents are only made available to professional clients and eligible counterparties as defined by the FCA. Past performance is not indicative of future results. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research.

For EU Investors: This marketing communication is issued by Pzena Investment Management Europe Limited (“PIM Europe”). PIM Europe (No. C457984) is authorised and regulated by the Central Bank of Ireland as a UCITS management company (pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended). PIM Europe is registered in Ireland with the Companies Registration Office (No. 699811), with its registered office at Riverside One, Sir John Rogerson’s Quay, Dublin, 2, Ireland. Past performance is not indicative of future results. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research.

For Australia and New Zealand Investors Only: This document has been prepared and issued by Pzena Investment Management, LLC (ARBN 108 743 415), a limited liability company (“Pzena”). Pzena is regulated by the Securities and Exchange Commission (SEC) under U.S. laws, which differ from Australian laws. Pzena is exempt from the requirement to hold an Australian financial services license in Australia in accordance with ASIC Corporations (Repeal and Transitional) Instrument 2016/396. Pzena offers financial services in Australia to ‘wholesale clients’ only pursuant to that exemption. This document is not intended to be distributed or passed on, directly or indirectly, to any other class of persons in Australia. In New Zealand, any offer is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013 (‘FMCA’). This document is not to be treated as an offer, and is not capable of acceptance by, any person in New Zealand who is not a Wholesale Investor.

For South African Investors Only: Pzena Investment Management, LLC is an authorised financial services provider licensed by the South African Financial Sector Conduct Authority (licence nr: 49029). Russell® is a trademark of the Frank Russell Company. FTSE Russell is the source and owner of the Russell Index data contained or reflected in this material and all trademarks and copyrights related thereto. The presentation may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a presentation of Pzena Investment Management, LLC. FTSE Russell is not responsible for the formatting or configuration of this material or for any inaccuracy in Pzena Investment Management’s presentation thereof.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Pzena Investment Management, LLC (“PIM”). Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, and of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

The MSCI information may only be used for internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the MSCI Parties) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.

© Pzena Investment Management, LLC, 2022. All rights reserved.