Second Quarter 2023 Global Research Review

We are seeing a diverse sector and geographic opportunity set, ranging from healthcare to a European truck maker, and Japan to China.

During the second quarter, value outperformed growth in emerging markets but trailed in the US, particularly among large-cap companies. Our Commentary elaborates on this dominance of a handful of mega-cap growth names, as well as the opportunity for disciplined value investors.

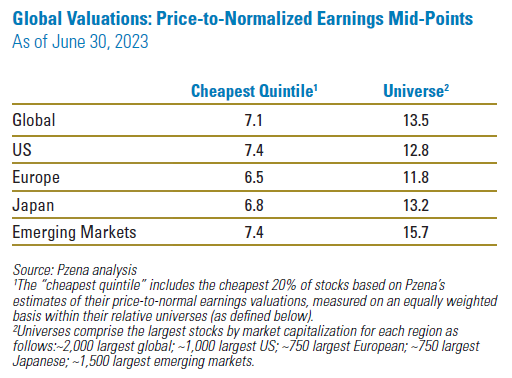

Looking at spreads, the cheapest quintile is trading at about half the universe median across the various geographies.

ONGOING BANKING UPDATE

Issues in the banking sector last quarter were resolved with depositors left whole at the troubled US regional banks and at Credit Suisse, in contrast to shareholders and bondholders. However, concerns about the sector’s exposure to commercial real estate still linger, reflecting the anemic post-COVID return-to-work patterns and the impact on office buildings. On average, the banks have about 2% of their loans in office space, with a higher proportion believed to be held by US regional banks. Loan-to-valuations are estimated to be around 60%, which should cap losses in the event of default. Our approach to the banks in portfolios is to be well diversified, favoring the largest, properly provisioned, “flight to safety” names in all regions of the world. We do hold, selectively, some regional banking names in our US portfolios. Life insurance companies’ exposures to commercial real estate are somewhat larger through collateralized mortgage loans/securities. Market concerns have hit their share prices hard, creating opportunities. We have analyzed these exposures and believe there are several factors mitigating the downside.

ONGOING OPPORTUNITIES IN HEALTH CARE

Recently, we have seen more health care names screening in the cheapest quintile of our universes. Medtronic plc is the world’s largest standalone medical devices company. Its products cover a broad range of therapeutic applications, from cardiovascular to diabetes (products and services for Type 1 and 2 diabetes). The company came under pressure after experiencing low organic growth, supply chain-related margin erosion, and some missteps, including a lack of product innovation in its diabetes franchise. The complexity of the business has also been an issue. However, management’s ongoing restructuring plan should accelerate growth and create a more resilient cost structure, while self-help initiatives in diabetes should arrest market share losses. We estimate long-term organic revenue growth of around 4%, with the other three of its four main divisions—Cardiovascular, Medical Surgical, and Neuroscience—returning to pre-COVID growth levels. The shares currently trade at 9.4x our normal earnings estimate.

CHINA

Outside of Russia, nearly every global market index is up from March 2020. The one notable exception

is China, the world’s second largest economy. The MSCI China Index is down 2.6% on a total return basis (in US dollar terms) from the COVID-19 low more than three years ago. Meanwhile, the rest of the developing world is up over 86%, with the S&P 500 having more than doubled. We recently traveled to China to meet with many companies and gauge overall sentiment. There appears to be a lack of Western investor interest in China, as investors have been mostly fixated on the CCP’s regulatory agenda, geopolitical tensions with the West, and the nation’s housing downturn. This has prompted them to “de-risk” away from China-domiciled stocks. That said, China remains a formidable economic powerhouse that is fully integrated into many aspects of the global economic system.

As a result, China’s weight in the MSCI Emerging Markets Index declined from a peak of over 40% to its current weight of under 30%, and the MSCI China Index has only been cheaper (on a price-to-book basis) less than 2% of the time over the past 20 years. As the market has corrected, our China exposure in emerging markets portfolios increased from less than 20% two years ago to almost 30% currently. China’s private sector has scores of quality businesses with massive scale, global operations, and leadership positions within their industries, and we have uncovered a number of attractively valued opportunities.

COVID-reopening exposures have included Macau hotel and casino group Galaxy Entertainment, and travel group Trip.com. The selloff in property names gave us the opportunity to invest in one of the top-tier names, China Overseas Land & Investment, and more recently, we added a pair of financials (Ping An Insurance and GF Securities). Other names have included electric appliance and air conditioning company Midea, global dye manufacturer Zhejiang Longsheng, and a leading maker of truck engines, Weichai Power, after changes to local emissions standards severely disrupted its sales pattern.

A EUROPEAN TRUCK MAKER

Daimler Truck was partially spun out of Mercedes–Benz Group in December 2021. The company operates in five segments: Mercedes-Benz (mostly trucks in Europe), Trucks North America (Freightliner and Western Star brands), Trucks Asia (primarily in Japan and Indonesia, not China), Daimler Buses, and Financial Services. The stock has traded down due to both cyclical concerns and the company losing share in Europe due to the over-engineering of its trucks and offering too many models, which were not correctly priced. These issues are being addressed. If the company can return to a margin similar to the last five years (ex-2020), at the current low stock price, it trades at an 8.4x price-to-normal earnings ratio, presenting an attractive risk-reward skew from any additional margin uplift.

JAPAN OPPORTUNITY

Minebea was Japan’s first miniature ball bearing manufacturer. Although the business has made diversifying acquisitions over time, the largest and most significant unit in Minebea Mitsumi remains its high-precision ball bearings, where it has a dominant market share. These are used in automotive, aerospace, data centers, and other applications within motors. Management’s near-term outlook for the ball bearing business has slightly worsened due to automotive customer production delays and a weakening outlook for data center demand. Some of the COVID-related headwinds for Minebea’s business units and their customers are now abating, and earnings should recover. The strength of the franchise here lies in the very high level of precision engineering of the bearings, where the cost of failure is disproportionate to the product cost. We see Minebea as a very strong franchise, trading at 8.8x our price-to-normal earnings estimate.

SUMMARY

This quarter, valuation spreads have widened once again. As the above examples demonstrate, the opportunity set (and the drivers thereof) remain diverse in this environment, as many good franchises come on sale as a result of disparate challenges to their near-term profitability. We remain energized by the many attractive research projects we are undertaking to find excellent opportunities for our portfolios.