Highlighted Holding: Sabre

Given Sabre’s focus on profitability and underwriting expertise in its niche specialty market, we believe it is among the best-positioned UK motor insurers as industry-wide policy pricing improves.

| Earnings Per Share | Price/Earnings | ||||||

| Price | FY23E | FY24E | Normal* | FY23E | FY24E | Normal* | |

| Sabre | £1.13 | £0.09 | £0.12 | £0.20 | 13.0x | 9.3x | 5.7x |

| Fiscal year-end March 31. *Pzena estimate of normalized earnings. Source: FactSet, Pzena analysis. Data as of March 31, 2023 | |||||||

Sabre Insurance Group is the leading nonstandard auto insurer in the UK. The company has been contending with a surge in claims inflation and increased competition from traditional auto insurers infringing on its business. As mainstream insurers begin to raise prices and exit the nonstandard market where they lack the requisite underwriting expertise, we expect Sabre to recover both volumes and profitability. With shares trading at just 5.7x our estimate of normal earnings, we believe the stock is a compelling, undiscovered opportunity.

Sabre’s Edge

We believe Sabre is uniquely poised for long-term outperformance for several key reasons.

- Sabre is exclusively focused on a narrow specialty segment in which it possesses a discernable competitive advantage on underwriting from having built a robust and consistent dataset of historical claims paid. Only Sabre has access to this data for its nonstandard policyholders, giving it a clear leg up on pricing risk in the specialty space.

- The company has a near singular emphasis on policy underwriting, which makes up ~90% of its profit, with little income from ancillary businesses or risk-taking in its investment book.

- Management’s commitment to profit over volume means that Sabre’s bottom line has been less volatile and more defensive when the market is weak, and its top-line growth potential will be higher once the market improves, which we believe is already happening.

Sabre’s Niche Marketplace

Any driver who is new on the road, an expat, temporarily unemployed, has points on their license, or owns a classic or luxury vehicle may be directed to the nonstandard auto insurance market. This specialized subsegment requires more careful assessments of the risk of loss than the standard market in which pricing and risk selection for the majority of drivers are largely commoditized. These policies are effectively priced higher because they are much harder to underwrite. Sabre focuses on an even smaller cohort of about 200,000 policyholders within the nonstandard group, accounting for just ~1% of the 28 million total policies sold in the UK.1

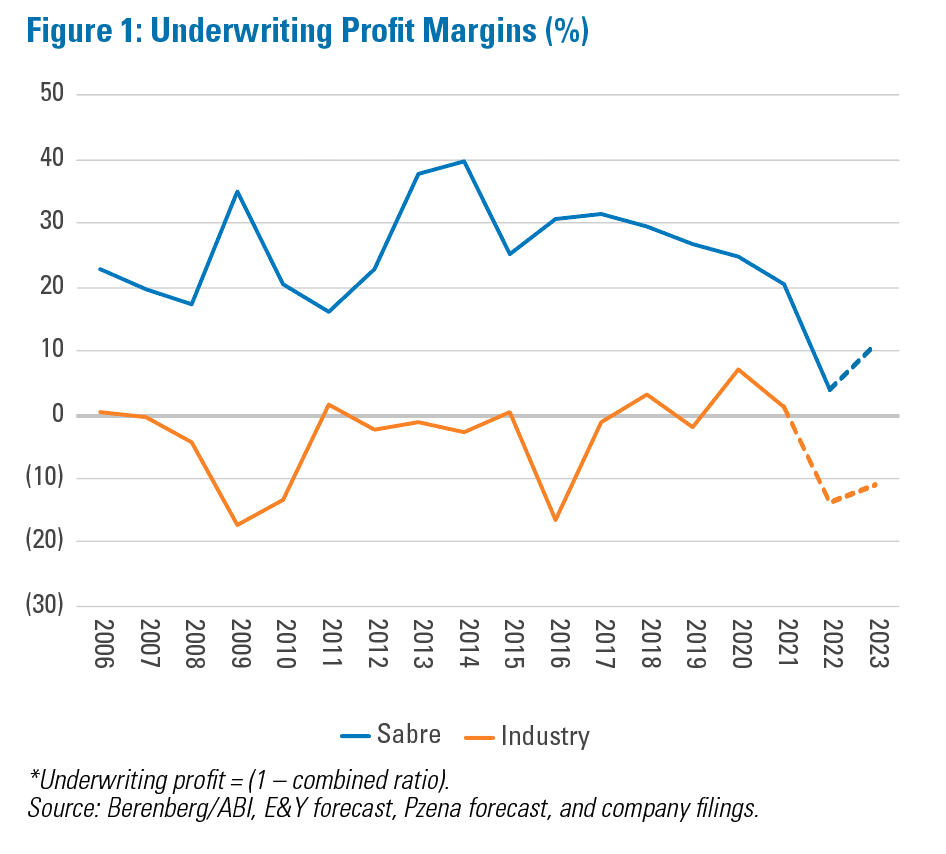

Sabre is the largest and steadiest participant in the nonstandard space. The company knows its niche and sticks to it— profitably—unlike most of the industry (Figure 1). Sabre’s underwriting advantage stems from its proprietary 20-year data depository of driver and claims histories, which its competitors do not have access to and cannot analyze. The effective utilization of this data has created strong barriers to entry, and management’s disciplined approach to risk selection and policy pricing within this small slice of the market has served the company well through numerous pricing cycles.

The Mechanics of the Market

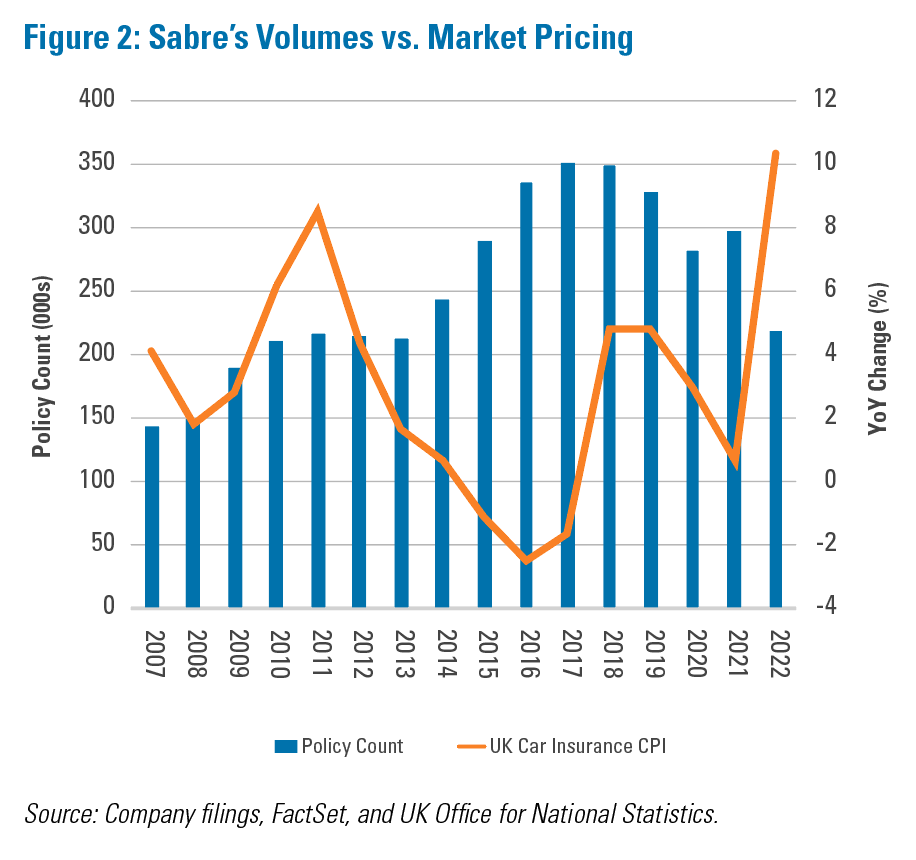

The UK auto insurance market is cyclical with high customer churn. During a soft market (weakening pricing, increased risk-taking), the established carriers that write commoditized policies mostly in the standard space attempt to grow faster by encroaching on Sabre’s turf. These forays into the nonstandard market historically end when the bills come due, and the contracts prove to be riskier and less profitable than expected. In that regard, the current cycle is no different. Standard insurers that took market share from Sabre during the pandemic-induced soft market are now just as swiftly heading for the exit, as the broader industry has become unprofitable. This pullback is evident from both traditional carriers like RSA retreating to their core markets and reinsurers pulling capital out of the space. Sabre should recover its volume and earnings power as these competitors exit (Figure 2).

Industry-wide Pain

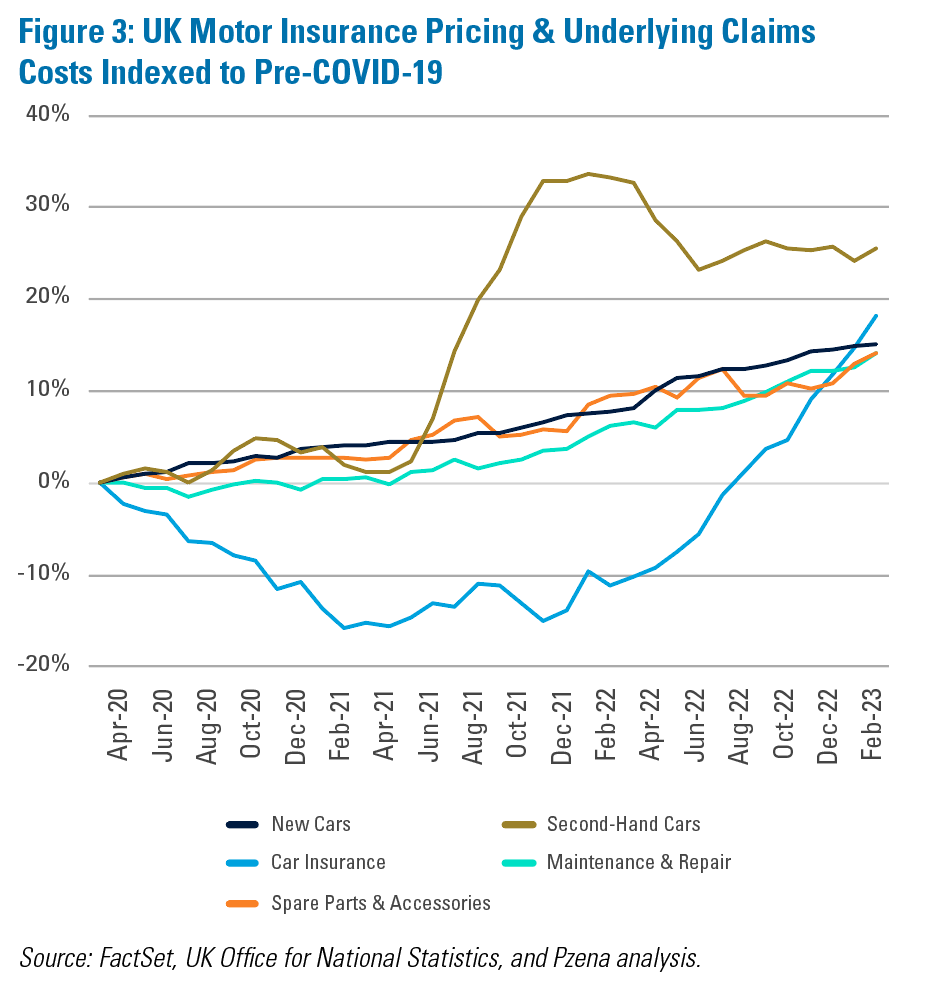

One major variable differentiates this cycle from previous iterations: historically high inflation. The well-documented parts and labor shortages are very much global phenomena, but the UK has been hit particularly hard. As a result, the costs of fixing and replacing vehicles have skyrocketed. The country’s labor scarcity means longer wait times for parts and services and more days of customer courtesy vehicles. With used car prices up nearly 30% from 2019, and maintenance, repair, and spare parts costs up double digits, the past year saw some of the highest underlying claims inflation readings on record. Given that contract prices are fixed while costs are variable, it is easy to see why 2022 was a year to forget for motor insurers.

Nevertheless, it is equally comprehensible to envision a light at the end of the tunnel. Part of what makes auto insurance an attractive business is that carriers can reprice policies annually. In response to the extreme inflation headwinds driving industry profitability down, every carrier has already raised prices significantly and is continuing to do so. While motor premiums are expected to keep rising throughout 2023 (nearly +15%, according to Berenberg),2 UK CPI inflation is forecasted to decline to 6.5% from 9.1% in 2022.3 It is a matter of when, not if, profitability returns as pricing catches up to and ultimately outstrips claims inflation (Figure 3). While this rising tide lifts all insurers’ boats, the impact should be disproportionally greater for Sabre because of its distinctive business model.

In addition to the sector-wide cyclical improvement, a number of regulations are taking effect that are positive for Sabre. The UK’s Financial Conduct Authority enacted changes in 2022 that eliminate uneconomic ancillary products designed to subsidize intentionally underpriced accident risk. These statutes also banned price-walking (charging a low price up front with steep renewal increases), and together, they should reduce overall churn and level the playing field for underwriting-focused players, such as Sabre.

Earnings Potential Quantified

From an underwriting margin of 4% in 2022, Sabre should recover closer to the historical level of 18%4 as industry pricing catches up with inflation. Without assuming significant volume gains, we believe Sabre can earn £0.205 per share in a normalized environment, making the stock extremely attractive at £1.13 per share. In an adverse scenario, even if rates do not materially improve underwriting profitability and/or UK labor shortages and inflation remain elevated, the company should remain profitable—as it was during an extremely difficult 2022—in contrast to the broad industry.

Conclusion

Sabre’s business model is simple: they maintain a singular focus on underwriting expertise, accepting that volumes will ebb and flow amid the market’s gyrations. From an investment standpoint, this provides relative full-cycle earnings predictability. Given the market’s fixation on Sabre’s temporary issues and it’s attractive valuation of 5.7x normalized earnings, we believe Sabre’s shares are poised to outperform.