Highlighted Holding: PVH Corp.

Fourth Quarter 2022 Highlighted Holding: PVH Corp.

For Financial Advisor Use Only

We believe PVH’s management has a viable plan to spur meaningful long-term earnings growth; the stock’s valuation is such that even a marginal improvement in sentiment may lead to shares re-rating.

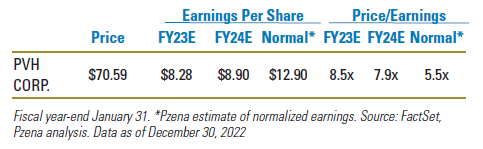

PVH Corp. is one of the largest brand houses in the world, with sales of over $9bn in 2021 generated in more than 40 countries. The bulk of the company’s earnings come from the eponymous Calvin Klein (CK) and Tommy Hilfiger (TH) labels, which are two of the most successful and well-known fashion lines in history. CK’s and TH’s underlying performance strongly suggests the brands are as strong as ever, but PVH’s share price—down over 33% in 2022 and trading at just 8.5x¹ its forward earnings estimate— implies otherwise. The factors underpinning PVH’s material valuation discount are, in our view, almost entirely temporary and unlikely to persist longer term. Investors are nonetheless valuing the company as if current recessionary conditions will be permanent, disregarding PVH’s long-term value proposition and potential for significant earnings normalization.

EXECUTION MISSTEP PRESENTS AN OPPORTUNITY

In 2016, PVH hired Dior’s reputable creative director Raf Simons, whose vision was to elevate CK’s status in the marketplace from premium to luxury. The strategy shift coincided with significant investment in the brand, pressuring margins. After a few fashion cycles, Simons’ designs were critically acclaimed and won several awards, but unfortunately, they were not commercially successful, and he left the firm in 2018. Beyond the CK fashion miss, the market believed PVH was ill-prepared to capitalize on the growing prevalence of e-commerce. Specifically, investors were concerned over PVH’s large brick and mortar presence and questioned whether its brands could command engagement and pricing power in a world of infinite online shelf space. Around the same time, U.S.-China trade/geopolitical tensions were boiling over and pressuring stocks linked to discretionary spending and tourism; these converging headwinds sent PVH’s stock into bargain territory, setting up a classic value opportunity.

Upon Raf Simons’ departure, PVH announced that CK would return to its roots as a premium apparel brand with a minimalist aesthetic. We made our initial investment in 2019 on the premise that CK’s timely transition would both reinvigorate the top line and improve margins given the discontinuation of luxury-related investments.

We also believed that macro-related pressures would prove temporary, and that PVH’s e-commerce initiatives were further along than investors were giving it credit for. PVH’s profitability began to improve, but the ensuing COVID-19 pandemic provided an unforeseen challenge for management.

PANDEMIC RESTRUCTURING AND PVH+

PVH acted quickly in the early months of the pandemic to bolster its liquidity position and cut discretionary investments. This afforded the company the financial flexibility to withstand prolonged periods of uncertainty and store closures, while its underappreciated e-commerce capabilities helped support sales. Under the leadership of CEO Stefan Larsson (who joined PVH in 2019), PVH has been using the downturn as an opportunity to enhance the company’s operating model and emerge as a stronger business. The new strategic plan, deemed PVH+, contemplates an end-to-end restructuring of the business, with investments focused on 1) demand generation, 2) channel optimization, and 3) cost efficiencies.

On the demand side, CK and TH plan to connect more closely with consumers, while repositioning supply chains to react more nimbly to demand signals. We believe this data-driven operating model should lead to structurally higher gross margins. PVH will look to augment this by a pruning the long tail of unproductive products at CK and TH and instead reemphasize core bestsellers.

On the channel optimization front, PVH is investing more to effectively reach consumers as they increasingly shift their purchases online. CK and TH’s ecommerce offerings (which account for 25% of revenue today versus 10% pre-COVID-19²) are being supercharged via demand-led initiatives in product assortment and consumer engagement. Additionally, fulfillment options are being expanded to meet consumer needs. These actions, combined with a store base of relatively short-duration leases, should allow CK and TH to rapidly follow consumers to their preferred shopping channels, however they may develop.

Additionally, fulfillment options are being expanded to meet consumer needs. These actions, combined with a store base of relatively short-duration leases, should allow CK and TH to rapidly follow consumers to their preferred shopping channels, however they may develop.

Lastly, on the cost efficiency side, PVH has undertaken holistic restructuring initiatives by divesting minor brands, which were unprofitable distractions, and reducing headcount and office space. The latest endeavors are expected to cut $100M in costs (~10% of operating profit)³.

While we do not dismiss management’s ability to execute on PVH+, we also do not account for it in our model. We do believe these actions will create a stronger, more profitable PVH, but our model assumes the company reverts to its pre-COVID-19 trajectory—which effectively implies a normalization of today’s irregular operating environment. We assume revenue grows at roughly 2% per year (in line with the historical average) off 2019’s base, with operating margins expanding to 11% from 9–10% today. On that basis, PVH is trading at just 5.5x our normal earnings projection4. For context, management believes PVH+ will manifest in sustainable margins of 15% and revenue of $12.5bn by 2025, and shares are trading at just ~3.1x their long-term earnings estimate5.

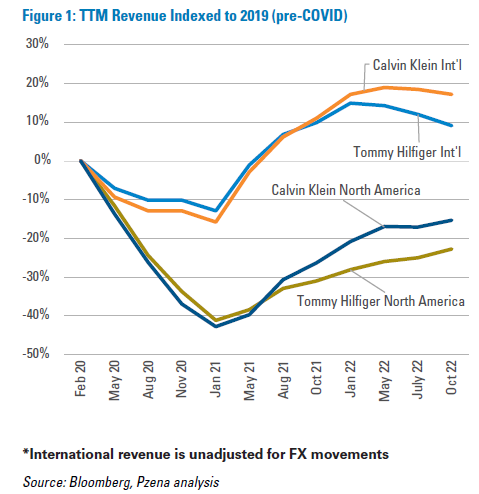

It is also important to note that in Europe, CK and TH are already executing at or above the operating model contemplated by PVH+. Case in point, both TH and CK’s international sales—which are highly exposed to Europe—are up from pre-COVID-19 levels (Figure 1), lending credence to management’s strategy of sharing best practices between its European, North America, and APAC units.

MACROECONOMIC FEARS DOMINATE SENTIMENT

For the better part of 2022, shares of PVH have largely fluctuated around macroeconomic developments. Arguably the event most damaging to investor sentiment was Russia’s invasion of Ukraine. Notwithstanding PVH’s direct sales exposure to Russia/Ukraine, which is fairly de minimis, investors’ main trepidation was the war’s negative impact on the European consumer, to which nearly half of PVH’s sales are levered to. Additionally, Europe’s economic stress has a knock-on effect for PVH via a weakening Euro, which was solely responsible for the recent revenue declines at both TH and CK International.

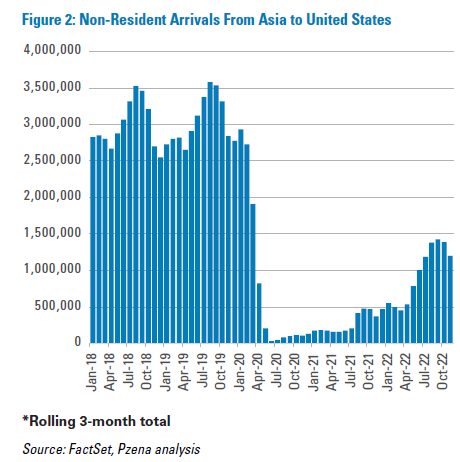

If that was not enough, up until very recently, the Chinese government’s strict adherence to zero-COVID not only hurt PVH’s direct sales there, but had a more pronounced effect on its North American business—the reason being that an estimated 30–40%6 of PVH’s North America sales typically come from inbound tourists to the U.S., and tourism is still materially below pre-COVID-19 levels, principally due to Chinese lockdowns that are only just starting to be scrapped (Figure 2).

To be sure, the global economic slowdown and COVID-19-related disruptions have caused financial pain for PVH, but even under these severely stressed conditions, the company is free cash flow positive and slated to generate over $1bn in EBITDA and $8 of EPS for 20227. Even with European recessionary conditions, elevated raw materials prices, minimal North American tourism, etc., the stock is still trading at 11.2x8 its current earnings that incorporate this pain. While it is certainly possible that the environment does not meaningfully improve in the short term, we do not believe it is rational to extrapolate current headwinds in perpetuity.

CONCLUSION

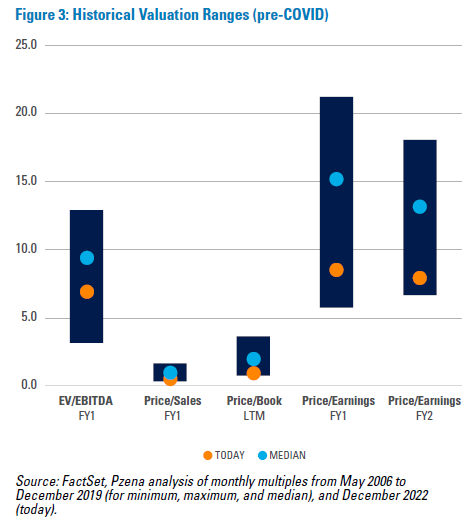

It seems unlikely that today’s global macroeconomic conditions will remain indelibly, but even in that dire scenario, PVH’s current multiple is roughly 25% below that of its pre-COVID-19 average9, implying years of future earnings degradation instead of any sort of improvement. If the environment begins to normalize, and at least some of the systematic pressures impacting PVH’s bottom line abate, we estimate earnings upside of 55%10. The stock is trading at just 5.5x that projection and appears cheap on virtually any valuation metric (Figure 3).

[1]. Source: FactSet Jan. ‘23E consensus EPS of $8.28

[2]. Source: Company filings, Pzena analysis

[3]. Source: Company filings, Pzena analysis

[4]. 12/30/22 closing price of $70.59 and Pzena NEPS estimate of $12.90

[5]. PVH Investor Day 2022 presentation

[6]. PVH Company Filings

[7]. Source: FactSet Jan. ‘23E consensus estimates

[8]. TTM diluted EPS of $6.30

[9]. Monthly average of PVH’s FY1 P/E ratio between Jan. 2010 and Jan. 2020

[10]. Jan. ‘23E consensus EPS of $8.28 versus Pzena NEPS estimate of $12.9

FURTHER INFORMATION

These materials are intended solely for informational purposes. The views expressed reflect the current views of Pzena Investment Management

(“PIM”) as of the date hereof and are subject to change. PIM is a registered investment adviser registered with the United States Securities and Exchange Commission. PIM does not undertake to advise you of any changes in the views expressed herein. There is no guarantee that any projection, forecast, or opinion in this material will be realized. Past performance is not indicative of future results.

All investments involve risk, including loss of principal. Investments may be in a variety of currencies and therefore changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The price of equity securities may rise or fall because of economic or political changes or changes in a company’s financial condition, sometimes rapidly or unpredictably. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in

Emerging Markets. Investments in small-cap or mid-cap companies involve additional risks such as limited liquidity and greater volatility than larger companies. PIM’s strategies emphasize a “value” style of investing, which targets undervalued companies with characteristics for improved valuations. This style of investing is subject to the risk that the valuations never improve or that returns on “value” securities may not move in tandem with the returns on other styles of investing or the stock market in general.

This document does not constitute a current or past recommendation, an offer, or solicitation of an offer to purchase any securities or provide investment advisory services and should not be construed as such. The information contained herein is general in nature and does not constitute legal, tax, or investment advice. PIM does not make any warranty, express or implied, as to the information’s accuracy or completeness. Prospective investors are encouraged to consult their own professional advisers as to the implications of making an investment in any securities or investment advisory services.

The specific portfolio securities discussed in this presentation are included for illustrative purposes only and were selected based on their ability to help you better understand our investment process. They were selected from securities in one or more of our strategies and were not selected based on performance. They do not represent all of the securities purchased or sold for our client accounts during any particular period, and it should not be assumed that investments in such securities were or will be profitable. PIM is a discretionary investment manager and does not make “recommendations” to buy or sell any securities. There is no assurance that any securities discussed herein remain in our portfolios at the time you receive this presentation or that securities sold have not been repurchased.

PVH Corp. was held in our Focused Value, Global Focused Value, Global Value, Large Cap Value, Large Cap Focused Value, Mid Cap Focused Value, Small Cap Focused Value, and other strategies during the fourth quarter of 2022.

For UK Investors Only:

This marketing communication is issued by Pzena Investment Management, Ltd. (“PIM UK”). PIM UK is a limited company registered in England and Wales with registered number 09380422, and its registered office is at 34-37 Liverpool Street, London EC2M 7PP, United Kingdom. PIM UK is an appointed representative of Mirabella Advisers LLP, which is authorised and regulated by the Financial Conduct Authority. The Pzena documents are only made available to professional clients and eligible counterparties as defined by the FCA. Past performance is not indicative of future results. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research.

For EU Investors Only:

This marketing communication is issued by Pzena Investment Management Europe Limited (“PIM Europe”). PIM Europe (No. C457984) is authorised and regulated by the Central Bank of Ireland as a UCITS management company (pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended). PIM Europe is registered in Ireland with the Companies Registration Office

(No. 699811), with its registered office at Riverside One, Sir John Rogerson’s Quay, Dublin, 2, Ireland. Past performance is not indicative of future results. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research.

For Australia and New Zealand Investors Only:

This document has been prepared and issued by Pzena Investment Management, LLC (ARBN 108 743 415), a limited liability company (“Pzena”). Pzena is regulated by the Securities and Exchange Commission (SEC) under U.S. laws, which differ from Australian laws. Pzena is exempt from the requirement to hold an Australian financial services license in Australia in accordance with ASIC Corporations (Repeal and Transitional) Instrument 2016/396. Pzena offers financial services in Australia to ‘wholesale clients’ only pursuant to that exemption. This document is not intended to be distributed or passed on, directly or indirectly, to any other class of persons in Australia.

In New Zealand, any offer is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013 (‘FMCA’). This document is not to be treated as an offer, and is not capable of acceptance by, any person in New Zealand who is not a Wholesale Investor.

For Jersey Investors Only:

Consent under the Control of Borrowing (Jersey) Order 1958 (the “COBO” Order) has not been obtained for the circulation of this document. Accordingly, the offer that is the subject of this document may only be made in Jersey where the offer is valid in the United Kingdom or Guernsey and is circulated in Jersey only to persons similar to those to whom, and in a manner similar to that in which, it is for the time being circulated in the United Kingdom, or Guernsey, as the case may be. The directors may, but are not obliged to, apply for such consent in the future. The services and/or products discussed herein are only suitable for sophisticated investors who understand the risks involved. Neither Pzena Investment Management, Ltd. nor Pzena Investment Management, LLC nor the activities of any functionary with regard to either Pzena Investment Management, Ltd. or Pzena Investment Management, LLC are subject to the provisions of the Financial Services (Jersey) Law 1998.

For South African Investors Only:

Pzena Investment Management, LLC is an authorised financial services provider licensed by the South African Financial Sector Conduct Authority

(licence nr: 49029).

© Pzena Investment Management, LLC, 2023. All rights reserved.