Gaining Perspective Podcast Featuring Rich Pzena

On the Gaining Perspective podcast, our founder and co-CIO Rich Pzena discusses the outlook for value investing with Robert Huebscher, founder and CEO of Advisor Perspectives, one of the leading publications for financial advisors.

DISCLOSURE

FURTHER INFORMATION

The securities mentioned comprised the following percentages of the Pzena Mid Cap Value Fund as of March 31, 2021: Halliburton Co. 3.21%. As of March 31, 2021 none of our funds owned the following mentioned companies: General Electric Company, Alphabet Inc. (Google), Facebook, Inc., Microsoft Corp.

Glossary:

ESG — Environmental, Social, and Governance.

Price to Book ratio (P/B ratio) — A ratio for valuing a company that measures its current share price relative to its book value per share.

Price/Cash Flow ratio (P/CF ratio) — A ratio for valuing a company that measures its current share price relative to its s cash flow per share.

Price/Sales Ratio (P/S ratio) — A ratio for valuing a company that measures its current share price relative to its revenue per share.

Opinions expressed are as of March 31, 2021 and are subject to change at any time, are not guaranteed and should not be considered investment advice.

This podcast is intended solely for informational purposes. The views expressed reflect the current views of Pzena Investment Management (“PIM”) as of the date hereof and are subject to change. PIM is a registered investment adviser registered with the United States Securities and Exchange Commission. PIM does not undertake to advise you of any changes in the views expressed herein. There is no guarantee that any projection, forecast, or opinion in this material will be realized. Past performance is not indicative of future results. All investments involve risk, including risk of total loss.

This podcast does not constitute a current or past recommendation, an offer, or solicitation of an offer to purchase any securities or provide investment advisory services and should not be construed as such. The information contained herein is general in nature and does not constitute legal, tax, or investment advice. PIM does not make any warranty, express or implied, as to the information’s accuracy or completeness. Prospective investors are encouraged to consult their own professional advisers as to the implications of making an investment in any securities or investment advisory services.

Mutual fund investing involves risk. Principal loss is possible. Investments in small- and mid-cap companies involve additional risks such as limited liquidity and greater volatility than larger companies. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in Emerging Markets. The funds may have emphasis on a specific sector which could adversely affect a fund to a greater extent than if its emphasis was less. The funds may invest in securities that are less liquid and more difficult to sell than more liquid securities. Investments in REITs are subject to the risks associated with the direct ownership of real estate.

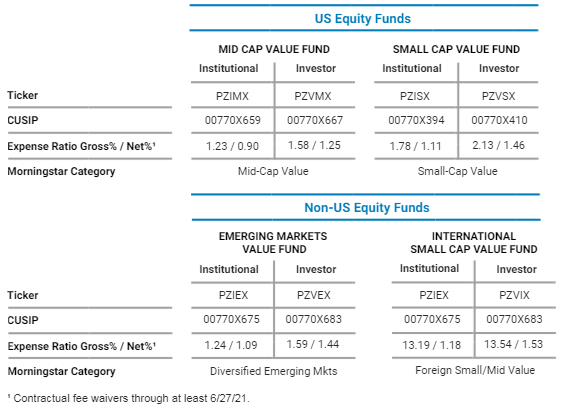

The funds’ investment objectives, risks, charges and expenses must be considered carefully before investing. The summary and statutory prospectus contain this and other important information about the investment company, and may be obtained by calling 1.844.PZN.1996 (1.844.796.1996), or visiting www.pzenafunds.com. Read it carefully before investing.

Fund holdings, regional and sector exposure and characteristics are as of the date shown and are subject to change at any time. As a result, current and future holdings are not recommendations to buy or sell any security.

The Pzena Funds are distributed by Quasar Distributors, LLC.

The specific portfolio securities discussed in this podcast were selected for inclusion based on their ability to help you better understand our investment process. They do not represent all of the securities purchased or sold during the quarter, and it should not be assumed that investments in such securities were or will be profitable. PIM is a discretionary investment manager and does not make “recommendations” to buy or sell securities. Holdings vary among client accounts as a result of different product strategies having been selected thereby. Holdings also may vary among client accounts as a result of opening dates, cash flows, tax strategies, etc. There is no assurance that any securities discussed herein remain in our portfolios at the time you receive this presentation or that securities sold have not been repurchased.