Environmental, Social, Governance (ESG) Investing Approach

Updated March 2024

![]() Introduction

Introduction

At Pzena, our role as responsible stewards of capital is as important to us as our fiduciary responsibility to act in our clients’ best interests, which we believe is maximizing long-term shareholder value. We view environmental, social, and governance (ESG) integration as an integral part of informed investment decision-making which, in turn, safeguards the interests of our clients. Our approach to ESG analysis is therefore best described as integrated, whereby financially material ESG risks and opportunities are a primary and transparent part of our investment philosophy.

As we do with all key investment issues, financially material ESG considerations are analyzed internally, discussed with company management and industry experts, and monitored. Each step of this process contributes to the team’s determination whether to invest and, if we do, at what position size. Once an investment has been made, we continue to engage management on an ongoing basis. Through these conversations, our proxy voting, and other escalation options, we seek to exert a constructive, long-term-oriented influence on the trajectory of the company.

Our commitment to incorporating ESG into our investment approach drives us to continually enhance the way we look at ESG issues. As a result, we actively review our ESG approach at least annually to make any necessary updates.

ESG/Value

The philosophy of a value investor and the principles of ESG integration harmonize. ESG issues, in our view, are a subset of business issues potentially impacting the valuation of a company. As such, our investment research would be incomplete without appropriate consideration of material ESG issues. ESG integration is therefore about fully understanding the value opportunity at stake for a given company. You can find out more about the compatibility between the core philosophical beliefs of a value investor and ESG integration by clicking here.

At Pzena we believe that value isn’t a factor, it’s a philosophy – it’s the conviction that out-of-favor stocks are systematically undervalued. Likewise, we think of ESG more in terms of a philosophy for sustainable investment. In that respect, ESG scores matter less than the process around selection and monitoring of investments. Our focus is therefore not “good” vs. “bad” ESG, but instead it is more about whether we think the company can recover its earnings potential over time. Exposure to, or inadequate management of, ESG risk may have created the value buying opportunity in the first place. In these cases, it is essential we evaluate the ESG issues head-on, take a view as to whether the company can remediate them, and actively engage management if we decide to become shareholders.

We may also be investing in companies with embedded sources of ESG opportunity. For example, it is not just growth oriented pure play clean tech companies that can contribute to the energy transition. Industry incumbents with a need to decarbonize can also be leaders in developing and scaling clean technologies and play an equally important role in helping to deliver a global energy transition. It is through our deep fundamental research that we are able to identify which companies are well positioned to capitalize on opportunities in the energy transition and which may instead have value destructive capital allocation plans.

In general, we believe that improvement in ESG credentials is more important than a point-in-time assessment of a company’s ESG profile. Through our own proprietary research, we examined the relationship between ESG scores and investment performance and found that companies with improved ESG scores tend to outperform stocks with lower improvement in their ESG scores.

ESG in our Research Process

Since Pzena’s founding we have demonstrated a commitment to classic value investing: buying good businesses at low prices that are lagging their historically demonstrated, long-term earnings power. Through fundamental research, we seek to determine whether such earnings shortfalls are temporary or permanent. Each investment decision weighs risk and return by considering all issues material to a company’s prospects. Among those, ESG issues can have a material impact on performance. If not effectively managed, ESG risks may drive unacceptably wide or asymmetric ranges of outcomes. On the flip side, remediation of ESG risks can narrow the range of possible outcomes.

Our research team comprises industry analysts, portfolio managers, and the ESG team. We believe that true ESG integration is industry-analyst led; just as industry analysts bear primary responsibility for issue identification and investment due diligence, they also judge the materiality of ESG-related issues and their potential ramifications. The industry analyst also determines how to engage management, working closely with other members of the research team, including the ESG team. Our ESG team provides specialist support to the industry analyst and portfolio management team on company-specific issues and material industry and thematic ESG issues that may cut across industries and portfolios.

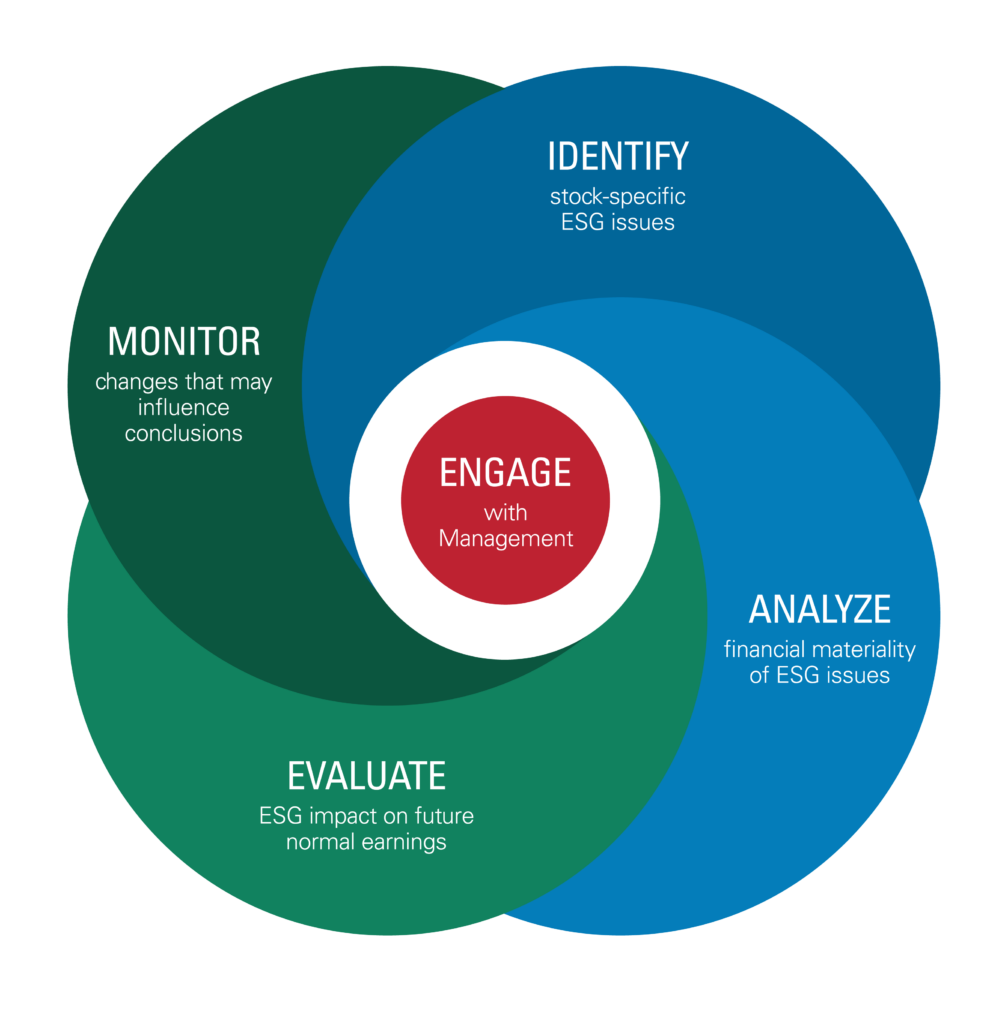

In the following sections we provide a more detailed look at how we integrate ESG issues into each stage of our fundamental investment research process. While we have outlined this five-step process in the context of ESG issues, it would just as easily apply to any other material investment issue.

ESG Integration Process

![]()

We focus our research on companies in the most undervalued 20% of the investment universe. While we do not restrict the investment universe based on any ESG issue or exclusionary list, we can exclude holdings if so-directed by a client. If we identify a financially material investment issue (ESG or otherwise) that management doesn’t have a clear plan to remediate, we may avoid investing, or exit an existing position altogether.

Some ESG issues may not have a clear financial impact on earnings but are deemed material societal risks, and therefore we assign them the same level of importance as material financial risks. At present, these issues include use of child labor and/or involvement in human trafficking. We plan to continually evaluate these issues and may add additional issues to this list in the future.

Once a name is selected for research, it is assigned to an analyst based upon its industry. Initially, we identify a short list of reasons why the stock is underperforming and a series of research questions for deeper exploration. This initial review can raise ESG issues that materially affect a company’s earnings. The industry analyst will review his/her findings with our portfolio management team to determine if further analysis of the business is warranted. Analysts consider ratings and research produced by a variety of third-party ESG data providers and refer to industry ESG standards and principles as appropriate.

ESG Data Sources

We use the following data sources throughout our research process:

- Industry/competitor experts and reports

- Company experts, employees and reported information

- Sell-side

- MSCI ESG data (e.g. ESG ratings, carbon footprint, UN Global Compact violations)

Additional data sources used primarily by the ESG team:

- RepRisk controversy data and watchlists

- Sustainability Accounting Standards Board (SASB)

- CDP for climate, water and biodiversity-specific information

We will continue to augment and enhance this list as new data sources become available.

![]()

Once we commit to a full research project for a company, we conduct a thorough fundamental assessment of the business, with a particular focus on those challenges that have created the value opportunity. We examine ESG issues as well as all other considerations that can influence the company’s long-term performance and risk profile. As a part of this process, we speak with competitors, customers, and suppliers; conduct field research such as site visits to plants, stores, or other facilities; analyze the financials and public filings of the company and its competitors; and occasionally purchase independent research reports. Thematic ESG research led by our ESG team can also be informative at this stage. Additionally, we use the third-party ESG resources described above to augment this analysis. Each issue, whether under the ESG heading or otherwise, is analyzed on its own merit and does not necessarily preclude us from considering an investment.

Example of Thematic ESG Research

- Assessing the credibility of company Net Zero plans

- Evaluating modern slavery risk

- Assessing the elements of corporate governance that matter the most for company performance

- Developing a framework for how to think about the financial materiality of biodiversity

![]()

Following completion of due diligence into all the key issues, we finalize our estimate of earnings potential, considering the full range of potential outcomes. The evaluation of ESG issues focuses on their potential to impact future profitability and risk profile, and we assess the degree to which these are already factored into the current market valuation of the company. This stage of our process culminates in an investment decision. An investment candidate may be rejected due to ESG concerns if the negative financial impact is deemed sufficiently material, the issue significantly increases the company’s risk profile, or management does not have a credible plan to remediate the issue.

![]()

We spend a large proportion of our research effort after investment continually monitoring risk factors that can have a financial impact on a company. Revisiting and testing our assumptions against a company’s real-time earnings progression — and emergent challenges and opportunities — is core to our process. Material developments can sometimes lead us to update our estimate of earnings potential and, if appropriate, make changes to our positioning in that stock. Much of this monitoring is done through our regular conversations with management and our own independent ongoing research. The ESG data sources we subscribe to can be a helpful addition in this process, to the extent that they track and flag material changes in the ESG profile of a company. The ESG team is responsible for an additional layer of ESG governance, whereby, through a series of watchlists, they monitor material ESG issues and developments in the portfolio. These may include, though are not limited to: UN Global Compact violations, reputational risk incidents, and company/portfolio carbon footprint.

![]()

Philosophy

We engage with company management throughout our due diligence process, and extensively after investment. We view stock ownership as an opportunity to help steer companies toward long- term shareholder value creation and therefore favor engagement over divestment. If we determine an ESG consideration to be material to our investment thesis, we raise it with the management team. Our aim is to develop a robust understanding of the company’s exposure to the issue, and management’s plans to address it.

Approach

Each company and management team is unique. Consequently, our approach to management conversations is organic in each case, however, we seek an open, cooperative dialogue. We prefer to maintain an ongoing dialogue with company management on all material or potentially material investment issues through regular meetings, in-person site visits, and calls.

Broadly speaking, our discussions with company management have the following purposes in mind:

- Testing assumptions — intended to deepen our understanding of issues that we have identified as material or potentially material to the investment. Sometimes we identify these issues at the point of investment and other times they arise during ownership. In both cases, we discuss the issues with management, solicit their input, assess their response, and evaluate the impact on our investment thesis. To the extent that the issues are ongoing, we continue to follow up until the issue is resolved or no longer relevant.

- Maintaining an informed dialogue — whereby we keep apprised of decisions relating to strategic and operational considerations. We usually routinely meet with management following earnings, strategic business updates, and management transitions.

- Advocacy – an explicit opportunity for us, as shareholders, to advocate for different decisions that we believe will enhance long-term shareholder value. With increasing regularity, companies also proactively seek our input on a range of issues.

Escalation

In instances where we feel that our concerns have not been adequately addressed during these conversations, we may consider the following actions to escalate our concerns:

- a private meeting with the chairman or other board members;

- a written letter to members of the senior management team and/or board members;

- voting against members of the board or resolutions at annual meetings;

- and/or divestment if the lack of progress changes our view of the risk-reward embedded.

Collaborative Engagement

Occasionally we recognize the potential benefits of collaborative engagement. In such cases we may seek to share opinions with other investors, but only when we believe it’s in our clients’ best interests, and permissible under applicable laws and regulations. We do not seek to become activists or insiders, nor do we encourage proxy battles.

Roles & Responsibilities

For ESG to be integrated into the research process, the industry analyst covering the stock must also lead the associated investment due diligence, of which engagement is a key part. The industry analysts are best placed to evaluate the investment implications of ESG issues, and therefore they bear primary responsibility for discussing these with company management. Our ESG team support the industry analysts in these conversations as needed but we intentionally do not delegate these responsibilities to a separate stewardship team.

ESG Integration: In Practice

Opportunity List

ESG improvement over time as a source of potential alpha is central to our ESG-integrated deep-value investment philosophy. It therefore makes sense to track the names in the portfolio with the greatest opportunity for ESG improvement. We call this the ESG Opportunity List.

This is a systematically-identified portfolio-specific list, generated through proprietary analysis conducted by the research team (PMs, research analysts and ESG team), of opportunities in our portfolio where material ESG issues exist and engagement could have a positive impact. This is not simply a list of all companies with material ESG issues and/or a list of laggards determined by a third party.

There are added documentation expectations for names on the Opportunity List, specifically an engagement plan developed by the research team. This engagement plan has a defined objective as well as key milestones to keep in mind when monitoring and tracking progress.

At the time we create an engagement plan, we also assign the company a progress rating from 1 to 3. A score of ‘1’ is for those companies that have made little to no progress on the objectives we have outlined and/or have not yet acknowledged the issues. A ‘3’ rating is for companies making substantial progress in addressing our objectives and/or are highly engaged in addressing the issues. Names that have been classified as a ‘3’ for 6 months or more may be – though not always – good candidates for potential removal from the Opportunity List. The rating system allows us to track the progress of names on the Opportunity List over time.

ESG Integration Examples

The nature and materiality of ESG factors vary across companies and industries. Recent examples

of ESG topics that have been the focus of detailed due diligence by our research team include:

- Single-use plastics and pressure on the chemicals industry

- Water stress in the semiconductor industry

- Risk of forced or child labour in industries that mobilize a large low-cost workforce

- Unwinding cross shareholdings in the Japanese market

- Financializing biodiversity in the crop sciences industry

- Climate transition risks for emerging markets utilities

- The shift from internal combustion engines to electric vehicles within the automotive industry

Proxy Voting

Philosophy

We believe proxy voting is a critical component of our engagement efforts and ability to drive change. We take our responsibilities as stewards of our clients’ capital seriously, actively voting the shares of companies in which we invest on their behalf as an integrated part of our investment process. Each proxy is voted in the best interest of our clients, defined as maximizing long-term shareholder value. We exercise proxy voting to highlight our views on management decisions, including ESG-related items, regardless of whether we agree with management’s recommendation.

Resources

Institutional Shareholder Services (“ISS”), provides us with a proxy analysis with supporting research and a vote recommendation for each shareholder meeting. Nevertheless, we retain ultimate responsibility for instructing ISS how to vote proxies on behalf of each individual proxy item for each company.

Our Proxy Voting Policy ensures vote decisions are made consistent with our fiduciary responsibilities and applicable regulations under the Investment Company Act of 1940 and Investment Advisers Act of 1940. We evaluate each proxy item for any investment on its own merit and therefore vote on a case-by-case basis.

We disclose our proxy voting records publicly and they can be found at this link.

Roles & Responsibilities

Each proxy is reviewed and voted by the industry analyst covering the stock. We believe proxy voting is a critical component of our engagement efforts and ability to drive change. As a result, we do not outsource this responsibility to a separate stewardship team, considering it a fundamental part of our investment due diligence and engagement.

The ESG team assists the industry analyst in making a vote determination, primarily on ESG items where either the specific issue falls outside of the scope of our policy or the industry analyst thinks it would be helpful to seek additional guidance.

Our Director of Research is responsible for monitoring analyst compliance with voting procedures.

ESG Governance

Our Executive Committee is ultimately responsible for ESG at Pzena, as an integrated part of Pzena’s research process.

We also have two internal committees governing ESG practices. The ESG Steering Committee is comprised of members of the Research team, specifically a sub-set of Portfolio Managers and the ESG team. The ESG Steering Committee meets quarterly to guide priorities at the intersection of ESG and Research. Responsibilities include determining quarterly thematic ESG research and setting external facing priorities, such as publications, interviews, and conference attendance.

The ESG Operating Committee is cross-functional, consisting of representatives from our Research, Client Services, Legal/Compliance, and Operations groups. The ESG Operating Committee meets as often as needed (at least once annually) to oversee the day-to-day operations of Pzena’s ESG efforts. Responsibilities include overseeing ESG reporting initiatives and evolving ESG regulations, evaluating membership of 3rd party ESG organizations, and other firm-level ESG initiatives.

ESG Organizations

- Signatory to the Principles for Responsible Investing (PRI) in 2018

- Member of SASB Alliance in 2020

- Signatory to the Japanese Stewardship Code in 2021

- Signatory to the Net Zero Asset Manager Initiative (NZAMi) in 2022

We continuously evaluate whether to become a member of other ESG-based organizations.