Energy Transition

September 2023 – For Financial Advisor Use Only

In 2022, global investment in clean energy surpassed the $1 trillion mark, according to the IEA – a major milestone, but likely just the beginning of a multi-decade trend. McKinsey estimates that cumulative capital spending related to the global energy transition could amount to $275T over the next thirty or so years. How and where this money is spent over the ensuing decades will have major implications for countless businesses around the world, many of which we hold in our portfolios.

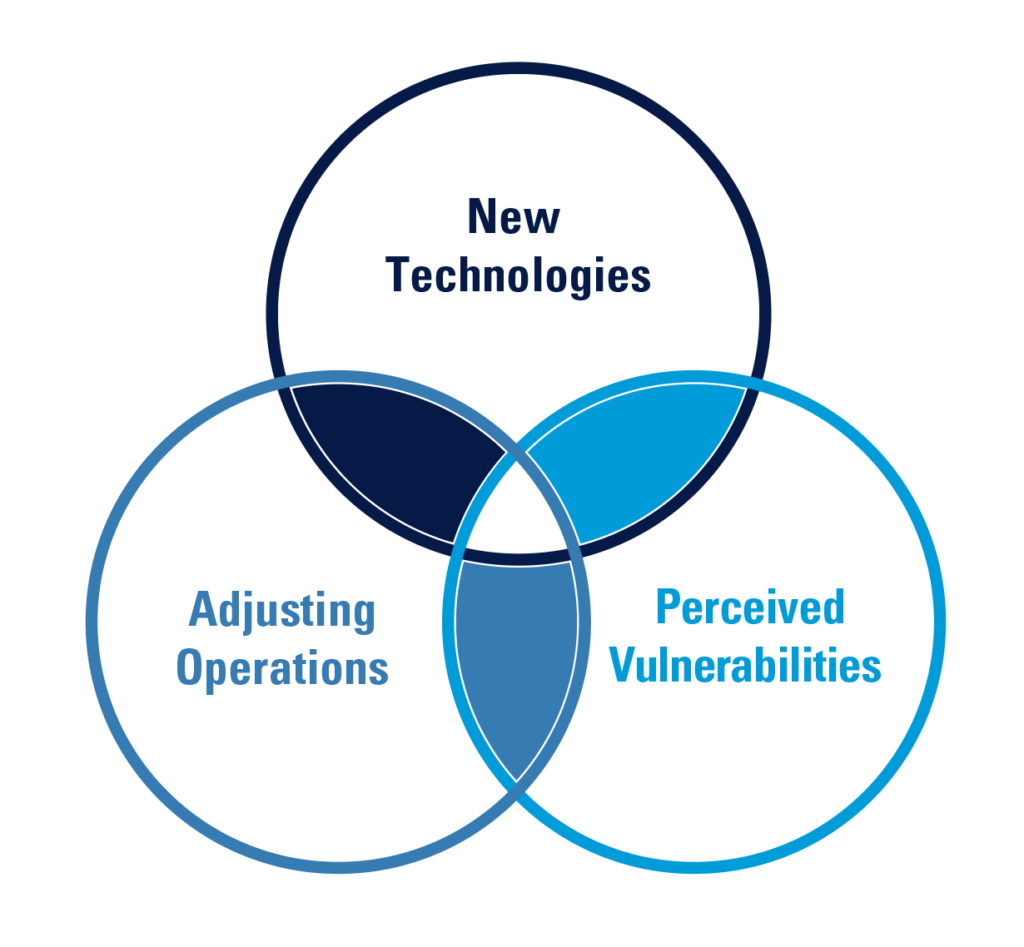

Each business we own is uniquely exposed to the effects of the energy transition. How are our holdings positioned for the green future, and, most importantly, are they poised to benefit from a changing of the energy guard? The companies we own are either (1) developing products and technologies to capitalize on the transition, (2) reshuffling existing business lines to adapt to a greener world, and/or (3) perceived (wrongly, in our opinion) to be at risk of becoming obsolete, which begets value opportunities. Below, we highlight a few examples of names under our research coverage that are applicable to each above-mentioned scenario.

Our research has uncovered a positive relationship between the improvement of environmental, social, and governance (ESG) credentials over time and share price performance. We therefore seek to actively engage with management if we determine that doing so could have a positive impact on their ESG (in this case, “E”) progress, and consequently, returns. These companies are included on our Opportunity List.

Read our extended comments on the following companies:

General Electric

US industrial giant General Electric’s Power and Renewables division (GE Vernova) has been developing new technologies to capitalize on the energy transition. Vernova is the market leader in CCGT (combined cycle gas turbine), and a key component of GE’s value-add is the efficiency of its products (i.e., converting a higher percentage of the resource into usable electricity), which reduce carbon emissions for power generation, particularly relative to coal-fired plants. GE is currently investing in technology that will enable its gas turbine installed base to further reduce emissions over time by incorporating carbon capture technology, as well as by burning cleaner fuels such as hydrogen. In addition to gas-powered turbines, Vernova houses a sizable wind turbine business (Renewables) that competes with Vestas and Siemens as the largest players in the world. The industry as a whole has been loss-making, as fixed-price contracts with long lead times quickly became uneconomic when input costs spiked in recent years amid the global inflationary environment. Though still in the red, GE’s Renewables unit has been improving, with 27% organic sales growth and order intake at an all-time high, reflecting surging demand[1]. Near-term cost pressures notwithstanding, this unit stands to benefit from long-term end-market demand, as governments incentivize wind power, and GE has been investing in groundbreaking initiatives such as large-scale offshore wind. In a similar vein, GE Aerospace (through its JV with Paris-based Safran) is developing next-generation jet engines that reduce fuel burn.

GE Vernova and Aerospace are both innovating with the energy transition in mind, but investors remain skeptical of the legacy power business, believing it’s at risk of obsolescence from the transition. Vernova already boasts the world’s largest installed base of gas turbines, with more than 670 million operating hours. However, because GE’s turbines today predominantly use natural gas, which is a fossil fuel, investors are concerned about the unit’s long-term prospects. Coal still accounts for a significant portion of the world’s power generation at ~27%[2], and, as we transition to a greener world, it will be the first fossil fuel to be phased out. However, the world’s energy needs will continue to grow; electrification (e.g., charging an EV car battery) is a prerequisite for meeting global CO2reductions, yet it will require significantly more power consumption. Zero-carbon technologies such as wind and solar will undoubtedly play a role in serving this demand growth. The challenge with these technologies is intermittency (i.e., generation is effectively zero on a calm, cloudy day). As such, readily dispatchable assets such as natural gas generators – potentially with carbon capture or hydrogen – will almost certainly have an important role to play in the long-term energy stack.

ArcelorMittal

As the world’s largest steelmaker, ArcelorMittal views the decarbonization trend as a net positive, precisely because it has the capital to invest in capex and R&D to develop new green steel technologies faster and at larger scale than its peers. Arcelor’s capital spend (both internal growth capex and external M&A) has become increasingly focused on sourcing strategically important green steel inputs (green & blue H2 & cleaner feedstocks) and diversifying that access. Management can also take calculated risks on potentially disruptive tech, such as electrolysis, which separates metallic iron from O2 in iron ore without any CO2 emissions. Whoever can decarbonize the quickest will likely have a leg up on the competition, and we believe Arcelor is in prime position to do just that.

Arcelor elicits some consternation from investors who worry its core business won’t be able to thrive amid a decarbonization push. While steel is undoubtedly a very dirty industry, accounting for approximately 8% of global carbon emissions[3], Arcelor is the global leader in steel decarbonization, which is particularly important given its European domicile, where roughly half of its production takes place. From a long-term demand perspective, it’s worth pointing out that iron ore and steel are crucial components for wind and solar products, while steel substitutes – aluminum and titanium – are up to twice as carbon-intensive. As we transition toward renewables, more steel will therefore be required to build out the infrastructure. According to Rocky Mountain Institute, solar and wind combined are expected to generate more than one third of the world’s electricity by 2030, and if that comes to fruition, steelmakers like Arcelor could enjoy a major boost to volumes from these end markets.

Part of Arcelor’s decarbonization strategy is to convert dirty blast furnaces to cleaner H-DRI EAF. Investors are concerned about the amount of capex this will require, which could be an additional $1bn per year. The H2 direct reduction iron (DRI) process will come with higher operating costs, but being that steel demand is relatively inelastic, management is confident in passing costs on to customers. Arcelor is also exploring other longer-term CO2 reduction strategies, such as carbon capture. The decarbonization of the steel industry – particularly in Europe – is a foregone conclusion; every industry player will eventually be required to spend capex. We believe Arcelor is ahead of the curve and could disproportionally benefit from the transition. As Arcelor is part of our Opportunity List, we continue to monitor its transition plan, including regional regulations and proposed decarbonization capex, to inform our view of the company’s ability to effectively manage climate transition risk exposure.

NOV, Inc.

A company whose business lines are evolving is NOV, Inc., an energy servicer that traditionally supported the upstream oil & gas industry. As a technically proficient designer and manufacturer of engineering systems, NOV’s core functions are being altered to cater to renewables customers. For instance, NOV provides tools and equipment designed to operate in the especially harsh conditions required for geothermal energy development, but its main opportunity is in offshore wind, which is an industry that is projected to grow astronomically over the ensuing decades. Retrofitted marine vessels are required to install massive offshore wind turbines, and NOV specializes in outfittingsuch ships, leveraging its engineering and manufacturing prowess, as well as its experience as the dominant supplier of offshore rig drilling systems. In order to grow the offshore wind installed base at the pace demanded by governments – which amounts to ~508k megawatts of capacity by 2035, implying a CAGR[4] of ~17% per year off 2022’s base of ~62k MW[5] – substantially more (and larger, given turbine blades can be in excess of 300 feet long) vessels will have to be produced. NOV is still in the early stages of tweaking its operations, and as it is an Opportunity List company, we are encouraging management to set emissions reduction targets alongside their efforts to capitalize on opportunities in the energy transition.

Shell Plc

Integrated energy major Shell Plc is predominantly exposed to oil & gas markets, but the company has been reshuffling its business for years in anticipation of the concerted shift away from hydrocarbons. Shell has become a leader in carbon capture storage technology and is a major player in hydrogen production, two areas expected to experience supernormal growth – due in part to sizable tax credit provisions in the Inflation Reduction Act – and where Shell possesses significant scale. Shell is also investing in sustainable fuels and circular chemistry, leveraging its current strengths in oil refining and organic chemistry. The energy major is continuing to invest in EV-charging infrastructure where it maintains a competitive edge, while pulling back on other initiatives like retail electricity, where it doesn’t excel.

Shell is particularly interesting from an investment perspective because of its material valuation discount to US peers Exxon and Chevron (~7.5x 2023E vs. ~12x)[6]. Shell garners a lower multiple because it is perceived to have a higher political risk than its US peers, which might pressure it to make value-destructive investments in renewables where the company has no clear competitive advantage. We believe traditional hydrocarbon fuels are going to remain a vital energy source for years to come while the world gradually transitions to greener fuels. In line with this thinking, the energy giant’s new CEO, Wael Sawan, recently outlined a shift in strategy that prioritizes cash flow and shareholder returns, while continuing to invest in renewables projects with the most attractive return profiles. Shell has historically been a good allocator of capital, which lends credence to management’s current transition strategy, while a greater appreciation for energy security in Europe is also becoming more constructive for the company. We believe Shell possesses the right business mix to generate the cash flow required for green investments to help propel it ahead of peers as the transition unfolds. As Shell is a featured name on our Opportunity List, we are monitoring its transition plan, including management’s stated goals, associated capital discipline, and runoff oil demand projections. To date, Shell has met or exceeded its stated emissions reduction targets, and we continue to evaluate capex allocated to decarbonization initiatives.

Edison International

Regulated electric utility Edison International is vulnerable to the physical effects of climate change in the form of raging California wildfires. This has resulted in a persistent overhang on the stock, which we believe the market is grossly overestimating. After sustaining heavy losses related to wildfire damages from the 2017/18 season, Edison embarked on a wildfire mitigation campaign, installing covered conductors to reduce the possibility of sparking power lines, as well as managing vegetation and instituting power shutoffs. To date, Edison has installed over 4,000 miles of covered conductors, which management believes has reduced catastrophic wildfire risk by 75-80% from 2017, and is targeting 10,000 miles in total[7]. The California regulatory environment should keep incentivizing Edison to invest in wildfire mitigation and decarbonization – namely grid electrification – which will grow the rate base (total assets) that the company earns a regulated return on, thus augmenting its bottom line. Edison’s efforts appear to be bearing fruit, with no major loss events in the past four years. Given the utility’s returns are regulated, and thus more transparent and less volatile, a reduction in wildfire liability expense substantially de-risks the company’s earnings stream, removing a major controversy in the stock. Even with some wildfire risk, Edison’s valuation is attractive, but absent those ongoing expenses, which we peg at $0.51/share, shares are trading under 10x our estimate of normal earnings versus a 20-year median of 17x for US electric utilities[8]. Edison is another name included on our Opportunity List, and we continue to monitor the utility’s exposure to financially material wildfire risk. In order to be eligible for removal from the list, our specific engagement milestones include spending sufficient annual capex on wildfire mitigation; monitoring miles of wires covered that are allowed by the California Public Utilities Commission; and a continued lack of exposure to any catastrophic fires.

Lear Corp.

Arguably, the industry undergoing the most high-profile and large-scale transformation is automotives. The notion that traditional auto suppliers will suffer as OEMs prioritize EVs is, in our view, misguided. There will be winners and losers from the transition, dictated by suppliers’ business mixes. As the world’s largest automotive seat supplier, Lear Corp.’s core business should be relatively unimpacted by consumers’ preference for EVs or internal combustion engine (ICE) vehicles – both of which require seats.

Lear’s other segment, E-Systems, is more enticing as it relates to EVs. This business produces wire harnesses, which are essentially the vehicle’s electrical plumbing. OEMs have been attempting to reduce the number of connections in battery electric vehicles (BEVs) to reduce weight, which could be misconstrued as a negative development for Lear’s wire harness unit. However, as vehicle connectivity becomes the norm, wire harnesses will be required to carry an increasing amount of power and data, rendering them vital for performance. For example, by 2036, the average number of sensors per vehicle is expected to increase from 147 to almost 200. Over 83% of vehicles are projected to have Connected Vehicle technologies (smartphone and embedded connectivity units) versus 54% today, and even the number of charging ports (total volumes) is expected to grow at a 12.5% CAGR through 2036[9]. BEVs also require an additional high voltage wire harness specifically for the EV drivetrain system. The need for higher-end complex wiring for BEVs to function as advertised plays to Lear’s strengths as a technological leader in the EV components space.

Michelin

The impact of the energy transition on tire manufacturers – particularly Michelin – is often misunderstood, in our view. As the technological leader in high value-add tires, Michelin stands to benefit from disruption and decarbonization via the shift to BEVs. A more rapid move to electrification plays into Michelin’s strengths. Tires for BEVs require more enhanced performance attributes than tires for ICEs, largely because BEVs weigh substantially more than ICE vehicles. This creates higher barriers to entry and benefits Michelin, which can already produce EV tires at scale and commands a near 50% share of the premium BEV tire market[10].

Conclusion

While these businesses are taking steps to decarbonize their operations in accordance with the regulatory environments in which they operate, challenges persist – particularly because the existing regulatory framework does not fully incentivize the desired end state. Many of these industries lack a credible path to Net Zero, and the technologies required to meet the demands of the energy transition are not yet commercially viable. As a result, today’s aggregate investment in green tech remains small relative to legacy “dirty” technologies. This makes active management all the more crucial, as we’re tasked with identifying and investing in companies that we believe are well-positioned for the future when these green technologies reach sufficient scale.

As the global energy transition unfolds, only time will tell what broad trends emerge. Surging demand for EV battery materials like nickel, cobalt, and lithium, combined with a push to decarbonize the notoriously dirty steel industry, could cause the price of metals to keep rising. At the same time, governments disincentivizing hydrocarbon exploration and production may keep energy costs elevated, while large-scale decarbonization spending packages flood the monetary system with cash. Global inflation may remain entrenched for quite some time, which policymakers would consider a necessary evil in the fight against climate change. In a world with higher inflation and policy rates, we believe investors should look to companies with near-term cash flows trading at attractive valuations, instead of high-multiple stocks with speculative profits far in the future. Ultimately, we can’t know with certainty how the energy transition will alter the global macroeconomy over the ensuing decades, but at the micro level, we are positioning our portfolios today to capitalize on the energy future.

Footnotes

- Fiscal 2Q23 results

- Bloomberg intelligence, IEA data (2021)

- McKinsey

- Compound annual growth rate

- BloombergNEF Forecast

- FactSet as of 8/31/23

- Company filings

- FactSet, Russell 1000 – Electricity (R1K051RG)

- Bloomberg, Just-auto

- Company filings