Approaching climate risks and opportunities in portfolio construction

Managing Climate Risk as a Value Manager

Pzena Investment Management applies a classic value approach to investing. Our approach is based on a bottom-up, research-driven stock selection process that fully integrates ESG considerations, requiring a focus on the long-term sustainability of business models.

When thinking about business longevity, climate change risks and opportunities are increasingly fundamental considerations. As a long-term ESG-integrated investor, we believe we have a role to play in allocating capital efficiently to both address financially material climate risks and capitalize on business opportunities in the energy transition over time.

Climate change poses risks to many industries that must undergo costly transitions to pivot legacy business models (e.g., oil & gas, auto) toward activities that facilitate the energy transition (e.g., green hydrogen, carbon capture and storage). The financial implications of these decisions can be significant, affecting a company’s future revenues, costs, expenditures, assets, and liabilities. It is therefore critically important that we assess, mitigate, manage, and monitor climate risks and opportunities specific to each individual investment.

When we uncover an undervalued company facing these challenges, its path toward long-term profitability quite often involves decisions that will improve its impact on the environment. For most companies, this typically involves a plan to reach net zero. The specifics of how and when net zero will be reached depends on the individual company situation. Our research and advocacy with companies in which we invest will therefore always be case-by-case.

As the quality of climate-related data is still improving, so too is the relevance and value of disclosure. Consequently, we believe our bottom-up, ESG-integrated company research provides better insight into specific developments at the business level than a top-down, scores-based system. Engagement with companies to improve business resilience and practices can be more effective in accelerating decarbonization efforts and driving change than an exclusionary approach based on third-party data.

Here we lay out our approach to managing climate change risks and opportunities in our portfolios, in line with the industry-leading Taskforce on Climate-Related Financial Disclosures (TCFD) disclosure framework. What follows is a detailed look at how the different aspects of our business come together to oversee and manage our clients’ exposure to climate change-related risks and opportunities.

1. GOVERNANCE

Organizational oversight of our ESG approach and policy is the responsibility of our Executive Committee, with input from our ESG Steering and Operating Committees. As an investment management firm, the most material way in which climate change risks and opportunities present themselves is through our investment portfolios, rather than through the day-to-day operations of our firm.

The entire investment team is responsible for the governance of climate change risks and opportunities within the portfolios. Our co-CIOs formulate an investment-specific ESG approach and set of policies, ensuring consistency and integration with our value investment philosophy and process. Our research analysts thoroughly evaluate and financialize any material issue relevant to a company, including where climate change is relevant to a given investment. Our ESG team and portfolio managers work with the research analysts, ensuring consistency in methodology. This dovetails into our bottom-up approach to investment analysis, placing the responsibility for managing material investment issues in the hands of those most closely connected to the relevant information. Portfolio construction decisions ultimately incorporate all of the above.

In addition, we have set up several internal ESG governance structures that have proven helpful in managing climate change risks and opportunities:

- The ESG Steering Committee is comprised of members of the Research department, specifically a sub-set of portfolio managers and the ESG team. The committee meets quarterly to guide priorities at the intersection of ESG and research. The ESG Steering Committee’s responsibilities include determining quarterly thematic ESG research and setting external facing priorities, such as publications, interviews, and conference attendance.

- The ESG Operating Committee is a cross-functional group of representatives from our Research, Client Services, Legal, Compliance, and Operations departments. The ESG Operating Committee meets annually or as needed to oversee the day-to-day operations of Pzena’s ESG efforts. Responsibilities include overseeing ESG reporting initiatives, monitoring evolving ESG regulations, evaluating membership in third-party ESG organizations, and other firm-level ESG initiatives.

- The Proxy Voting Committee, comprised of members of our Research, Operations, Legal, and Compliance departments,

is responsible for overseeing our approach to proxy voting. In 2021, this committee recommended additional guidelines for

our proxy voting policy related to climate and other ESG-related disclosure. Increasingly robust climate-related disclosure is needed to help investors assess and quantify related risks and opportunities. To ensure full transparency, the committee also recommended publishing proxy votes on our website.

Given that climate change is not a static issue, we are constantly evolving and updating our approach to managing it. Current areas of focus include::

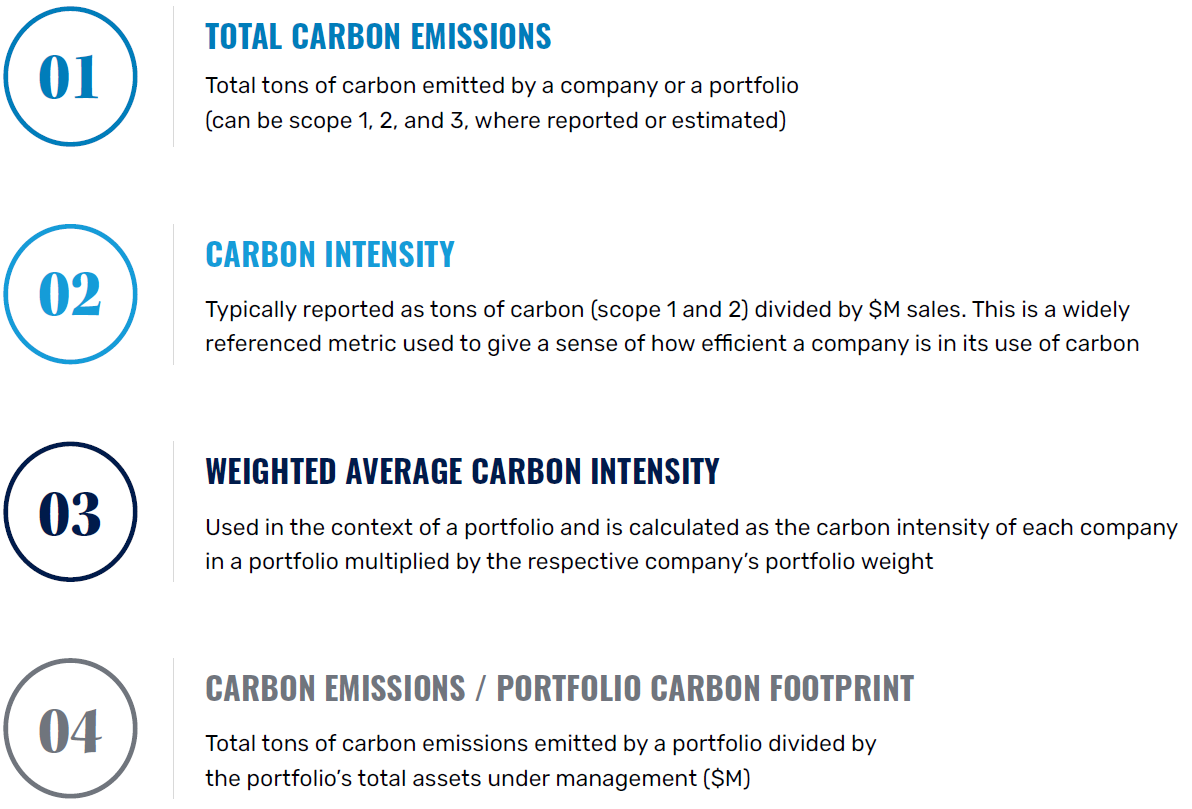

- Concentrating our climate change-related engagement efforts on the companies with the highest 10% of carbon emissions intensity (scope 1+2 emissions/$M sales) as determined by investment universe. Companies that fall into this designation are usually added to our ESG Opportunity List. The Opportunity List seeks to systematically identify opportunities in the portfolio where material ESG issues exist and engagement could have a positive impact, improving financial outcomes for investors.

- Providing clients with more detailed insights into climate-related exposure in their investment portfolios.

- Identifying additional external data sources to supplement our own research and analysis.

Opportunity List Process

2. STRATEGY

We believe climate change has the potential to cause significant disruption to the operations and franchise longevity of many businesses. This disruption can be highly material to earnings over varying timeframes and can play out through higher levels of operating and capital expenditures, as well as elevated risk of stranded assets. Disruption also brings opportunities, and we see evidence of companies capitalizing on areas of competitive strength to meet the needs of the energy transition.

Given the magnitude of transition that is underway and the range of potential outcomes for industries and individual companies, analyzing the impacts of climate change is necessary to make informed investment decisions and have a productive dialogue with management teams about any associated risks and/or opportunities.

Investment Strategy

As value managers, we seek to underpay for companies relative to their expected long-term earnings potential. We analyze material risks and opportunities and incorporate them into our decision-making for every investment. Consequently, understanding climate risks and opportunities, as long-term drivers of business outcomes, is central to our investment philosophy; they are analyzed and priced in to help inform our investment thesis, just like any other issue. As a result, we may choose not to invest in a company if we think exposure to climate-related risks will impair future earnings and the valuation does not reflect the potential impairment. Alternatively, we might invest in a company with a higher-than-average carbon footprint if we see potential for it to manage the energy transition effectively and the valuation does not reflect the improvement potential.

With regard to climate change, investment considerations may include, but are not limited to the following:

- Transition risk, such as the stranding of non-useful assets and levying of a price on carbon emissions

- Opportunities arising from the energy transition, including technological innovation and new business growth opportunities across sectors

- Direct climate risk caused by the physical impacts of climate change, such as the increased severity of hurricanes or frequency of wildfires

- Indirect climate risk caused by the physical effects of climate change, such as disruption of a company’s suppliers or customer-base

When evaluating individual holdings, we use a range of forward-looking scenarios at the company and industry level to determine the impact on company profitability. These scenarios may include—but are not limited to—those published by the Intergovernmental Panel on Climate Change (IPCC).

As an example of how we quantify transition risk, we consider a base-case and likely future- state carbon price for the companies we are researching in geographies where a carbon price is relevant. These projections are based on our knowledge and understanding of the ambition of various regulatory frameworks around the world.

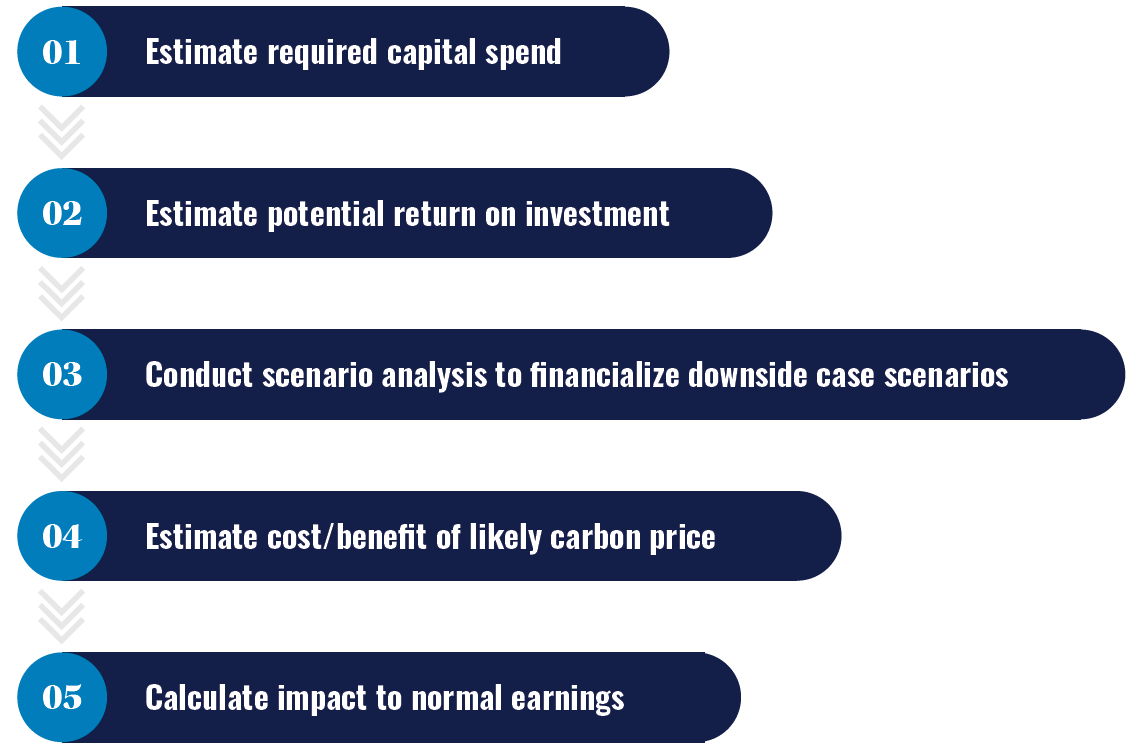

Quantifying Transition Risk

Enel: an example of the energy transition as a value driver

Enel, a diversified Italian utility, inherently possesses some climate transition risk given its large traditional generation fleet and exposure to coal-fired power. However, Enel’s management has embarked on a forward-thinking strategy that should ultimately position the company as a contributor to and beneficiary of the energy transition.

Management’s forward-thinking approach to its asset base has effectively turned a risk into an opportunity through three main initiatives:

- Enel more than halved its coal capacity between 2017 and 2022 and has accelerated its eventual exit to 2027, minimizing its interim investment in those assets.

- Enel has invested heavily in renewables, such that now it has optionality to pursue the projects with the highest returns. Its large existing asset base and project management experience also give it advantages of scale compared to other renewable operators.

- Enel will maintain its position in select natural gas generation plants during the energy transition, where plants are still profitable and offer sufficient returns. Overall, Enel projects its electricity production will be approximately 90%greenhouse gas-free by 2030, up from 83% in 2024. Additionally, Enel is targeting emissions cuts consistent with a 1.5 degree warming scenario and a commitment to net zero by 2040.

Enel is on our Opportunity List because the energy transition is an inherent risk, yet also an opportunity, for the business. We engage regularly with senior management, and we have been pleased to see Enel making progress toward its emissions reduction targets while also pursuing a disciplined approach to capital allocation. We will continue to engage management to ensure they stay on course toward these goals. Enel is currently rated a 2 on our proprietary rating scale for Opportunity List companies, reflecting the progress being made on decarbonization. Enel will be a candidate for a 3 rating once the company completes the planned coal exit.

Stewardship Strategy

We engage with company management throughout our due diligence process and extensively after investment. We view stock ownership as an opportunity to help steer companies toward long-term shareholder value creation and therefore favor engagement over divestment. For material ESG issues, including climate change, our aim is to develop a robust understanding of the company’s exposure to the issue and management’s plans to address it. Broadly speaking, our discussions with company management have the following purposes in mind: 1) testing assumptions, 2) maintaining an informed dialogue, and 3) advocacy.

We continually engage with the management of our companies to ensure they are prepared for the energy transition and are structuring their operations to preserve shareholder value. We thoroughly evaluate the quality of company transition plans, and a key part of this analysis is the extent to which we think a company can contribute to and/or benefit from the energy transition. We are also diligent in assessing a company’s carbon intensity (Scope 1 & 2 emissions/$M sales) and will engage with management to discuss the alignment between business strategy and the realities of the energy transition.

Highest Emitters

While we engage with management of our holdings across the board on this issue, we place particular focus on the highest emitters (top 10% of carbon emissions intensity by investment universe) as identified on our Opportunity List. Some of the areas where we may advocate for changes to a company’s actions include, but are not limited to: improved disclosure, including disclosure of scope 1 and 2 emissions at a minimum; laying out a credible path to net zero by 2050 or earlier; and capital allocation earmarked for the energy transition on areas of competitive strength.

We do not exclude companies solely based on their emissions history or carbon intensity. We believe that automatically excluding or divesting from companies with a high carbon footprint negates the importance of active ownership and improvement over time. With the transition to a lower carbon economy underway, starving economically critical businesses of capital because they are more carbon intensive will only make the monumental task of the transition that much harder. The economic criticality of a business does not vanish because it needs to find a way to decarbonize. Simply divesting achieves nothing and may actually drive these companies toward less accountable sources of capital. With that said, if we do not think the company is well positioned in the energy transition, we may avoid buying the stock in the first place, or we may sell it if the investment thesis materially deteriorates throughout the course of our ownership.

Escalation

If engagement has not satisfied our concerns, we may consider multiple escalation strategies. Examples include, but are not limited to, a private meeting with the chairman or other board members; a written letter to members of the senior management team and/or board members; voting against members of the board or resolutions at annual general meetings; and divestment, if the lack of progress changes our view of the risk-reward embedded.